U.S. LNG PROBLEMS

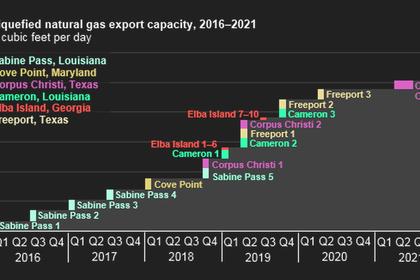

PLATTS - 17 Mar 2020 - North American liquefaction terminals currently being built may see reduced construction activity for an indefinite period due to health officials' recommendation to avoid assembling large groups of people to guard against further spread of the coronavirus.

Limiting the size of work crews would lengthen construction schedules and could delay startup of projects. Before the respiratory illness that was first observed in China in December became a global pandemic, affecting trade flows and commercial efforts, the LNG industry was already under pressure from low international prices and weaker-than-expected demand in key end-user markets.

In a sign of what may be to come elsewhere, Shell-backed LNG Canada, which began construction in late 2018 of the up to $31 billion facility, is cutting by half the amount of staff at its site in Kitimat, British Columbia, including workers flying in on rotation, it said Tuesday in a message posted on its website. The developer and its engineering, procurement and construction contractor may further cut the number of workers to only essential staff to maintain security and environmental controls.

Cheniere Energy, the biggest US LNG exporter, has reduced large group meetings, non-essential travel and implemented work-from-home schedules. The company does not expect those measures to affect production at its two terminals, nor does it expect impacts on construction of remaining trains at the sites "at this time," spokesman Eben Burnham-Snyder said.

At Sempra's Cameron LNG facility in Louisiana, where a third train is under construction, there were "no current reductions in site staff" due to the virus outbreak, spokeswoman Anya McInnis said. Kinder Morgan's Elba Liquefaction facility in Georgia, where half the 10 planned trains remain under construction or in commissioning, the operator was not "reducing, limiting or shutting down" any of its operations, spokeswoman Katherine Hill said.

"Our construction at this point involves far fewer workers than at its peak," Hill said. "This is not a small terminal, and there is plenty of space on the island to allow for social distancing and limiting access to certain areas."

The two new US export terminals being built are Golden Pass, the ExxonMobil- and Qatar Petroleum-backed project in Texas, and Venture Global LNG's Calcasieu Pass in Louisiana. A spokesman for Golden Pass said there has been no delay in the project's latest targeted startup date, though he could not say whether construction activity has been reduced. A Venture Global executive did not respond to a message seeking comment on the status of construction.

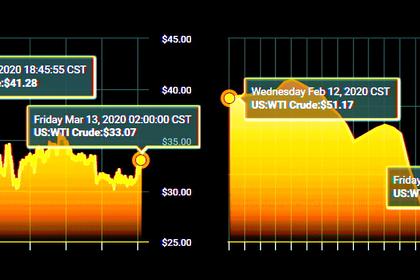

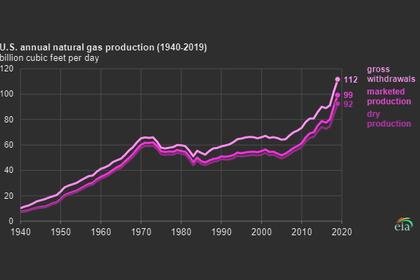

Despite the impact on workers, utilization of existing trains at US liquefaction facilities rebounded Tuesday and was expected to remain relatively robust through the summer, S&P Global Platts Analytics data show. Netbacks continue to offer premiums to exporters and long-term contracts generally provide protection from cancellations, even as the coronavirus outbreak raises fears of weakening demand in Europe due to travel restrictions and economic pressures. LNG prices in Northeast Asia, as represented by the Platts JKM, have been recovering steadily since bottoming out at $2.713/MMBtu on February 14. The spot price of cargoes into the region for delivery in May was assessed Tuesday at $3.538/MMBtu. The rise in prices in Asia combined with relatively cheap Atlantic day-charter rates have bolstered the value of cargoes originating from the US Gulf Coast, Platts Analytics data show.

PERSISTENT FOG

Total US LNG feedgas demand has averaged just over 8 Bcf/d in March, down roughly 7% from February. The primary driver of lower month-on-month production has been fog that has impacted LNG cargo loadings at Cheniere's Sabine Pass facility in Louisiana. On Tuesday, LNG feedgas deliveries bounced back to just over 8.6 Bcf/d, largely on the back of higher flows to Sabine Pass. However, pilot services along the channel that serves the terminal were again suspended, suggesting that there could be future impacts to flows to the facility.

"If you think about the spot market, those transactions happen every day without people getting together -- over the phone or in the marketplace," Chrisman said. "Long-term, transactions to underwrite new projects, those will be impacted somewhat depending on where they are in the negotiations and the relationships the parties have with each other already."

He added, "I think the biggest uncertainty is, 'Do parties want to delay signing something until they have a better handle on demand.'"

-----

Earlier: