ASIA STOCKS DOWN

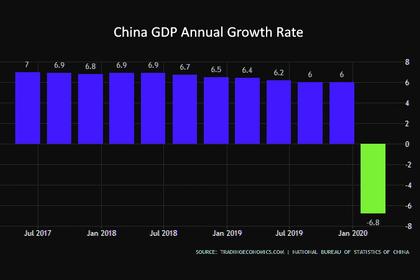

REUTERS - April 22 - Asian share markets were on the defensive on Wednesday as the floor fell out from under crude prices, sparking worries about further turmoil in the energy sector, already reeling from the heavy blow from global shutdowns.

The dizzying dive in oil has turned investors away from stocks to the safety of high-grade bonds, with short-term U.S. Treasuries yields edging down near record low levels.

European shares are on course to claw back earlier losses with pan-European Euro Stoxx 50 futures up 0.98%.

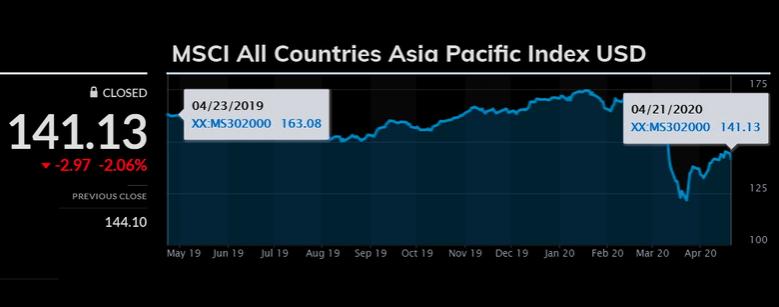

MSCI's broadest index of Asia-Pacific shares outside Japan fell as much as 1% before erasing losses to last stand at 0.4% higher while Japan's Nikkei slumped 0.7%.

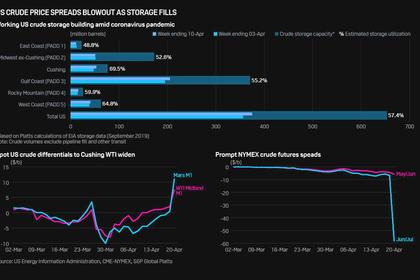

Oil prices plunged again after a shocking fall earlier this week in U.S. crude futures prices to negative levels, hurting anyone saddled with a glut of the commodity.

"Until we see an end in the demand destruction by coronavirus, markets will remain nervous about the possibility of U.S. prices hitting negative levels," said Tatsufumi Okoshi, senior commodity analyst at Nomura Securities.

"No U.S. producers will be making money at current price levels. Some oil producing producers in the Middle East may scrape home minimum cash to get by. But at national levels, their fiscal conditions will be very severe."

International benchmark Brent futures dropped 14.3% to $16.57 per barrel. So far this week, it has lost 40%.

U.S. June crude futures dropped 4.7% to $11.03 per barrel.

The cost of insurance against default by oil companies rose in the credit default swap market while the U.S. dollar pegged-Saudi riyal fell in forwards trade as speculators bet on a devaluation.

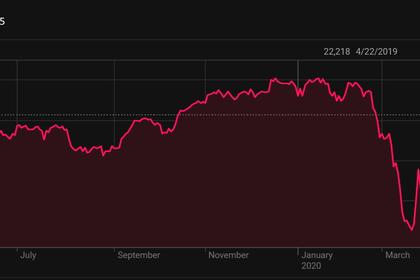

On Wall Street, the S&P 500 lost 3.07% and the Nasdaq Composite, which has outperformed due to increased demand for various internet services amid lockdowns, dropped 3.48%.

"The plunge in oil prices sparked fresh caution about the stock market. Overnight, companies that have been seen as a winner in the post-corona world, such as Amazon, fell. That is a worrying sign," said Naoya Oshikubo, senior manager of research at Sumitomo Mitsui Trust Asset Management.

Amazon fell 2.7% on Tuesday.

U.S. stock futures bounced back 1% in late Asian trade but were still down 3.8% so far this week.

The five-year U.S. Treasuries yield hit a record low of 0.3010% on Tuesday and last stood at 0.3339%. The 10-year notes yield stood at 0.561%, near the lowest since March 9, when panic buying drove it a record low.

The risk-averse mood offset news that the U.S. Senate on Tuesday unanimously approved $484 billion in fresh relief for the U.S. economy and hospitals hammered by the pandemic.

Governors of about half a dozen U.S. states pushed ahead on Tuesday with plans to partially reopen for business but some health officials warned doing so could trigger a new surge in coronavirus cases - fears shared by some investors.

As the difficulties of restarting the U.S. economy sank in, U.S. Treasury yields tumbled, with the five-year note hitting a new record low on rising prices for bonds: one of the safest assets.

In the currency market, the dollar was broadly supported as investors fled riskier assets for the world's most liquid currency while putting pressure on oil-linked currencies such as the Norwegian crown and the Canadian dollar .

The safe-haven yen held firm at 107.79 to the dollar while the Swiss franc stood near five-year high against the euro at 1.05255 franc.

-----

Earlier: