RUSSIA FOR U.S. SHALE: $570 BLN

FT - MARCH 12 2020 - A popular post on Russian social media this week depicts Karl Bryullov’s apocalyptic painting “The Last Day of Pompeii”, with Igor Sechin, head of Russia’s biggest oil company, added to the picture, amid the carnage and suffering. Mr Sechin does not look the least bit perturbed. As the most powerful man in Russia’s oil industry and one of President Vladimir Putin’s closest confidants, Mr Sechin was the architect of Moscow’s decision to withdraw last week from a pact with Saudi Arabia to limit crude production, sparking an oil war that sent prices crashing 30 per cent on Monday, upending global markets. The shock of a new fight for market share, and its potential to devastate rival producers in the US, terrified investors who dumped American shale company shares in a brutal Monday-morning sell-off. By contrast the Kremlin has appeared calm and unfazed.

Armed with a $570bn foreign reserves war chest, a floating exchange rate and an economy that relies far less on foreign capital and imports than just a few years ago, Russia believes it can weather the sharpest fall in crude prices since 1991 for longer than rival producers such as Saudi Arabia and — most importantly — the US shale industry. “With significant financial reserves available, the Russian government is probably right to think that it can sustain a low price environment for some time,” said James Henderson, a director at the Oxford Institute for Energy Studies. “It won’t be easy, but three years would probably be achievable.”

US shale producers, dependent on high prices and the goodwill of investors to fund a business model that requires constant spending, have been huge beneficiaries of Russia’s co-operation with Opec in the past four years. Since 2016, when Moscow started negotiating production cuts with Riyadh, American output has soared by more than 4.5m barrels a day, eating into Russia and Saudi Arabia’s global market share. By February this year the US’s slice of world production had leapt by 4 percentage points. The combined share held by Saudi Arabia and Russia was down by three.

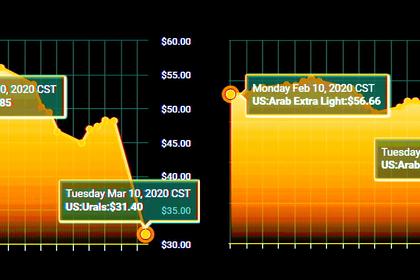

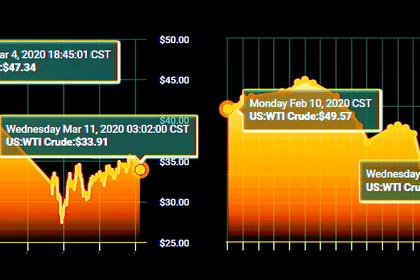

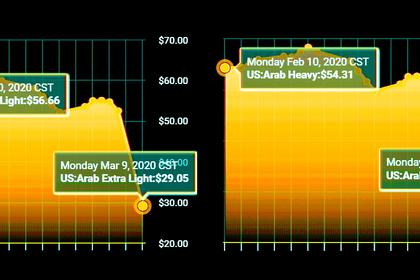

Reversing that shift was the Kremlin’s main objective when it decided to reject Saudi Arabia’s request last week to prolong and deepen the production cuts to support prices. Saudi Arabia’s response has driven prices down further than even Moscow may have predicted, but in contrast to previous oil market crashes Russia appears prepared for a crisis. By the end of the day on Monday the rouble had fallen more than 10 per cent against the dollar but pared some of those losses by Wednesday, after Russia’s central bank intervened by selling foreign currency. Since 2015, when the last big oil crash and a swath of western sanctions imposed after Russia’s invasion of Crimea combined to tip the country into recession, Moscow has restructured the economy to make it more stable and more resilient. Hydrocarbons still accounted for 40 per cent of Russia’s budget income in 2019, and diversification efforts have underwhelmed. But Moscow’s decision to promote stability over growth in the past six years, largely at the expense of its population’s incomes, means Russia is better placed to survive the current shock.

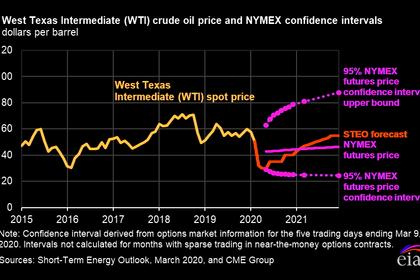

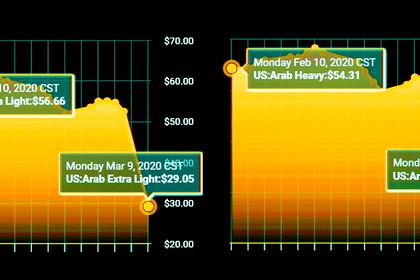

The country’s budget break-even oil price has fallen to $42 a barrel — down from about $100 a barrel a decade ago — and it has run budget surpluses for the past two years. Most importantly, in 2017 it began diverting excess oil revenues into a national wealth fund, while prices remained above that break-even level thanks in large part to the Saudi pact. “The deal itself . . . was the right decision,” Russia’s energy minister Alexander Novak said on Tuesday. “It has allowed us to earn additional Rbs10tn (about $137bn) . . . and form the necessary reserves, including by filling the National Wealth Fund.” Today the fund holds more than $150bn. Using those reserves, Russia could navigate oil prices between $25 and $30 a barrel for six to 10 years, the finance ministry said on Monday, estimating that average prices of $27 a barrel would require $20bn a year of budget support from the fund a year.

“Russia’s strong balance sheet means that low oil prices shouldn’t result in major strains in the economy — certainly nothing like those which occurred in 2015-16,” said William Jackson, chief emerging markets economist at Capital Economics. “We suspect that oil prices would probably have to drop to $25 [a barrel] before Russia changed tack.” In contrast the US shale sector was struggling even before this week’s oil-price collapse with mounting debts, unhappy investors, rising bankruptcy risks and the prospect of slowing output growth.

It means US shale will start to show the strain even if prices remain depressed for just six to 12 months, analysts said. “There will be a very swift reduction in capex and a significant [production] volume decrease”, said Matt Portillo, a managing director at Tudor, Pickering & Holt & Co, a Houston-based investment bank. US oil executives have lobbied President Donald Trump to extend financial aid to shale producers. But their business model depended on Russian and Saudi support for the oil price — and Moscow has just ended that.

-----

Earlier: