OPEC'S PROPOSAL: $60

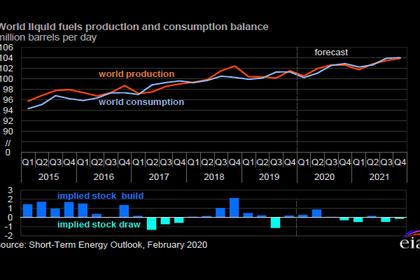

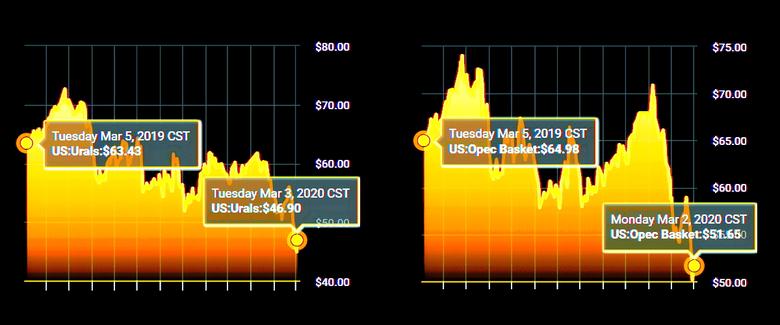

REUTERS - MARCH 3, 2020 - OPEC's proposal to cut oil production by up to 1 million barrels a day would be enough to balance the oil market and lift prices to $60 a barrel, Leonid Fedun, vice-president of Russian oil producer Lukoil, told Reuters.

The comments from Fedun, who was talking on the sidelines of the company's presentation of its low-carbon energy strategy, suggest Russia may be willing to agree to OPEC's proposals for more output cuts in light of the coronavirus outbreak.

The Organization of the Petroleum Exporting Countries and its partners, a group known as OPEC+, will meet in Vienna on March 5-6 to discuss additional steps to support the oil market as the spread of the coronavirus risks hurting demand.

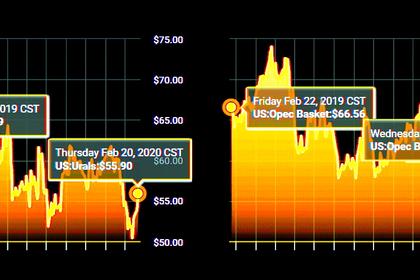

OPEC initially called for a cut of 600,000 barrels per day (bpd) to prop up prices, in addition to existing cuts of 1.7 million bpd which are expected to be extended when expire this at the end of this month.

It has since proposed deeper cuts of 1 million bpd though Russia has yet to agree to any new cuts.

"Conoravirus ... is a short-lived factor which is affecting oil prices ... There will be an OPEC (and non-OPEC) meeting, compensatory measures will be taken which will take the excess oil off the market and the oil price will rebound," Fedun said.

"In my view, (a joint) cut of between 600,000 bpd to 1 million bpd is enough to balance the market hit by 'black swans' such as coronavirus. This is enough for oil to rebound to $60 per barrel," he told Reuters.

Russia is the world's second biggest oil exporter after Saudi Arabia.

Lukoil is also Russia's second biggest oil producer, pumping nearly 1.8 million bpd, which is on a par with OPEC member Nigeria. Most of its oil comes from Russia but it also has operations in a number of ex-Soviet countries, as well as in Iraq, Africa and some other places.

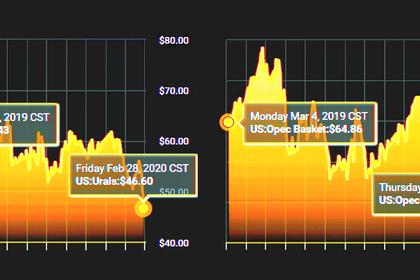

Brent crude futures have slumped from January's peak of $71.75 to a low for 2020 of $48.40 on Monday on concerns the virus outbreak will hit global demand for oil.

MIDDLE EAST TIES

Partnership with OPEC is essential for Russia's budget and for its ties with Middle East leaders because Moscow plays an important role in a number of conflicts in the region.

Russian President Vladimir Putin met oil companies, including Lukoil, on Sunday. He indicated that he favoured joint action with OPEC but stressed that the current oil price level was acceptable to Moscow, signalling that Russia's contribution to further output cuts may be limited.

Fedun, who is also Lukoil's second-biggest shareholder, told reporters on Monday that he expected Russia to cut its oil output by about 200,000-300,000 bpd.

"We are ready to cut (our oil production) as much as we are told to. Better to sell less oil but at a higher price," Fedun said.

He also said on Monday that OPEC+ could cut output by even more than 1 million bpd but his comments to Reuters suggest he believes the existing proposals should suffice.

While playing down any long-term risks to global markets from the coronavirus outbreak, Fedun said it was a carbon emissions reduction agenda that was set to drastically change the global oil industry, including Lukoil.

Major western oil firms have all set carbon reduction goals of varying degrees, including reaching a net zero-carbon level by 2050.

"Lukoil is starting to develop its own climate strategy - we will be aiming to reach carbon neutrality by 2050 along with the rest of Europe," Fedun said, adding that his firm was looking to expand further into solar and wind energy along with hydropower.

Fedun also reiterated that Lukoil aims to allocate all free cash flow to dividends, while also taking spending on share buyback programmes into consideration.

-----

Earlier: