ENERGY PRICES DOWN

REUTERS - APRIL 1, 2020 - European spot electricity prices for day-ahead delivery fell on Wednesday on higher nuclear supply in France and forecasts for increased wind power in Germany, while year-ahead contracts dropped, tracking declines in carbon, coal and gas futures.

* The German over-the-counter baseload contract for Thursday delivery was down 11.2% at 19.75 euros ($21.51) a megawatt hour (MWh) at 1012 GMT.

* The equivalent French day-ahead price fell 6.8% to 20.50 euros/MWh.

* Daily wind power supply was forecast to jump 7.8 gigawatts (GW) in Germany to 20.2 GW on Thursday, according to Refinitiv Eikon data.

* German solar power supply should dip by 820 MW to 6.8 GW, the data showed.

* French nuclear power availability rose by over 2 percentage points to 69.70% of total installed capacity following the restart of two nuclear reactors.

* French wind electricity generation was forecast to slide 1.2 GW to 2 GW, while electricity generation from French solar panels was expected to be flat at 1.7 GW.

* On the demand side, electricity usage was forecast to drop 410 MW in Germany day-on-day to 68.3 GW on Thursday.

* French power consumption was expected to fall by 370 MW to 54.1 GW in the same period, the Refinitiv data showed.

* The average temperature was expected to rise by 2.5 degrees Celsius in Germany on Thursday. The average temperature should remain steady in France at around 8 degrees Celsius.

* Along the power forward curve, Germany's Cal '21 contract , Europe's futures benchmark, shed 1.9% to 34.85 euros/MWh, tracking the fall in oil, coal, gas and carbon emissions prices.

* The equivalent French year-ahead baseload position dropped by 1.7% to 39.10 euros/MWh.

* In eastern Europe, the Czech year-ahead baseload contract fell 1.6% to 39.75 euros/MWh.

* December 2020 expiry European CO2 allowances lost 4.8% to 16.83 euros a tonne.

* Hard coal for northern European delivery in 2021 was down 0.6% at $54.85 per tonne.

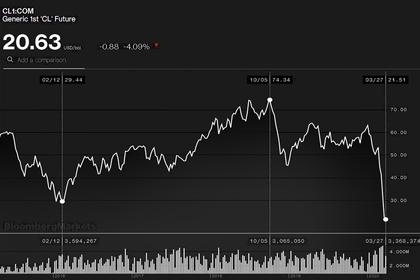

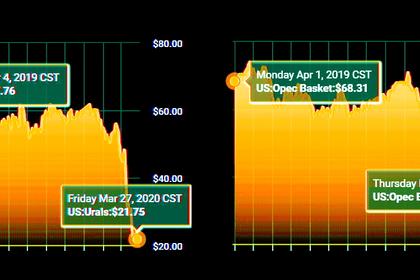

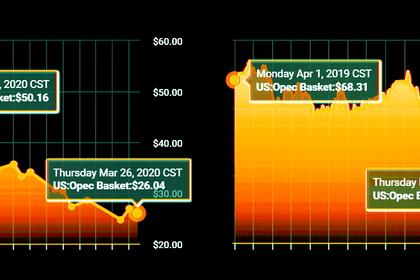

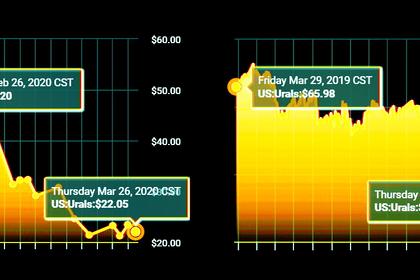

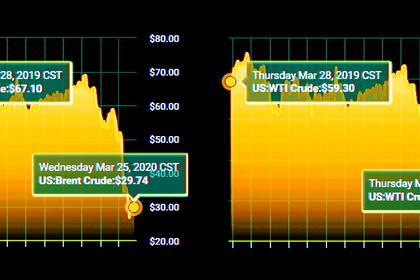

* Oil slid to $25 a barrel on Wednesday, within sight of its lowest in 18 years, as a report showing a big rise in U.S. inventories and a widening rift within OPEC heightened oversupply concerns. ($1 = 0.9137 euros)

-----

Earlier: