COVID-19: HISTORIC CHALLENGE

IMF - The April 2020 Global Financial Stability Report

Chapter 1

Executive summary

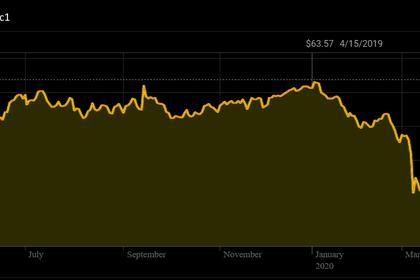

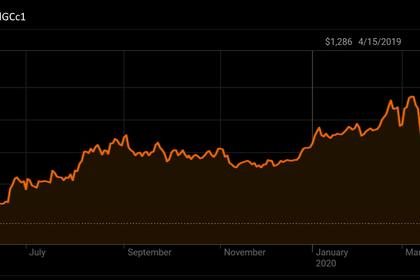

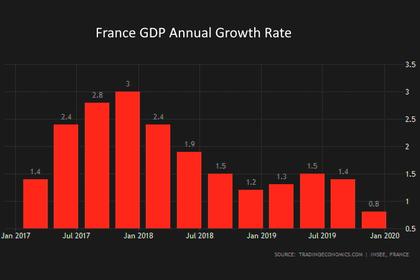

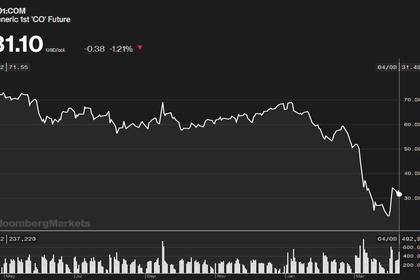

The coronavirus (COVID-19) pandemic presents a historic challenge. In mid-February, when market participants started to fear that the outbreak would become a global pandemic, the prices of equities fell sharply, from previously overstretched levels. In credit markets, spreads skyrocketed, especially in risky segments such as high-yield bonds, leveraged loans, and private debt, where issuance essentially came to a halt. Oil prices plummeted in the face of weakening global demand and the failure of the OPEC+ countries to reach an agreement on output cuts, adding a further leg to the deterioration in risk appetite. These volatile market conditions led to a flight to quality, with yields on safe-haven bonds declining abruptly.

A number of factors amplified asset price moves, contributing to a sharp tightening of financial conditions at unprecedented speed. Signs of strain emerged in major short-term funding markets, including the global market for US dollars—a development reminiscent of dynamics last seen during the financial crisis a decade ago. Market liquidity deteriorated considerably, including in markets traditionally seen as very deep. Leveraged investors came under pressure, with some reportedly forced to close out some of their positions in order to meet margin calls and rebalance their portfolios.

However, markets have pared back some of the losses. Decisive monetary and fiscal policy actions, aimed at containing the fallout from the pandemic, have stabilized investor sentiment. Nevertheless, there is still a risk of a further tightening in financial conditions that could expose financial vulnerabilities, which have been highlighted repeatedly in previous Global Financial Stability Reports.

Emerging and frontier market economies are facing the perfect storm. They have experienced the sharpest reversal in portfolio flows on record, both in dollar terms and as a share of emerging and frontier market GDP. This loss of external debt financing is likely to put pressure on more leveraged and less creditworthy borrowers. This may lead to a rise in debt restructurings, which could test existing debt resolution frameworks.

Asset managers may face further outflows from their funds and may be forced to sell assets into falling markets, potentially exacerbating price moves. High levels of borrowing by companies and households may lead to debt distress as the economy comes to a sudden stop. Banks have more capital and liquidity than in the past, they have been subject to stress tests, and central bank liquidity support has helped mitigate funding risks, putting them in a better position than at the onset of the global financial crisis. The resilience of banks, however, may be tested in some countries in the face of large market and credit losses, and this may cause them to cut back their lending to the economy, amplifying the slowdown in activity.

This historic challenge necessitates a forceful policy response. The priority is to save lives and to implement appropriate containment measures to avoid overwhelming health systems. Country authorities need to support people and companies that have been most affected by the virus outbreak, as discussed in the April 2020 World Economic Outlook.

To that end, authorities across the globe have already implemented wide-ranging policies. The April 2020 Fiscal Monitor describes the fiscal support packages that have been announced by governments across the globe. Large, timely, temporary, and targeted fiscal measures are necessary to ensure that a temporary shutdown of activity does not lead to more permanent damage to the productive capacity of the economy and to society as a whole.

Central banks globally have taken bold and decisive actions by easing monetary policy, purchasing a range of assets, and providing liquidity to the financial system in an effort to lean against the tightening in financial conditions and maintain the flow of credit to the economy. As policy rates are now near or below zero in many major advanced economies, unconventional measures and forward guidance about the expected policy path are becoming the main tools for these central banks going forward. Central banks may also consider further measures to support the economy during these challenging times.

Policymakers need to maintain a balance between safeguarding financial stability and supporting economic activity.

• Banks. In the first instance, banks’ existing capital and liquidity buffers should be used to absorb losses and funding pressures. In cases where the impact is sizable or longer lasting and bank capital adequacy is affected, supervisors should take targeted actions, including asking banks to submit credible capital restoration plans. Authorities may also need to step in with fiscal support—either direct subsidies or tax relief—to help borrowers to repay their loans and finance their operations, or provide credit guarantees to banks. Supervisors should also encourage banks to negotiate, in a prudent manner, temporary adjustments to loan terms for companies and households struggling to service their debts.

• Asset managers. To prudently manage liquidity risks associated with large outflows, regulators should encourage fund managers to make full use of the available liquidity tools where it would be in the interests of unit holders to do so.

• Financial markets. Market resilience should be promoted through well-calibrated, clearly defined, and appropriately communicated measures, such as circuit breakers.

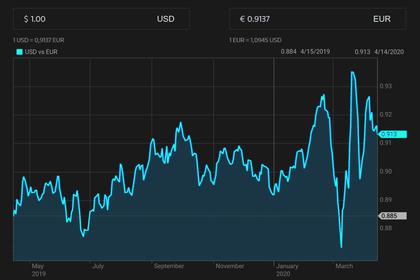

Many emerging market economies are already facing volatile market conditions and should manage these pressures through exchange rate flexibility, where feasible. For countries with adequate reserves, exchange rate intervention can lean against market illiquidity and thus play a role in muting excessive volatility. However, interventions should not prevent necessary adjustments in the exchange rate. In the face of an imminent crisis, capital flow management measures could be part of a broad policy package, but they cannot substitute for warranted macroeconomic adjustment.

Sovereign debt managers should prepare for longer-term funding disruptions by putting contingency plans in place to deal with limited access to external financing.

Multilateral cooperation is essential to help reduce the intensity of the COVID-19 shock and its damage to the global economy and financial system. Countries confronting the twin crises of health and external funding shocks—for example, those reliant on external financing or commodity exporters dealing with the plunge in commodity prices—may additionally need bilateral or multilateral assistance to ensure that health spending is not compromised in their difficult adjustment process. Official bilateral creditors have been called upon by the IMF Managing Director and the World Bank President to suspend debt payments from countries below the International Development Association’s operational threshold that request forbearance while they battle the pandemic. The IMF, with $1 trillion in available resources, is actively supporting member countries.

-----

Earlier: