U.S., CHINA LNG DOWN

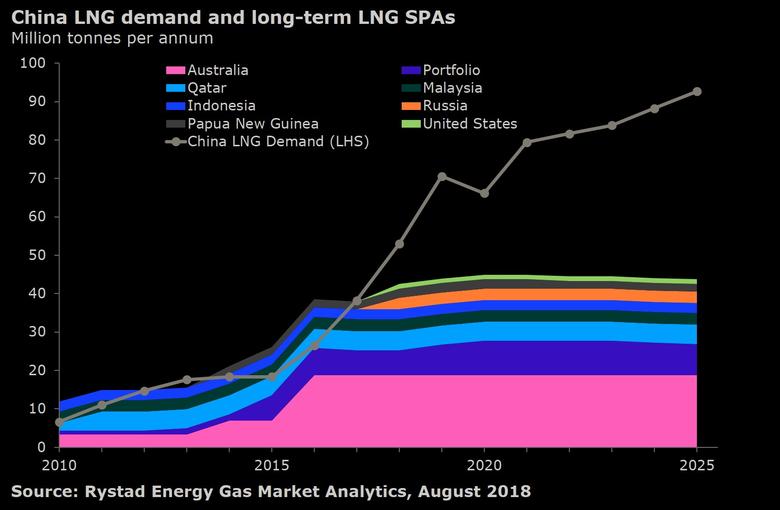

PLATTS - 10 Mar 2020 - An initial trade deal between Washington and Beijing in mid-January was hailed by the energy industry as a first step to encouraging China to sign new long-term contracts to import more US LNG.

Two months later -- amid super low international prices, weaker than expected demand and trade flow restrictions due to the coronavirus outbreak -- that door is still shut.

Several liquefaction terminal developers acknowledged during an industry conference in Houston on Tuesday that without China as a buyer it will be very difficult for most new US projects to advance to construction this year and perhaps even next year. Commodity traders and traditional utility end-users in East Asia and Europe have also been hesitant to sign new binding offtake contracts for US supplies.

"China is effectively closed for business as it relates to long-term contracts right now," said Omar Khayum, CEO of Annova LNG, a proposed 6.5 million mt/year export project in Brownsville, Texas.

Five years into development, the Exelon-backed project has yet to announce any firm offtake deals. It has said it wants to sell at least 4 million mt/year of supplies to be able to make a final investment decision.

Privately held Commonwealth LNG, a proposed 8.4 million mt/year export project in Cameron Parish, Louisiana, has been targeting an FID for early 2021, though it, too, has yet to announce any firm offtake deals. Its CEO, Paul Varello, lamented at the conference the tough commercial environment, especially as it relates to China. His project's liquefaction trains would be built in Asia and delivered to the terminal site. The six LNG storage tanks also would be built offsite.

"This is not for the faint of heart, or the thin of checkbook," Varello said. "Right now, we have to hunker down."

Price volatility

Asian LNG prices hit historic lows in February with Platts JKM, the benchmark price for spot-traded LNG in Northeast Asia, falling to $2.71/MMBtu on underlying weak Asian demand compounded by mild temperatures and the coronavirus. The global demand decline of 3.5% month over month was driven by China, according to Platts Analytics.

Though JKM prices rebounded so far in March, the spread of the virus into Japan and Korea, which together account for nearly a third of all LNG demand globally, continue to pose risk to LNG demand and prices.

Global liquefaction utilization remained unusually high through February, resisting historic seasonal turndowns, with supply up 10% year-on-year. Russia, in particular, has seen exceptionally high utilization, with exports well above nameplate capacity in an effort to compete with higher US Gulf Coast exports.

No US exporter or project developer has been untouched by the market turmoil.

Over the past several weeks, Cheniere Energy has disclosed cancellations of two cargoes that were scheduled to load in April and postponed to later in the year a final investment decision on a proposed midscale liquefaction expansion in Texas. Australia's LNG Limited floated a buyout offer to investors that it said is the best option to save its proposed Magnolia LNG project in Louisiana. And investors sharply sold off shares of Rio Grande LNG developer NextDecade.

Looking ahead

Perhaps the hardest hit has been Tellurian, which recently shed 38% of its workforce as part of a cost-cutting move designed to give the developer a lifeline as it struggles to secure the remaining partnership agreements it needs to finance construction of its Driftwood LNG export project in Louisiana.

Tellurian had previously expected to begin construction this year, with first exports in 2023. With the stock down about 80% in the last month, investors seem to be pricing in the possibility the FID could be pushed to 2021 or beyond.

It's admittedly hard in the current market environment for liquefaction project developers that are usually long-term thinkers to focus on the next several years, when they are glued to what could happen over the next several weeks, said Fred Hutchison, president and CEO of industry trade association LNG Allies, which co-sponsored Tuesday's conference.

"It is an extraordinary time," Hutchison said. "I don't think any of us know how extraordinary until it is done."

-----

Earlier: