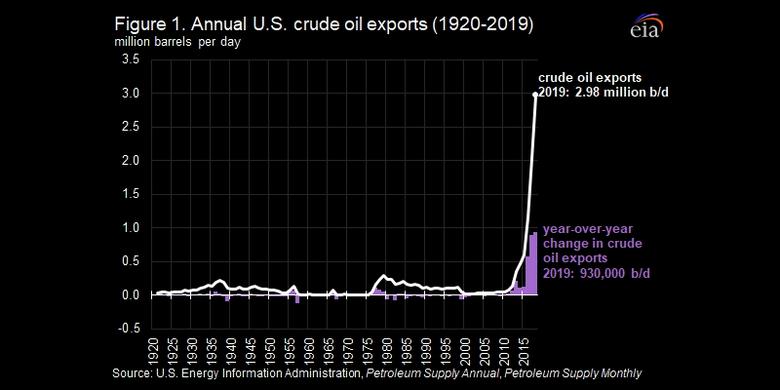

U.S. OIL EXPORTS +45%

U.S. EIA - U.S. crude oil exports averaged 2.98 million barrels per day (b/d) in 2019, an increase of 930,000 b/d (45%) from 2018 (Figure 1). The number of destinations for U.S. crude oil exports increased from 41 to 44, and Canada continued to receive the largest share (15%, or 459,000 b/d), followed by South Korea (14%, or 426,000 b/d). U.S. crude oil exports to China, the third-largest export destination in 2018, fell by nearly 100,000 b/d to average 133,000 b/d in 2019. Decreased U.S. crude oil exports to China were more than offset by increases to other destinations, resulting in shifting trade patterns. The growth in U.S. crude oil exports was driven by increasing U.S. crude oil production, expanding domestic infrastructure, and increased global demand for light, low-sulfur crude oils.

Of the 15 top destinations for U.S. crude oil exports, 8 are in Asia and Oceania and 5 are in Europe. The eight destinations in Asia and Oceania represent 1.3 million b/d, or a 43% share of total U.S. crude oil exports in 2019, and the five destinations in Europe represent 779,000 b/d, or a 26% share (Figure 2).

China dropped from the third-largest destination for U.S. crude oil exports in 2018 to the seventh-largest in 2019. In the summer of 2018, trade negotiations between the United States and China and unfavorable prices led China to reduce imports of U.S. crude oil, which continued into 2019. In the first-half of 2018, the United States exported 389,000 b/d of crude oil to China, which made China the largest destination for U.S. crude oil exports during that period. However, in the second half of 2018, the United States exported just 77,000 b/d on average of crude oil to China. In 2019, China received an average of 133,000 b/d of U.S. crude oil exports compared with 232,000 b/d in full-year 2018.

Although exports to China declined, U.S. crude oil exports to other destinations increased, most notably to South Korea, the Netherlands, and India. In 2019, U.S. exports of crude oil (Figure 3)

- To South Korea rose from 242,000 b/d in 2018 to 426,000 b/d, an increase of 184,000 b/d (76%)

- To the Netherlands more than doubled from 132,000 b/d in 2018 to 281,000 b/d, an increase of 149,000 b/d (113%)

- To India increased by more than 100,000 b/d (69%)

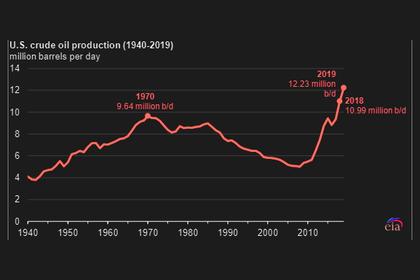

Increased U.S. crude oil production, which rose 1.24 million b/d in 2019 (11%) over the previous year, allowed for greater volumes of U.S. crude oil exports. The increased production is mostly of light, sweet crude oils, but U.S. Gulf Coast refineries are complex and largely optimized to process heavy, sour crude oils. Higher crude oil production and a mismatch between crude oil type and refinery configuration increases the availability of U.S. crude oil production for exports.

Another factor enabling increased U.S. crude oil exports has been the completion of pipeline capacity from producing regions such as the Permian in West Texas to the U.S. Gulf Coast. According to the U.S. Energy Information Administration's (EIA) liquids pipeline project database, about 2.8 million b/d of additional pipeline capacity was scheduled to be completed in 2019 in Texas alone.

In addition, the lead-up to the 2020 International Maritime Organization (IMO) marine fuel sulfur regulation likely contributed to increased demand for U.S. crude oil by global refineries, particularly in South Korea and the Netherlands. Increasing the amount of light, sweet crude oils that a refinery processes is one way to increase the production of IMO-compliant low-sulfur marine fuels and minimize the production of residual fuel oil. Although details on the exact gravity and sulfur content of U.S. crude oil exports is not collected in a way that allows specific grade distinctions by official U.S. Customs and Border Protection export forms (on which EIA exports data are based), most U.S. crude oil exports are likely light and low in sulfur content. This characteristic made U.S. crude oil exports attractive to many refiners as they prepared for IMO 2020 in the latter half of 2019.

-----

Earlier: