SAUDI ARABIA, RUSSIA'S OIL UP

REUTERS - MARCH 10, 2020 - Saudi Arabia said on Tuesday it would boost its oil supplies to a record high in April, raising the stakes in a standoff with Russia and effectively rebuffing Moscow's suggestion for new talks.

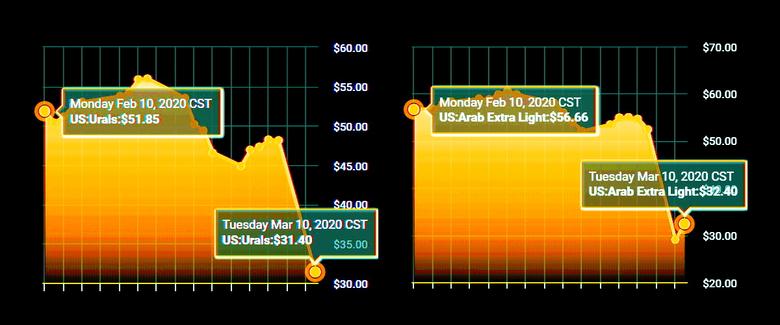

The clash of oil titans Saudi Arabia and Russia sparked a 25% slump in crude prices on Monday, triggering panic selling on Wall Street and other equity markets that have already been badly hit by the impact of the coronavirus outbreak.

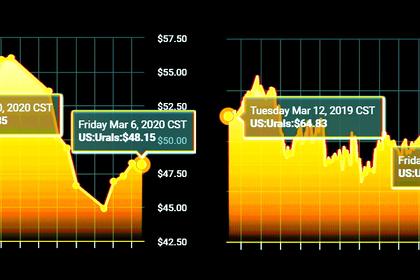

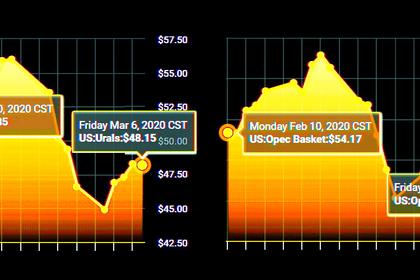

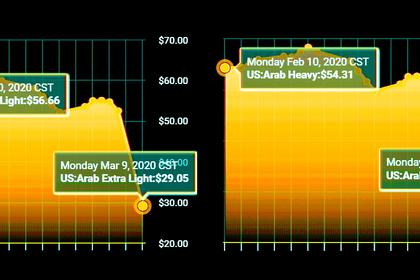

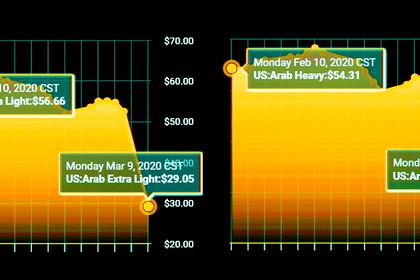

Oil prices LCOc1 recovered some ground on Tuesday, but were still 40% down on the start of the year.

U.S. President Donald Trump spoke with Saudi Crown Prince Mohammed bin Salman in a call on Monday to discuss global energy markets, the White House said on Tuesday.

Trump is seeking re-election this year and will benefit from lower gasoline prices at the pump. But the U.S. government will also be concerned by the potential for bankruptcies in the U.S. shale industry, which plays an increasingly important economic role.

Several U.S. oil firms said on Tuesday they would cut spending and dividends.

Amin Nasser, chief executive of Saudi Aramco 2222.SE said the state-run oil giant would increase supply in April to 12.3 million barrels per day (bpd), or 300,000 bpd above its maximum production capacity, indicating it may draw from storage.

Saudi Arabia has been pumping around 9.7 million bpd in the past few months, but has extra production capacity it can turn on and it has hundreds of millions of barrels of crude in store.

Moscow said Russian oil companies might boost output by up to 300,000 bpd and could increase it by as much as 500,000 bpd, sending the Russian rouble and stocks plunging.

U.S. Treasury Secretary Steven Mnuchin told Russia that energy markets needed to stay "orderly".

Brent oil prices jumped 8% on Tuesday to above $37 per barrel after Russian Energy Minister Alexander Novak said Moscow was ready to discuss new measures with OPEC.

Russia's Energy Ministry also called for a meeting with Russian oil firms on Wednesday to discuss future cooperation with OPEC, two sources told Reuters.

But Saudi Energy Minister Prince Abdulaziz bin Salman appeared to rebuff the suggestion.

"I fail to see the wisdom for holding meetings in May-June that would only demonstrate our failure in attending to what we should have done in a crisis like this and taking the necessary measures," he told Reuters.

STRAINED BUDGETS

Riyadh's unprecedented hike in supply follows the collapse of talks last week between members of the OPEC+ grouping, an informal alliance of OPEC states, Russia and other producers that has propped up prices since 2016.

Russia rejected OPEC's call to deepen existing supply cuts, prompting OPEC to scrap all production limits and Russia to say it would also boost output, sending crude prices briefly down to almost $31 and reviving fears of a 2014-style price crash.

Saudi Arabia needs an oil price of around $80 to balance its budget, but has cash reserves and the ability to borrow to deal with a price plunge for now. Russia needs about $42 to balance its books and also has hefty cash reserves it can draw on.

Iraq and some other OPEC nations, with more meager financial resources to cope with a dramatic drop in oil revenues, called for action to shore up prices.

Ratings agency Fitch said a sustained sharp drop in oil prices would hit the sovereign ratings of those exporting countries with weaker finances, particularly those with exchange rates pegged to the dollar.

But even Saudi Arabia, with its hefty financial reserves and sovereign wealth fund, did not have "infinite leeway" to support its A (stable) rating, Fitch analyst Jan Friederich said.

Aramco shares, which slid at the start of the week, were up 9.9% at 31.15 riyals at 1353 GMT on Tuesday but were still below their December listing price of 32 riyals.

Shares in U.S. firms which had also dropped recovered slightly on Tuesday. Occidental Petroleum (OXY.N) said it would cut dividend and spending, while Chevron (CVX.N) said it might cut spending and production.

The U.S. Department of Energy said on Tuesday it had suspended a sale of up to 12 million barrels of oil from the government's emergency crude reserve due to the price drop.

OPEC+ had effectively been cutting output by 2.1 million bpd, including the extra voluntary cuts by Saudi Arabia.

OPEC had sought further cuts that would have brought the total to about 3.6 million bpd or roughly 3.6% of global supplies, but Moscow's rejection of that plan led to the collapse of the whole deal.

-----

Earlier: