SAUDI'S OIL PRICES DOWN

PLATTS - 08 Mar 2020 - Saudi Aramco slashed pricing of its crude exports for April, including the biggest cut ever for Arab Light crude for Asia, after OPEC and key ally Russia failed to agree to a production cut, pushing global oil prices to their worst day in more than five years.

The drop for key export regions of Asia and Europe is likely to set off a price war among producers in the Middle East and Russia, market participants said.

"This is really drastic. Basically a battle move by Saudi against Russia," an analyst focused on Middle East crude said.

Eight hours of talks at OPEC in Vienna on Friday failed to move Russian Energy Minister Alexander Novak to back the supply curbs sought so keenly by Saudi Arabia and other key producers to offset the coronavirus outbreak's bite out of global oil demand.

With no deal agreed, the 23-country OPEC + coalition's current production quotas will expire at the end of the month, potentially unleashing a price-tanking market share battle.

COMPETITIVE PRICING

A Saudi industry source said the world's biggest oil exporter is merely responding to Novak's comments that as of April 1, countries are no longer bound by their quotas. The current OPEC+ agreement to cut 1.7 million b/d winds up at the end of March.

"Saudi Arabia has maintained capacity to be optimally used for crises," the source said. "Saudi Arabia has been investing to maintain this capacity. The [OPEC+] agreement is ending and in such an environment you have to be competitive.” The lower prices will also stimulate demand, the source said.

OPEC kingpin Saudi Arabia has no output target for April and is capable of reaching 12 million b/d, the source added, without saying if the kingdom would reach its full production capacity.

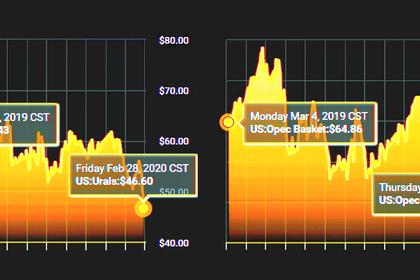

Oil prices plunged by around 10% on Friday, suffering their worst one-day decline in more than five years, on fears of increased supplies coming just when demand is falling on coronavirus.

NYMEX front-month crude settled at $41.28/b down $4.62 (10.1%) day on day, while ICE front-month Brent settled $4.72 (9.4%) lower at $45.27/b on Friday. Brent prices are currently the lowest since June 2017, when OPEC+ members were in the midst of their first collective cuts that started in January that year.

Saudi Aramco's share price was also hammered on Sunday, falling below its IPO price of Riyals 32 ($8.53) for the first time and tumbling by 9% to Riyals 30.

2014 REPEAT?

Russia, which leads the 10 non-OPEC members of the alliance, refused to sign on to an agreement to cut another 500,000 b/d, alongside a 1 million b/d additional cut from OPEC members, who agreed on Thursday to the conditional output curbs. Russia rejected being cornered into a deal, putting the alliance forged in 2016 at risk of falling apart for the first time.

Saudi Arabia and Russia's failure to broker a deal stoked fears of the price destruction of 2014 that occurred after both countries jostled for market share in the global oil markets.

Brent prices in 2014 fell from highs of $115/b in June to less than $70/b in December after a November meeting of OPEC members failed to reach an agreement on production curbs.

This battle over market share pushed prices to a low of less than $35/b in the beginning of 2016, pushing several OPEC countries into fiscal deficits and economic slowdown. The oil price meltdown prompted Saudi Arabia to talk to Russia and other non-OPEC members to collectively coordinate production to temper price falls and soak up excess market supply amid a spike in US shale oil output.

The official selling prices in Asia for Arab Light was cut by $6/b to minus $3.10/b, Saudi Aramco said in a March 7 pricing letter. It was the biggest month-on-month cut ever for the Saudi Arab Light crude OSP differential for Asia, according to S&P Global Platts data. Pricing for Extra Light and Arab Medium was also reduced $6/b from March, and Arab Heavy was cut by $5/b. In comparison, market participants surveyed as part of S&P Global Platts earlier this month expected the producer to cut price differentials of its crude grades to Asia by $1/b to $2/b for April.

The new differential for Arab Extra Light and Arab Light is minus $3.10/b, while it's minus $4.05/b for Arab Medium and minus $4.45/b for Arab Heavy. The differential is against the average of Platts Dubai assessments and DME Oman futures.

EUROPE PRICING

In the Mediterranean, April pricing was cut $7/b for Extra Light, Light and Medium and was reduced $6/b for Heavy. New prices are minus $5.80/b for Extra Light, minus $8.60/b for Light, minus $10.40/b for Medium and minus $10.70/b for Heavy. The differential is against ICE Brent.

In the US, the differential was reduced by $7/b, to minus $2.10/b for Extra Light, minus $3.75/b for Light, minus $5.55/b for Medium and minus $6.30/b for Heavy. The differential is against Argus Sour Crude Index.

In northwest Europe, the differential against ICE Brent was lowered by $8/b for Extra Light, Light and Medium and by $7/b for Heavy. The new pricing is minus $8.10/b for Extra Light, minus $10.25/b for Light, minus $12.60/b for Medium and minus $13/b for Heavy.

-----

Earlier: