U.S., SAUDI ARABIA #SANCTIONS

PLATTS - 23 Mar 2020 - The collapse in global oil prices has US policymakers scrambling for ways to save the domestic oil sector, but disagreement is brewing on whether to work with Saudi Arabia for market balance or pursue penalties against the OPEC kingpin for plans to significantly ramp up its crude production in the coming months.

"Energy is a key part of the diplomatic dialogue between the US and Saudi Arabia, and the US today should be talking with the kingdom about what steps can be taken to support the global economy in the midst of a historic economic crisis," Jason Bordoff, a former energy adviser to US President Barack Obama and director of the Center on Global Energy Policy at Columbia University, told S&P Global Platts Monday. "This is a moment when the kingdom can demonstrate its commitment to being a responsible swing supplier.

In the span of just a few hours Friday: Texas Railroad Commissioner Ryan Sitton floated the idea of an international supply cut pact to OPEC Secretary General Mohammed Barkindo; Commission Chairman Wayne Christian dismissed the idea; and nine Republican senators asked the Department of Commerce to launch an anti-dumping case against Saudi Arabia following its price war with Russia.

Saudi Arabia and Russia were flooding the market with an "unprecedented" amount of crude, the senators wrote to Commerce Secretary Wilbur Ross.

"This manipulation of markets has roiled the economy, causing severe trauma to the American energy industry," the senators wrote.

Commerce officials did not reply to a request for comment Monday.

MAJOR DIVISIONS

US Senator Kevin Cramer, a North Dakota Republican and one of the nine senators to sign the letter to Commerce, has also asked President Donald Trump to place an embargo on US imports of Saudi and other crudes.

The issue has divided lawmakers, administration officials and the domestic oil industry.

The Domestic Energy Producers' Alliance, which is chaired by Continental Resources Executive Director Harold Hamm, has petitioned for an anti-dumping investigation and called for tariffs on Saudi imports.

But the American Petroleum Institute, the industry's main Washington trade group, has publicly opposed any efforts toward US retaliation against overseas producers.

"The challenges we face today are unprecedented, but they are not an excuse to walk away from the free market principles that have guided this industry for more than a century," Frank Macchiarola, a senior vice president with API, said in a statement.

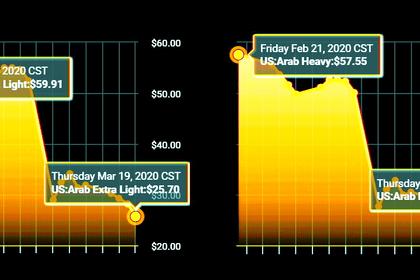

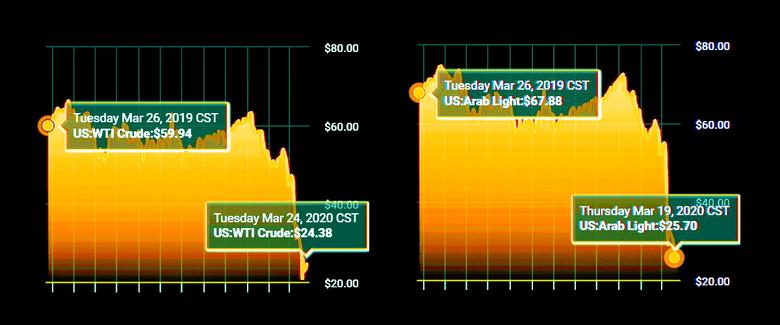

Following the failure of OPEC and its allies, including Russia, to agree on production cuts earlier this month to prop up the market in the face of the demand destruction caused by the coronavirus outbreak, Saudi Arabia announced it would abandon all output restraint and boost the amount of crude it supplies to the market by about a third to 12.3 million b/d. Saudi officials said this would involve raising production to a record 12 million b/d and drawing some 300,000 b/d from its vast inventories.

The Saudi energy ministry and the Saudi embassy in Washington have declined to comment on whether the country would engage with the US on production policy. Saudi officials have been piqued in the past by tweets by President Trump criticizing Saudi Arabia and OPEC for not pumping enough crude.

Saudi Arabia is already the world's largest exporter of crude, and its plans have sent oil prices nosediving, imperiling many US shale producers, who have slashed budgets and warned of layoffs and bankruptcies.

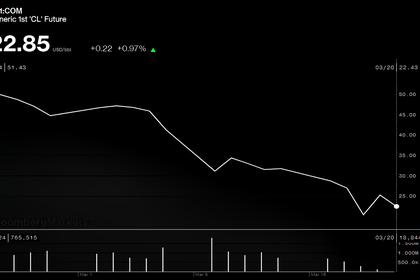

On Monday, NYMEX May WTI settled up 73 cents/b from Friday's close at $23.36/b and ICE May Brent settled 5 cents/b higher at $27.03/b.

SHORT-TERM PENALTIES

David Goldwyn, president of Goldwyn Global Strategies, said an anti-dumping cause is unlikely to find success, but the Trump administration may pursue other, short-term penalties in order to compel the Saudis towards an action which may boost prices.

"I can easily see the Trump administration using this as leverage to encourage the Saudis to return to the table for a production cut," the former US Department of State special envoy and coordinator for international energy affairs said Monday. "The challenge, of course, is that there is little incentive for the Russians to come to the table unless [the US shale sector] cuts back on production as well."

But Russia may not act until after weeks or months of Saudi output at maximum capacity forces them back to the bargaining table, said Helima Croft, managing director and global head of commodity strategy at RBC Capital Markets.

"The question is: Did the Russians know that they were signed up for the current price environment?" Croft said in an interview with the Platts Capitol Crude podcast. "If we were to go into the low teens or single digits for oil prices would Putin's decisionmaking calculus change?"

Saudi Arabia is chairing this year's G20 meeting and some analysts believe if a Saudi-Russia agreement takes place, the G20 meeting in November may be the forum for it.

-----

Earlier: