ASIA'S SHARES UP

REUTERS - APRIL 7, 2020 - Asian stock markets rallied for a second day on Tuesday and riskier currencies rose, on tentative signs the coronavirus crisis may be levelling off in New York and receding in Europe.

Gains, however, lacked Monday's momentum as the number of coronavirus cases kept rising globally and an economic crash on a scale not seen for generations looms large.

FTSE futures gained 3.08% and EuroSTOXX 50 futures rose 0.61%, pointing to a steady open in Europe, while U.S. stock futures were steady after trading either side of flat through the Asian day.

"At the moment Asian markets are leading their global counterparts and reacting with some optimism to speculation that we may be reaching peak infection and mortality rates in major cities," said Michael McCarthy, chief market strategist at CMC Markets. "But frankly that may be ill-founded."

The United States is bracing for its toughest week yet as the death toll climbs above 10,000 while across the Atlantic, British Prime Minister Boris Johnson has entered intensive care after his COVID-19 symptoms worsened.

Japan's Nikkei rose 2% and has erased most of last week's losses after Prime Minister Shinzo Abe promised a massive $991 billion economic stimulus package - equal to 20% of GDP.

MSCI's broadest index of Asia-Pacific shares outside Japan pared early gains, but rose 1.4%.

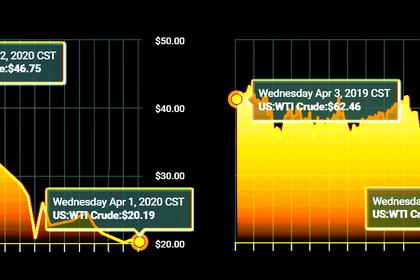

Oil rose on hopes the world's biggest producers will agree to cut output as the virus pandemic crushes demand, while the risk-sensitive Australian dollar rose 1%.

"The market is front running what it believes is a peak in the virus case count with Europe leading the way," said Chris Weston, head of research at Melbourne brokerage Pepperstone.

"You can almost smell the fear of missing out from active managers."

Worldwide, the virus has infected more than 1.3 million people and killed over 74,000, and the numbers are rising even as swathes of the globe are under lockdown.

Hope stems though from hardest-hit Italy and Spain, where authorities have started looking ahead to easing lockdowns after steady falls in coronavirus-related fatality rates.

In New York, the number of deaths each day has also steadied while hospitalisations, admissions to intensive care and the number of patients put on ventilators all declined.

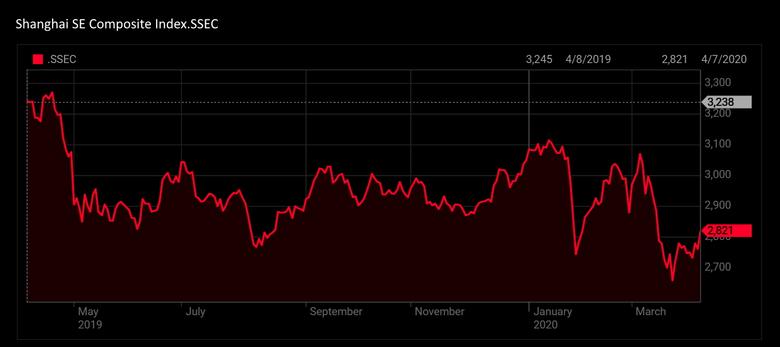

Markets in Seoul, Shanghai and Hong Kong opened higher, then pared gains. Australia's ASX 200 slipped into the red.

-----

Earlier: