U.S. ENERGY BONDS: $110 BLN

FT - MARCH 10 2020 - Nearly $110bn of bonds sold by energy companies in the US have fallen into distressed territory, after a plunge in the oil price left investors doubting that the money will be paid back.

Almost 12 per cent of the $936bn of bonds issued by US oil and gas companies are were trading on Monday with a yield more than 10 percentage points above Treasuries — a commonly used definition of distress — according to indices run by Ice Data Services. Yields rise as prices fall.

Among junk-rated borrowers, issuers with ratings below triple-B, which account for $175bn of the total, the proportion of debt in distressed territory has risen to almost two-thirds.

"There is definitely a significant amount of default risk," said Michael Anderson, a strategist at Citi, adding that a lot of bonds are in the "danger zone" where a default or restructuring looks likely.

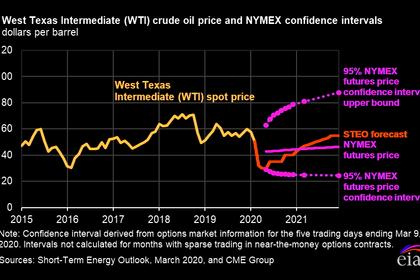

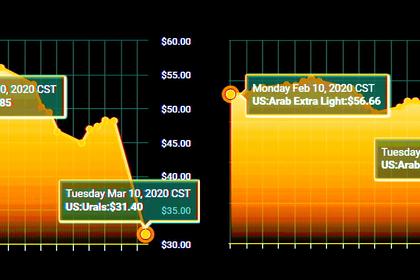

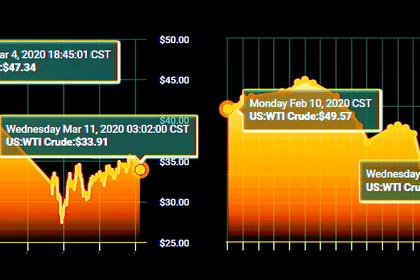

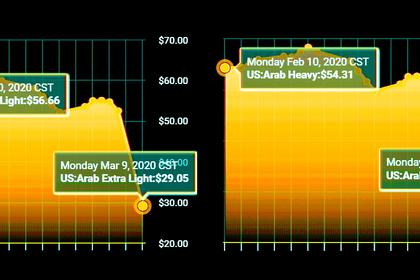

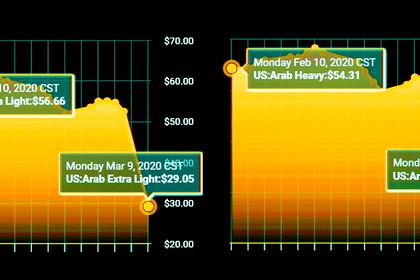

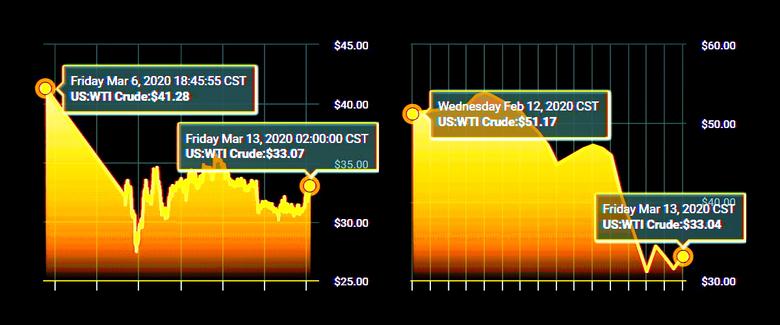

The falls in the bonds come in the wake of the failure of Opec and Russia late last week to agree a deal on cutting production, which effectively scrapped a three-year pact between Riyadh and Moscow to prop up crude prices. Instead, Saudi Arabia has indicated it will boost supplies by record amounts as it seeks to gain share and drive rivals out of business. WTI crude was trading at less than $34 a barrel on Wednesday, a little over half the highs of January.

The price war has dealt a severe blow to shale-oil producers in the US, many of which had been struggling to break even with crude at much higher levels. A $477m bond maturing in 2022 issued by Denver-headquartered SM Energy, for example, lost more than half its value on Monday, tumbling from 90 cents on the dollar on Friday to 42 cents.

Callon Petroleum and Oasis Petroleum, both of Houston, also suffered falls of more than 40 cents on the dollar in the price of their debt.

Energy debt has led the sell-off across high-yield bonds, sending the average yield for the sector to its highest level since early 2016 on Monday.

The tough conditions were also evident in higher-rated debt. Occidental Petroleum's $1.5bn bond maturing in 2029 plummeted on Monday, sinking from 97 cents on the dollar on Friday to as low as 72 cents. It rebounded to 77 cents on Tuesday after the company announced a cut to its dividend.

Analysts have warned that the shift in investor sentiment will weigh on companies' ability to refinance debt. Almost $27bn of US oil and gas bonds come due this year, according to S&P Global.

The rapid moves left some investors nursing losses. Lord Abbett, a New Jersey-based asset manager, owns more than 10 per cent of SM Energy's and Oasis Petroleum's beaten down bonds in its short-duration income fund. The falls wiped out most of the fund's returns for the year in just one day.

Franklin Income Fund, meanwhile, owns 51 per cent of a $2.2bn Chesapeake Energy bond maturing in 2025 that declined from 40 cents on the dollar to 17 cents on the dollar on Monday. The fund's losses this year come to 11.2 per cent.

Lord Abbett and Franklin Resources, manager of the Franklin Income Fund, did not immediately respond to requests for comment.

"We continue to have these big, outsized moves," said Mr Anderson. "It seems like the financial markets are suffering more and more volatility and extreme moves than we have had historically. A lot just seems to happen all at once."

-----

Earlier: