ДИАЛОГ РОССИИ, США

МИНЭНЕРГО РОССИИ - Москва, 1 апреля. - В развитии беседы Президента Российской Федерации Владимира Путина и Президента Соединённых Штатов Америки Дональда Трампа состоялся разговор между Министром энергетики Российской Федерации Александром Новаком и Министром энергетики США Дэн Бруйеттом.

Стороны обсудили текущее состояние мирового нефтяного рынка и перспективные направления сотрудничества двух стран на энергетическом рынке по линии G20 и Всемирного банка. Министры отметили, что падение спроса и избыток на нефтяном рынке не способствуют поступательному развитию мировой энергетики и создают риски стабильного снабжения рынка после начала восстановления мировой экономики. Кроме того, главами энергетических ведомств была отмечена необходимость конструктивного ответа на существующие вызовы и последующее продолжение диалога.

-----

ДИАЛОГ РОССИИ, США

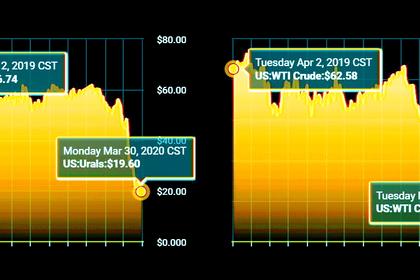

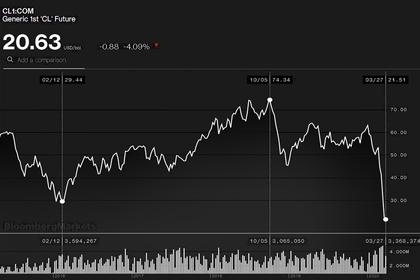

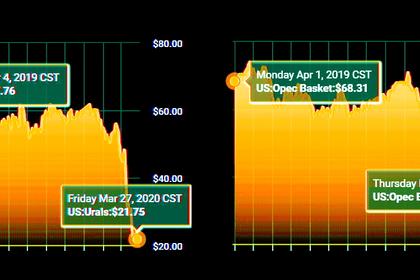

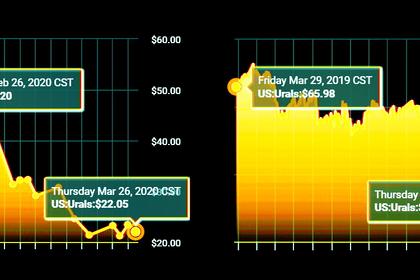

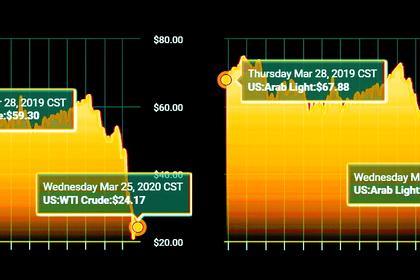

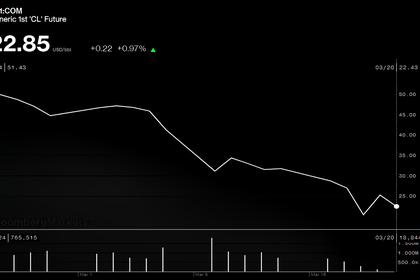

REUTERS - APRIL 1, 2020 - Oil slid to $25 a barrel on Wednesday, within sight of its lowest in 18 years, as a report showing a big rise in U.S. inventories and a widening rift within OPEC heightened oversupply concerns.

Pledges of higher output from Saudi Arabia and Russia after a supply pact collapsed and a slide in demand due to the coronavirus outbreak have hammered the market.

Global benchmark Brent crude fell 66% in the first three months of 2020 in its biggest ever quarterly loss.

As of 0830 GMT, Brent was down $1.45, or 5.5%, at $24.90. The price fell to $21.65 on Monday, the lowest since 2002. U.S. West Texas Intermediate crude was down 27 cents, or 1.3%, at $20.21.

"April will be one of the toughest months in history for oil and this is no April fool's joke," said Bjornar Tonhaugen of Rystad Energy.

"The market is oversupplied in April to the tune of 25 million barrels per day. There's nowhere to hide from this tsunami of oversupply."

Underlining supply glut fears, the American Petroleum Institute, an industry group, reported U.S. crude inventories rose by 10.5 million barrels, far exceeding forecasts for a 4 million barrel increase.

Attention will focus on U.S. government figures due on Wednesday to confirm the API figures.

The bearish mood was also fueled by a rift within the Organization of the Petroleum Exporting Countries. Saudi Arabia and other OPEC members have not agreed to hold a technical meeting in April to discuss sliding prices.

An OPEC-led supply deal fell apart on March 6 when Russia refused to cut output further. Saudi Arabia has already begun to boost output, a Reuters OPEC survey showed on Tuesday, and is expected to pump more in April.

"It is very unlikely that OPEC, with or without Russia or the United States, will agree a sufficient volumetric solution to offset oil demand losses," BNP Paribas analyst Harry Tchilinguirian said in a report on Tuesday.

Adding to the downward pressure, sources told Reuters that top U.S. officials have for now put aside a proposal for an alliance with Saudi Arabia to manage the global oil market.

"Diplomacy won't be able to help the physical oil market nor oil prices in the short term," Tonhaugen of Rystad said. "The market is officially broken and no longer reflecting the value of crude."

-----