OPEC+ OIL CUTS

PLATTS - 28 Feb 2020 - Saudi Arabia and Russia will test the bonds of their OPEC+ covenant when they meet in Vienna next week to debate another round of production cuts to stem the oil market's COVID-19 rout.

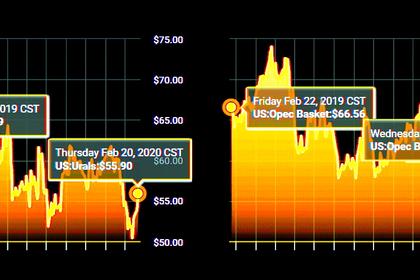

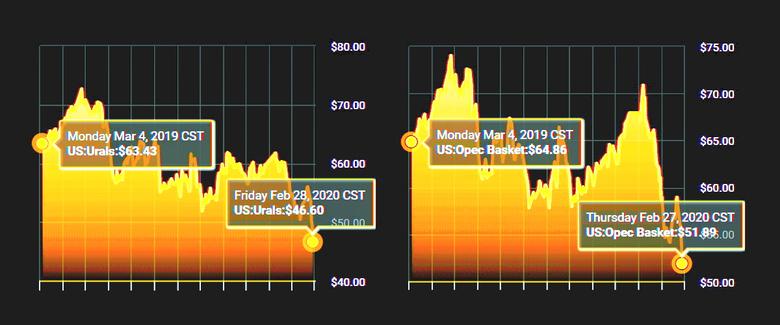

Oil prices have fallen about a quarter since late January, when news of the coronavirus outbreak began spooking traders, with the sell-off accelerating this week to hit a nearly three-year low.

But despite heavy lobbying by Saudi Arabia, the 23-country coalition of OPEC and non-OPEC producers has yet to agree on any plans to rein in crude oil production further. Russia, the key non-OPEC partner in the deal, appears relatively nonplussed by the market plunge, given its higher fiscal tolerance for lower prices.

The alliance meets March 5-6 in Vienna. Failure to reach an accord could put the entire OPEC+ pact at risk.

"If Russia is not on board, the Declaration of Cooperation means nothing in the future," one OPEC delegate said on condition of anonymity.

The DOC, signed last July to much fanfare, institutionalized the OPEC+ coalition's cooperation of the last three years, committing members to permanent consultations on oil market management, though not necessarily continued production cuts.

Russia has yet to declare how it thinks the producer group should respond to the coronavirus, though energy minister Alexander Novak on Thursday sought to downplay notions of a rift, saying Moscow was "very satisfied with cooperation with our partners from Saudi Arabia, and naturally we want to continue to cooperate."

The falling prices of the last week could nudge Russia into a deal, analysts say.

The coronavirus has sparked panic within many OPEC members, with Saudi energy minister Prince Abdulaziz bin Salman earlier comparing the oil market skid to a "house on fire," at an energy symposium earlier this month, according to people who heard his remarks.

Saudi Arabia is in the midst of aggressive structural reforms and has a now publicly traded state oil company to support. The prince has been urging other members to extend and deepen their 1.7 million b/d OPEC+ production cut accord, which expires at the end of March. Saudi leaders have spoken with Russian counterparts several times over the last month to try to strike a deal.

DOING THE MATH

Among the scenarios being floated are additional supply curbs of up to 1 million b/d, according to sources familiar with the talks, though they stressed that several options were under discussion. One delegate said the coalition risked oil prices tumbling further, into the $40/b range, if a cut is not agreed.

An advisory technical committee on February 7 recommended 600,000 b/d in new cuts on top of extending the current deal but that was before this week's market sell-off, with front-month Brent having its worst week since December 2008.

"No doubt they need to deliver more than the 600,000 b/d," said Jamie Webster, a fellow with Columbia University's Center of Global Energy Policy.

Joe McMonigle, an analyst with Hedgeye Capital, said the coalition could agree to the committee's recommendation and have Saudi Arabia announce it will voluntarily overcomply with its quota to get the total level of the cuts to 1 million b/d. The kingdom made a similar commitment in December, when it pledged to hold its output 400,000 b/d below its cap, to bring the 1.7 million b/d OPEC+ cut deal to 2.1 million b/d.

But Saudi Arabia may be reluctant to take on such a burden on its own, with reports suggesting that the kingdom had approached Gulf allies Kuwait and the UAE to share in the extra cuts.

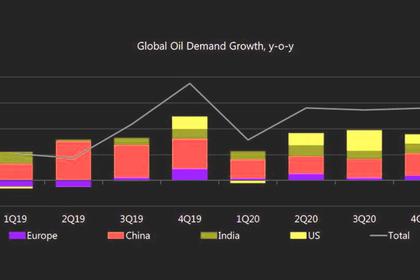

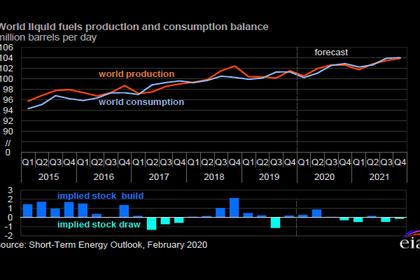

Many forecasters have downgraded their projections of global oil demand for 2020 due to the virus, but the estimates vary significantly.

The US Energy Information Administration, for example, expects 2020 demand growth to come in at 1.03 million b/d, while the International Energy Agency forecasts growth of 830,000 b/d. Investment bank Goldman Sachs has slashed its projection down to 600,000 b/d, and S&P Global Platts Analytics expects 860,000 b/d of demand growth.

One OPEC official, speaking on condition of anonymity, said the group was being challenged by an asymmetric oil market reaction to the coronavirus demand shock versus the significant levels of supply outages.

"We are losing more than 5 million b/d in the market of supply" between Libya's oil port blockade, US sanctions on Iran and Venezuela and OPEC+ cuts, the source said. "But we reduce 300,000 b/d in demand and prices go down. This is what is complicated for OPEC now. We are facing demand destruction, but it's a small amount compared to the amount of outages in the market."

-----

Earlier: