ARAMCO WILL REDUCE DELIVERIES

PLATTS - 17 Apr 2020 - State-owned Saudi Aramco said Friday it will cut oil supplies in May by almost 4 million b/d, in line with the kingdom's commitments under the new OPEC/non-OPEC deal, as it seeks to assure an oil market devastated by the COVID-19 pandemic.

Aramco "will provide its customers with 8.5 million b/d of crude oil starting May 1," it said in a statement posted on the Saudi stock exchange Tadawul. This includes allocations to its crude buyers abroad but also to its domestic customers.

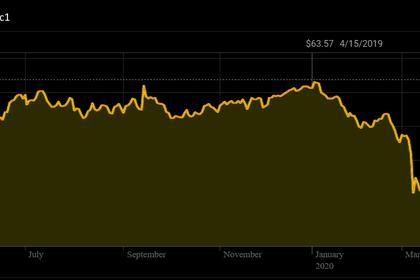

This is another signal from the OPEC kingpin that it has officially ended its oil price war, which led oil prices to crash close to two-decade lows, exacerbated by massive demand destruction caused by the coronavirus.

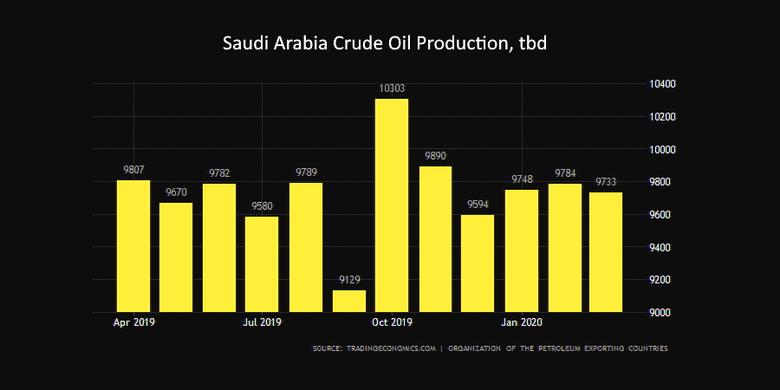

However, for April Saudi Arabia will still pump at an all-time record of 12.30 million b/d, according to the Saudi oil minister Prince Abdulaziz bin Salman.

Aramco had pledged to max out its production capacity, on orders from the Saudi energy ministry, after March's OPEC+ meeting fell apart with no deal on output restraints.

Saudi, Russia hint at further measures

Late Thursday, the Saudi and Russian energy ministers put out a joint statement that the two oil producers were strongly committed to the new output cuts which were agreed over the weekend as the oil market faces the worst demand destruction in its history from widespread lockdown measures implemented to contain the virus.

"We are prepared to take further measures jointly with OPEC+ and other producers if these are deemed necessary," the statement said.

The deal calls on OPEC, Russia and nine other allies to cut 9.7 million b/d of crude production in May and June, ramping down to 7.7 million b/d for the second half of 2020, and then 5.8 million b/d for all of 2021 through April 2022.

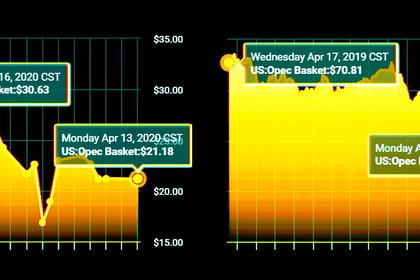

Despite the agreement of the largest production cuts in the history of the oil industry, prices have fallen since the deal was announced.

At 0852 GMT ICE June Brent was trading at $27.92/b, up by 10 cents from Thursday's settle. Brent futures briefly jumped to just over $36/b on April 2 after US President Donald Trump first said that that major oil producers like Russia and Saudi Arabia were planning to cut as much as 10 million b/d.

Under the new output deal, Saudi Arabia had agreed to reduce crude oil production to 8.5 million b/d in May and June from a baseline of 11 million b/d.

It will ramp its output up to 8.99 million b/d for the second half of 2020, and then to 9.5 million b/d for all of 2021 through April 2022.

Armada of crude

In a press briefing earlier in the week, the prince acknowledged that the kingdom was unable to reduce its output immediately due to contractual obligations. But he said domestic refinery runs were down on lower product demand, which will free up more crude for export.

Saudi Arabia is currently sending an armada of crude into an oil market reeling from coronavirus.

For the first half of April, Saudi exports are averaging as high at 10.55 million b/d, according to provisional data from Platts trade flow software cFlow.

Saudi crude exports were at a 15-month high of 7.60 million b/d in March, a rise of 400,000 b/d from February, the data showed.

Aramco already began hiking its crude exports towards the end of March, shipping 8.96 million b/d during the last week, up from 7.50 million b/d in the first week of the month, according to cFlow data.

Saudi Aramco has again made big cuts to its official selling prices to Asia, surprising some market watchers. But the prince said the reductions were done to remain competitively priced in a region that makes up 50% of the company's market share and has seen significant refinery run cuts due to the coronavirus.

Many analysts remain doubtful that the OPEC+ production cuts will be enough to rebalance supply and demand, given the magnitude of demand destruction caused by the coronavirus.

-----

Earlier: