SAUDI ARABIA'S OIL 12 MBD

PLATTS - 16 Mar 2020 - Saudi Aramco can pump crude at its maximum 12 million b/d capacity for a year without any new investment, its CEO said Monday, as the world's largest oil producer girds for a potentially protracted price war against Russia and US shale companies.

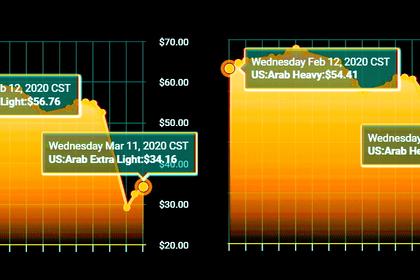

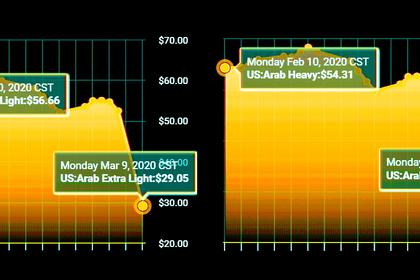

The Saudi oil giant earlier this month aggressively slashed its selling prices for crude exports and announced plans for a surge in production, after its more-than-three-year partnership with Russia and other key producers on output cuts broke up in acrimony. The moves have contributed to a massive rout in crude prices, with the market already weakened by the impact of the coronavirus outbreak.

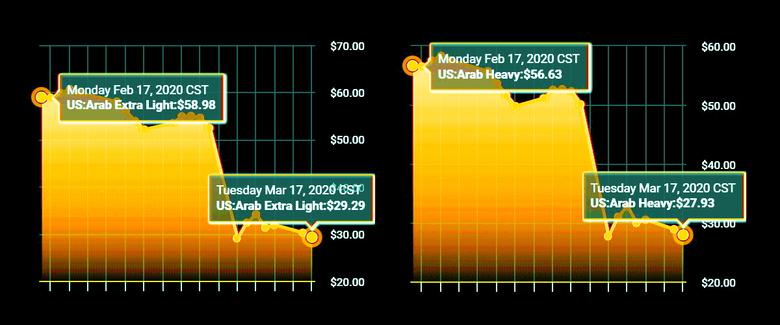

"Saudi Aramco can sustain low oil prices for a long time," Aramco CEO Amin Nasser said on an earnings call. "We are very comfortable with a $30/b price [and] can meet our dividend and shareholder expectations at $30/b and even lower."

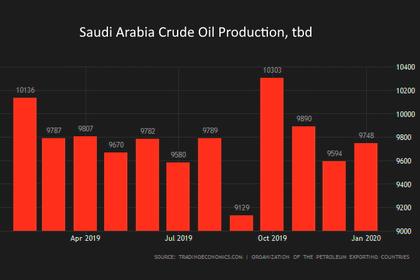

Aramco said last week it planned to supply 12.3 million b/d of crude to the market in April once its OPEC production quota expires - some 25% above current levels. Nasser revealed Monday that 300,000 b/d of that would be drawn from its substantial inventories, implying that Aramco planned to pump at full tilt for the month.

May supplies would likely be similar, Nasser said, but future months' levels had yet to be determined. If needed, Aramco could maintain its production at its maximum level for a year without additional capex spending, he added.

"We will look at supply and demand fundamentals each month and look at feedback from customers," he said.

Saudi Arabia, which has granted Aramco exclusive rights to produce all the crude within its borders, has never reported monthly production higher than the 11.09 million b/d it achieved in November 2018, and its ability to achieve its full capacity is untested.

S&P Global Platts Analytics pegs the kingdom's sustainable capacity for more than a quarter at closer to 10.5 million b/d.

Aramco officials, however, said the company has already begun pre-engineering work to accelerate the company's expansion to 13 million b/d of production capacity, as directed by Saudi Arabia's energy ministry last week.

But Nasser said a timeline had yet to be established to achieve this, nor had the company determined which fields to develop.

"There is no time frame, we are assessing that now and will come back at a later date," the CEO said.

LOWER CAPEX WITH LOWER PRICES

The earnings call was Saudi Aramco's first as a publicly traded company, after it launched the world's largest initial public offering in December on the kingdom's domestic stock exchange to much fanfare.

The IPO provided an injection of capital to the Saudi government, which retains some 98% of the company's stock, as it embarks on ambitious economic reforms.

But the coronavirus' hit to the global economy, along with OPEC's failure to corral Russia into another round of production cuts at a contentious meeting in Vienna this month, have sent Aramco shares tumbling along with oil prices.

Aramco closed down 3.14% in Monday trading, with a share price of Riyals 27.80 ($7.41), compared to the IPO price of Riyals 32 ($8.53).

Front-month ICE Brent futures, meanwhile, sunk below $30/b for the first time since 2016.

The uncertain oil outlook due to the coronavirus prompted Aramco to slash its capex budget for 2020 to $25 billion to $30 billion, from previous guidance of $35 billion to $40 billion. That budget does not include the tens of billions of dollars that the company would likely need to boost its production capacity to 13 million b/d, officials said.

Capex spending for 2019 was $33 billion, the company reported.

The capex reduction is based on optimizing the company's spending plan plus increased oil production, which will result in higher associated gas volumes that will, in turn, free up more crude for export, rather than being consumed in power plants, Aramco's Chief Financial Officer Khalid al-Dabbagh said on the earnings call.

Aramco has "flexibility for further action" on its capex levels, he added.

Upstream lifting costs were $2.80/b of oil equivalent and capex was $4.70/b of oil equivalent; the bill for sustaining maximum spare capacity in 2019 was $15 billion, the company said. Going forward, as production increases, the company expects capex to also rise, Nasser said.

On Sunday, in advance of the earnings call, Aramco reported that its profit in 2019 fell 21% to $88.2 billion "primarily due to lower crude oil prices and production volumes, coupled with declining refining and chemicals margins, and a $1.6 billion impairment associated with Sadara Chemical."

Company officials said Monday that Aramco would continue to honor the $75 billion of annual dividend payments to shareholders that were promised in the IPO prospectus for the next five years.

-----

Earlier: