U.S. LNG LIMITATION

PLATTS - Policy analysts on Thursday honed in on the uncertainties restraining investment and buyer confidence needed to back additional US LNG export terminals despite potential long-term demand growth.

The conversation, at a Washington forum on supporting US LNG exports through global investment in natural gas infrastructure, comes at a challenging time for LNG markets, as the analysts acknowledged.

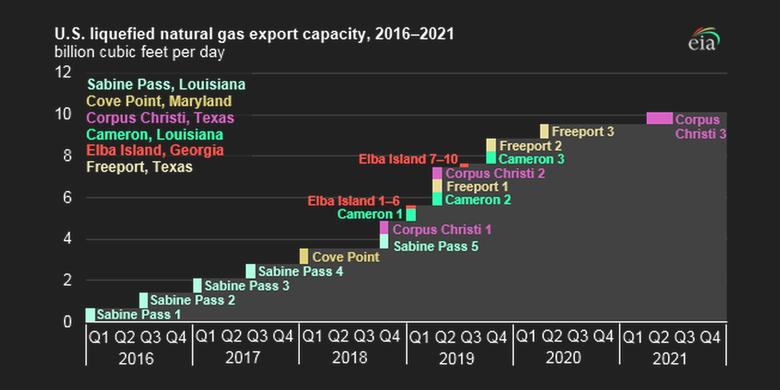

"It's a little more than the perfect storm. It may be the perfect typhoon or the perfect hurricane," said Christopher Goncalves, chair and managing director of the energy practice at consultancy BRG, pointing to a deceleration in demand in Asia, layered with tariffs and the US-China trade dispute, the coronavirus outbreak and a steady flow of US LNG coming to market.

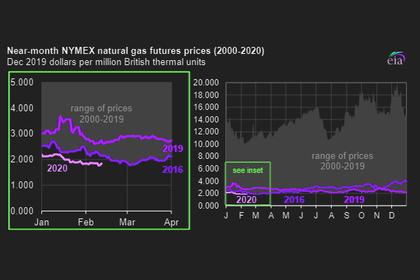

"It's a tough thing for a market to digest," he said, "and I do think we have sort of irrationally low pricing."

With the recent "major correction" in LNG equities, Katie Bays, co-founder of Sandhill Strategy, said LNG companies are facing "a put up or shut up" moment with institutional investors, who are seeing LNG as more speculative and risky than they have in the past.

While recent stock price declines also provide a buying opportunity, institutional investors are hesitating, she said, adding: "Investors are doubting more than I have seen ... what the future is that they are buying into."

POLICY DOUBTS

Bays identified policy uncertainty, including the US presidential election, as another major overhang. But she also saw the increasing emphasis by investors on ESG or environment, social and governance requirements as an opportunity for LNG to draw investors' attention to its potential to help decarbonize the power sector.

Goncalves flagged US climate policy and its posture toward hydraulic fracturing as a question mark for LNG buyers because of what it could mean for Henry Hub prices, to which US LNG exports are mostly indexed.

"One of the biggest preoccupations of buyers is long-term cross commodity or cross-index risk for their purchases," he said, referring to the relationship between Henry Hub, the Dutch TTF hub and the JKM index in Asia, as well as oil prices.

"I can tell you for sure that buyers right now are almost all really wrestling with these issues, and finding particularly the relationship between Henry Hub and oil above all, and secondarily JKM and TTF, as being vexing for making decisions," he said.

CROSS-BORDER POLICIES

Kevin Book, managing partner of ClearView Energy Partners, said climate policy could soon factor into a competition usually centered on price differentials, as he reflected on increased US gas exports to Europe.

"The climate-based, gas-on-gas competition, life-cycle analysis-based competition has been bottled up and waiting," he said, adding national averages related to carbon, aggregates and proxies are going to become important. "The elimination of certain rules and the creation of others can become market access tools."

The European Union has indicated it will propose a border carbon adjustment proposal by the middle of 2021, he said. "If they're quite serious about this, we're going to move from a trade war to carbon trade war in the next four to five years," he said.

Goncalves argued that getting policy established and clear in the next US administration and between the EU and the US will be incredibly important to determining how much of a role gas will play in the energy future.

"I think suppliers are starting to think strategically about 'how much longer do I have to monetize my margins," he said, potentially deterring some producers from scaling back amid low prices.

GOVERNMENT ASSIST

Fred Hutchison of LNG Allies said the best thing that the US government could do to help US LNG exporters and gas producers is to help on demand creation and "help bridge this gap that we currently face with regard to project financing issues."

The event, put on the US Chamber of Commerce, LNG Allies and the US Trade and Development Agency, featured multiple federal government agencies discussing their coordinated efforts to support gas infrastructure development and open markets in emerging economies that are potential future demand sources for US gas.

Despite current challenges, Nikos Tsafos, senior fellow at the Center for Strategic and International Studies, offered some balance to the picture for the US sector. "Last year was the best year for [final investment decisions] for the US LNG industry ever," he noted.

-----

Earlier: