#OilPriceWar: CHINA WINS

GT - March 26 2020 - As the US finds itself in the unfamiliar position of lobbying for higher oil prices, China's enjoying what amounts to a major rebate from crude's crash just as it tries to recover from the coronavirus.

The world's biggest oil importer is saving about $250mn a day after crude prices crashed this year amid dual demand and supply shocks.

It's coming at an opportune time for its economy, which is expected to post the slowest growth since the end of the Mao era. Should low prices last, benefits could include a boost in consumer spending, a stronger trade balance and less stress on currency reserves, as well as a source of cheap supplies for its strategic reserves.

While all oil consuming nations generally stand to gain from the crash, China is perhaps among the best placed.

Unlike the US, which is now both the top consumer and producer, the oil industry doesn't account for such a sizeable piece of economic output, jobs and debt, all of which are threatened by the price tumble.

And weaker oil is of little use for most nations as activity grinds to a halt and transportation restrictions tighten to contain Covid-19. But in China, leaders are beginning to talk up the prospects for a rapid economic rebound as the spread of the disease appears to be under control.

"It's a comfort to an economy that's healing," Li Li, a China-based analyst at commodities researcher ICIS, said of the low oil prices. "Reducing the cost of energy is beneficial to stabilising inflation.

It is not only saving money on energy and petrochemicals, but also the cost of logistics and infrastructure."

China overtook the US in 2017 as the world's top buyer and last year imported 10mn barrels a day, spending $239bn on foreign crude, more than 10% of its total import bill, according to customs data.

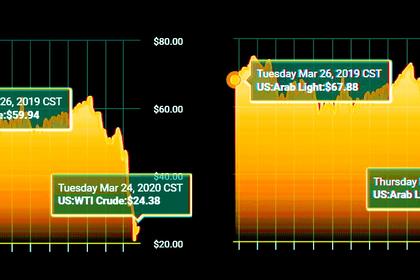

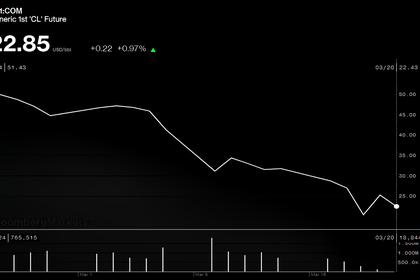

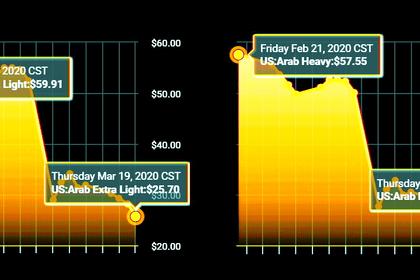

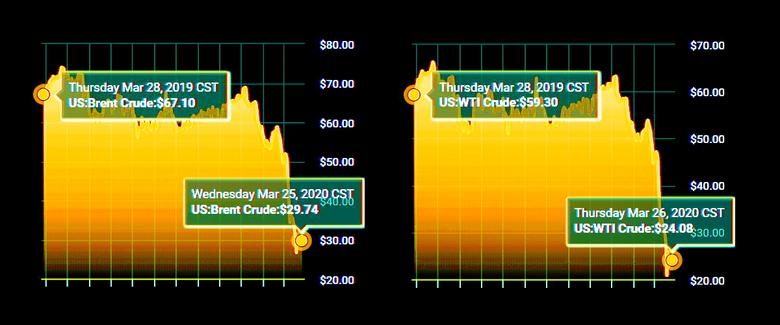

With a price drop to about $30 a barrel from $55 – which it averaged last month before an alliance between Saudi Arabia and Russia unravelled, sending crude into free fall – the country is saving about $250mn a day, according to Michal Meidan, director of China research at the Oxford Institute of Energy Studies. "It reduces China's import bill and in that respect can help bolster demand slightly," she said.

China's top economic planner, the National Development & Reform Commission, and the National Energy Administration didn't respond to requests for comment. Brent crude, the global oil benchmark, was trading down 0.7% at $26.96 a barrel as of 6:03am in New York.

Other major importers will share some of the benefits.

For India and Thailand, the decline in oil prices is equivalent to a gross domestic product boost of 1% or 2%, according to Sanford C Bernstein & Co.

-----

Earlier: