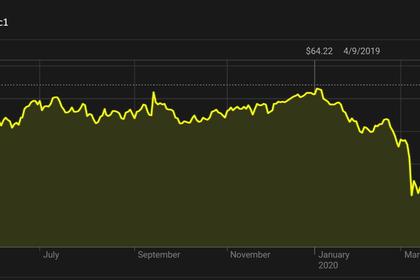

$5 TLN FOR COVID-19

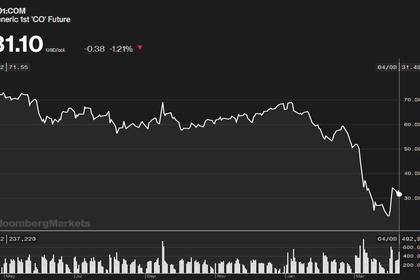

CSIS - April 13, - 2020 Confirmed cases of the novel coronavirus (Covid-19) exceed 1.9 million as of April 13 and will likely climb significantly higher. To combat the virus’ spread, governments have implemented restrictions on economic activity unprecedented in peacetime. The Organisation for Economic Co-operation and Development estimates that containment measures will cause an initial decline in the level of output of 20 to 25 percent in many economies, and the International Monetary Fund (IMF) projects negative global growth for 2020 with “the worst economic fallout since the Great Depression.”

In response to this unprecedented shock, governments have pledged massive economic support, from direct payments to individuals to “limitless” loans for struggling businesses. At a March 26 virtual summit, leaders of the Group of Twenty (G20) major economies said they were spending over $5 trillion, equivalent to 7.4 percent of 2019 G20 countries’ gross domestic product (GDP), to “counteract the social, economic, and financial impacts of the pandemic.” Since then, G20 governments have added to this figure as the extent of the economic fallout has become clearer.

The CSIS Simon Chair analyzed and categorized major fiscal actions taken by G20 countries to respond to the economic shock. Several key trends emerge:

- The largest component of fiscal support is intended to provide financing to businesses: As of April 10, 2020, we estimate G20 countries to have pledged $5.4 trillion in fiscal support, representing 8.0 percent of 2019 G20 GDP. Of the total, $2.5 trillion will support credit enhancements (3.7 percent of 2019 G20 GDP), compared to $2.3 trillion (3.3 percent of GDP) in direct government spending and $0.6 trillion (0.9 percent) in tax relief. (Our analysis does not include tax deferments.) Almost all support focuses on keeping companies and individuals afloat rather than stimulating new demand and investment, which will become the priority when health restrictions ease.

- Direct government spending is higher than levels during the global financial crisis (GFC), so far: The 3.3 percent of G20 2019 GDP in direct government spending compares to 2.5 percent of G20 GDP in 2008-2009 “crisis-related discretionary measures” in response to the GFC. By the end of the pandemic, G20 countries will likely have spent far more than they did in the GFC as a percent of GDP.

- G20 countries have responded faster than during the GFC: In response to the pandemic, G20 governments announced 8 percent of GDP in fiscal support between early February and early April, with more expected in the coming weeks and months. During the GFC, governments’ responses were more protracted: in the United States, the epicenter of the GFC, the Economic Stimulus Act was signed into law in February 2008; the Emergency Economic Stabilization Act, which included government funding for the purchase of troubled assets from financial institutions, was signed in October 2008; and the American Recovery and Reinvestment Act of 2009, which authorized significant government spending, was signed in February 2009.

- Thus far, China’s fiscal response is more limited than during the GFC: China’s fiscal support as of April 10 amounts to roughly 1.3 percent of GDP, primarily through loans for impacted businesses and tax relief. This spending at the national level is far lower than the nearly 13 percent of GDP in fiscal spending (inclusive of local, provincial, and national spending) China announced in November 2008 in response to the GFC. Chinese officials have recently signaled they could provide additional stimulus later this year as the health situation stabilizes, but a desire to avoid adding to already high total debt levels will likely limit potential spending.

- Emerging market (EM) economies are more constrained: As a percent of GDP, EM members of the G20 have announced far less fiscal support than advanced economy (AE) G20 peers, reflecting, in part, more binding financing constraints. G20 EM fiscal support as of April 10 averages 2 percent of GDP versus 11.7 percent among G20 AEs. Many EMs are at an earlier stage of the pandemic relative to many AEs and may need international support to finance necessary relief measures.

-----

Earlier: