#OilPriceWar VICTIM

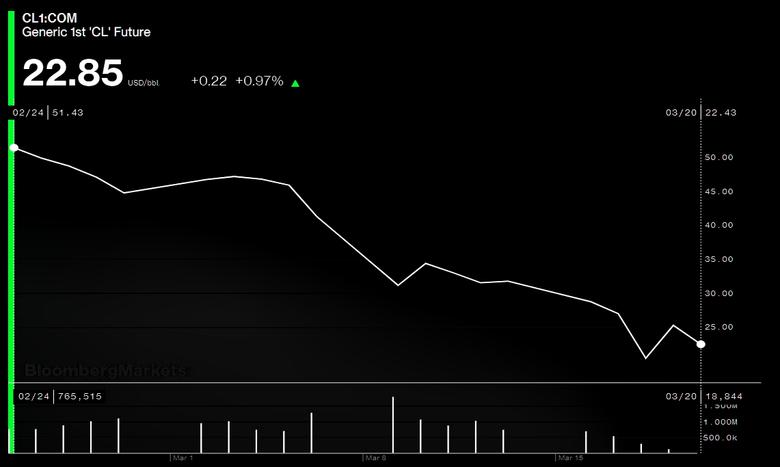

PLATTS - 22 Mar 2020 - S&P Global Ratings lowered its 2020 oil price assumptions for the second time in a month, and said US producers are likely to be hurt the most by lower oil prices.

The 2020 price assumptions were lowered $10/b, to $25/b for WTI and to $30/b for Brent, according to a March 22 statement. Assumptions for 2021 and 2022 were not changed.

S&P Global Ratings joins a number of organizations that are reassessing oil price forecasts as prices continue to tumble despite multi-trillion stimulus measures announced around the world.

WTI plunged almost 13% on Friday to settle at $22.63/b and Brent plummeted 5.23% to $26.98/b. March is heading for the worst month ever for oil prices, which began to plunge after OPEC+ failed to reach an agreement on extending and deepening output curbs beyond March.

Saudi Arabia's lowering of its selling prices for April and its plans to provide the market with 12.3 million b/d next month, the most ever for the world's biggest oil exporter, exacerbated the price plunge.

Stimulus measures

Stimulus measures for global economies announced over the last week have failed to shore up prices hurt by the rapid spread of the coronavirus, which has so far infected over 300,000 individuals and killed more than 10,000.

S&P Global Ratings does not expect Russia and Saudi Arabia to overcome their differences and return to the negotiating table, despite the oil price crash.

US oil producers are likely to be a victim of the oil-price war, according to S&P Global Ratings.

"A price war by OPEC and Russia would clearly target higher-cost producers--typically those in the US," the rating agency said. "The US has become a major player in the global oil markets and a major exporter. It is currently just how high Saudi production will go and for how long."

S&P Global Ratings, which has warned that it may take rating actions in the coming weeks, does not expect U.S. production to fall immediately "due to hedges and previously drilled wells."

"Instead, production should begin to be largely affected toward the end of this year and into next as spending levels decline and steep decline curves become impactful," it said.

-----