SAUDI ARABIA'S ECONOMY UP

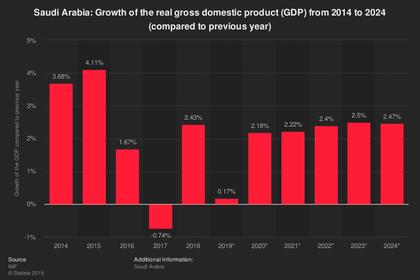

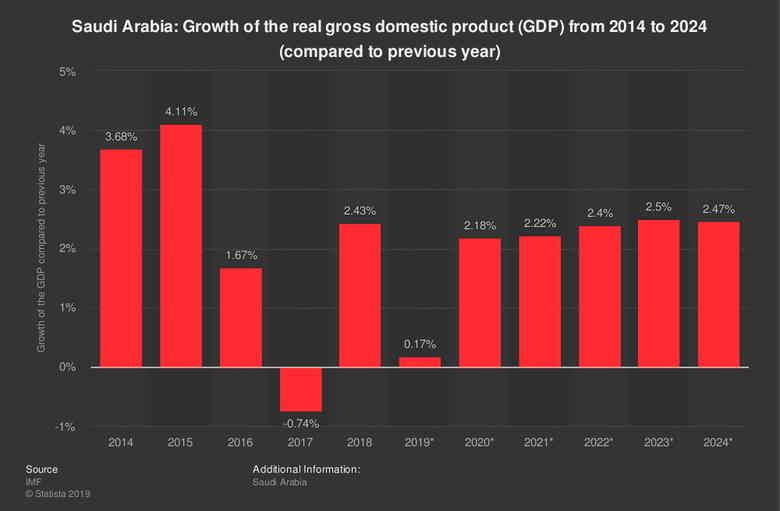

AN - 03 March 2020 - Saudi Arabia's non-oil economy grew by 3.3 percent last year, its fastest rate since 2014, even as the energy sector contracted and slowed overall growth.

Most of the increase in output was driven by the retail, hotel and financial sectors, which are attracting increased investment as the Kingdom moves away from dependence on oil revenues. The oil sector declined by 3.6 percent in 2019 dragging overall GDP growth to 0.3 percent according to data released on Sunday by Saudi Arabia's General Authority for Statistics.

"The weakness in the real headline GDP growth was due to the construction in the oil sector," Monica Malik, chief economist at Abu Dhabi Commercial Bank, told Arab News.

"Positively, non-oil activity expanded at the fastest pace since 2014 thanks to a strengthening in non-oil growth. We believe that higher investment growth will remain a key support factor for non-oil activity in 2020 with greater progress with key projects."

Saudi GDP at current prices amounted to SR2.974 trillion in 2019 - up by about 0.8 percent from a year earlier.

Crude petroleum and natural gas accounted for some 27.4 percent of the Kingdom's economic output, followed by government services at 19.4 percent. Wholesale and retail trade, restaurants and hotels made up the third largest contributor to GDP, accounting for a 10 percent share.

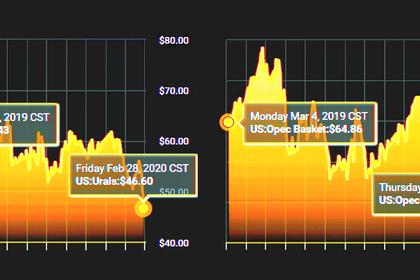

Weaker oil demand globally hit the Kingdom's exports in 2019 which were down by about 10.4 percent in value over the year to about SR1.05 trillion.

Gulf oil exporting economies have started 2020 with an uncertain outlook as oil markets again come under pressure from the spread of the coronavirus beyond China - hitting demand for crude oil and aviation fuel as people stay at home and factories reduce production.

Still, Saudi Arabia is hoping its plans to boost gas production in the Kingdom could help offset the impact from lower oil prices.

The country expects the recently disclosed Jafurah field to be a major contributor to GDP growth over the coming decades.

Holding an estimated 200 trillion cubic feet of wet gas, it could generate $8.6 billion a year in income and contribute $20 billion a year to the Kingdom's GDP.

-----

Earlier: