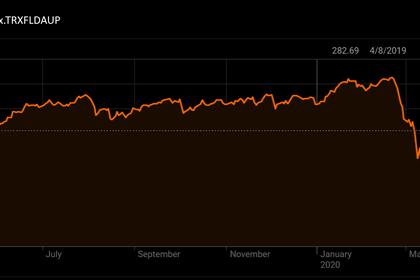

AUSTRALIA'S INDEX DOWN

REUTERS - APRIL 20, 2020 - Australian shares finished lower on Monday weighed by energy stocks, as concerns over a slump in oil demand due to the coronavirus pandemic drove the energy sub-index to its worst session in more than three weeks.

The S&P/ASX 200 index fell 2.5% or 134.50 points to 5,353.00 at the close of trade.

The energy sub-index suffered a 4.6% drop as U.S. crude oil futures plunged to their lowest levels since 1999. Concerns mounted over whether U.S. storage facilities would soon reach capacity.

"Oil names (are) looking sickly here today," RBC Capital Markets' head of equities Karen Jorritsma wrote in a note.

Jorritsma added that, as oil prices remain far below production costs for many producers, "at current levels, the entire industry is out of the money".

Industry giants Woodside Petroleum and Santos lost 4.4% and 3.7%, respectively.

Caltex Australia shares plunged 7.8% after Canadian company Alimentation Couche-Tard scrapped its takeover bid for the petrol station operator, citing coronavirus-related uncertainties.

Meanwhile, Sydney Airport Holdings eased 2.9%, hurt by a more than 45% drop in passenger traffic in March. The airport operator said data for the first 16 days of April showed traffic had slowed to a trickle.

Healthcare stocks settled 3.1% lower, with heavyweight CSL sliding 3.8% and hospital operator Ramsay Health Care dropping 2.5%.

Miners were weighed down by a 2.3% fall in gold stocks as the bullion price weakened amid doubts over the United States' plans to reopen its economy.

Gold producer Newcrest Mining and Australian-listed shares of AngloGold Ashanti lost 3.8% and 2.3%, respectively.

New Zealand's benchmark S&P/NZX 50 index slipped 0.1% or 16.05 points to finish the session at 10,762.67 after starting the day in positive territory.

Prime Minister Jacinda Ardern said the country would loosen some of its virus-driven lockdown measures next week after a month of strict restrictions.

Meanwhile, data showed consumer inflation came in higher-than-expected in the first quarter.

However, the market is placing little weight on the first quarter inflation figures, which largely predate the COVID-19 lockdowns, analysts at Goldman Sachs said in a note.

"... we continue to expect a large rise in unemployment and associated fall in demand will outweigh any supply-side effects on inflation over the course of 2020," they wrote.

-----

Earlier: