CHINA'S ECONOMY UPDOWN

PLATTS - 17 Apr 2020 - As the global economy battles the deadly COVID-19 pandemic, all eyes are on China and the rate at which its economy returns to business.

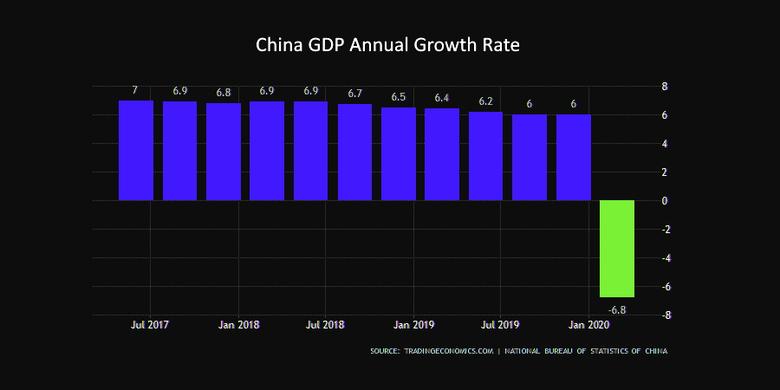

China on Friday reported a contraction of 6.8% in its Q1 GDP and all data pointed to the deepest quarterly year-on-year contraction since the reform era began in the late 1970s.

But some key Q1 economic indicators such as fixed-asset investment, industry production, and completed building floor space suggest that economic activity improved in March from January-February.

China's fixed asset investment fell by 16.1% year on year over January-March, compared with a drop of 24.5% in the first two months of the year. Meanwhile, floor space of buildings completed, an important indicator for aluminum consumption, came up to 155.57 million sq m over January-March, down 15.8% from a year earlier. The drop was 7.1 percentage points less than that in the first two months of the year.

Industry production fell 1.1% year on year in March, 12.4 percentage points less than the decline in January-February.

Commodity trends as observed by S&P Global Platts also indicate that the country is slowly but surely returning to business as usual.

OIL

** China's planned crude throughput in April is expected to recover to about 12.5 million b/d, about 90% of the level in January after falling by about 3.3 million b/d in February, a Platts survey showed.

** Gasoline and gasoil retail sales volumes as of April 10 recovered to over 90% of levels prior to the spread of COVID-19, a source with the country's largest refiner and retailer Sinopec said, adding that lockdowns in the country slashed the volume by a half in February.

** Traffic volume on highways across the country hit 34.93 million vehicles on April 12, up 21.91% year on year, according to the Ministry of Transportation. In comparison, on February 16, traffic volume on highways across the country was 5.42 million vehicles.

** Analysts expect gasoline and gasoil consumption to recover to 100% by end-April as people would prefer to drive than use public transport to avoid the pandemic.

** Jet fuel consumption is, however, estimated to remain low as the number of daily flights, comprising domestic and international ones, averaged at 5,548 so far in April, around a third of 16,135 recorded in January but slightly up from 5,303 in February, VeriFlight data showed.

** Platts Analytics expects the decline in China's oil demand to ease to 7.2% year on year in Q2 from 12% in Q1. For 2020, Platts Analytics estimates the country's oil demand at 14.41 million b/d, down 2% year on year.

GAS

** China's natural gas consumption is expected to have reached around 90% of normal levels across the country in H1 April as industrial and commercial activities continue to recover, compared with 50%-60% in February and 70%-80% in March, according to domestic market sources.

** LNG truck sales hit 518 trucks/day from the CNOOC Tianjin terminal on April 1, slightly higher than normal levels of around 500 trucks/day during peak season, a source with knowledge of the matter said.

** China Gas, one of the major city gas operators, said its LNG sales have resumed to above 90% of normal levels in April, compared with around 50% in February and around 70% in March.

** Platts Analytics expects China's LNG imports to inch up 0.4% on the year in Q2 after seeing a year-on-year contraction of 2.3% in Q1 2020.

** China's propane dehydrogenation plants are expected to operate at an average rate of 82% in H1 April, up from 66% in January, 74% in February and 75% in March, JLC data showed.

COAL

** China's domestic 5,500 kcal/kg NAR coal prices fell by around 10% early April compared with mid-February, as production has gradually gone up. Coal production, which had fallen 6.3% year on year to 490 million mt in January and February, is now back online with March production at 340 million mt, up 9.6% on the year as the spread of the coronavirus has subsided.

** Daily coal consumption at the six major coastal power plants is currently at 564,100 mt, compared with 542,000 mt mid-March and 381,000 mt mid-February.

** Stockpiles at these power plants have fallen to 16.3 million mt, compared with 17.6 million mt mid-March and 16.9 million mt mid-February.

METALS

** Construction activity in China has returned to around 70%-90% of normal levels depending on the region, compared with almost zero activity in February when the country was in lockdown. This has supported domestic rebar prices which reached Yuan 3,570/mt ($505/mt) on April 16, up around 5% from the start of March, but still below Yuan 3,700/mt on January 25, according to Platts. Domestic rebar margins on April 16 were a relatively healthy $63.24/mt, compared with $59.60/mt on the last day of trading before the Lunar New Year holidays, Platts data shows.

** Manufacturing activity is around 80%-90% now that workers have largely returned to factories, as evidenced by the National Bureau of Statistics' purchasing managers' index climbing from a record low of 35.7 points in February to 52.3 in March.

** According to a Platts outlook survey for iron ore and steel in Q2, 35% of respondents thought China's steel market would fully recover by end-May and a further 25% by end-June. The survey found that 37% of respondents expected steel demand growth to come mainly from infrastructure, while 19% thought construction would continue to be the key demand growth segment.

**China's car making sector reached around 75% of normal operating levels in March, with output and sales up fourfold on February to 1.422 million units and 1.43 million units, respectively, according to the China Association of Automobile Manufacturers.

** China's Q2 alumina prices are expected to suffer from a sharp contraction in domestic and global demand as a result of the coronavirus pandemic, a survey by Platts showed. This is because much of the current infrastructure plans are targeting high-tech and communications sectors, which would have limited impact on boosting aluminum demand. Majority of aluminum consumption comes from property, vehicle production and power sectors.

SOYBEANS

** Food demand is inelastic and as such did not bear the brunt of COVID-19, but the industry suffered logistical constraints that are slowly easing.

** Production at feed mills was interrupted late January and February due to movement restrictions on vehicles and people throughout China. But, according to China's Ministry of Agriculture and Rural Affairs survey, 80% of feed mills resumed normal operations as of the beginning of March 2020.

** China's soybean imports in April is forecast at 13 million-14 million mt, up 225% month on month and 75% higher on the year, according to analysts. Analysts anticipate gradual easing of port restrictions and a shorter quarantine waiting period in April.

** There will certainly be blips of coronavirus recurrences and a possible flare up of African swine fever once again, but for the most part the worst is over for China, said Pete Meyer, head of grain and oilseed analytics, at Platts. China can import up to 90 million mt of soybeans in the current marketing year (September-October), up 9% year on year, Meyer said.

-----

Earlier: