EURO DOWN

REUTERS - APRIL 23, 2020 - The euro fell to its lowest in a month on Thursday after data showed economic activity in the euro zone virtually halted by government-imposed lockdowns to stop the coronavirus pandemic.

The single currency dropped 0.6% against the dollar EUR=EBS to its lowest since March 24, after IHS Markit's Flash Composite Purchasing Managers' Index (PMI) sank to by far its lowest reading since the survey began in 1998.

The euro was last at $1.07795, with investors awaiting the result of a meeting of European Union leaders on the bloc's response to the economic turmoil caused by the pandemic.

The summit will bring a move towards joint financing to help the bloc recover from a forecast deep recession caused by the pandemic by asking the European Commission to propose a fund big enough to target the most affected sectors and regions.

But uncertainty remains over how far EU governments will be prepared to share the burden.

"The proposed Recovery Fund could help, but a lot will depend on its size, conditions and debt mutualization," Bank of America analysts wrote.

"We do not see a strong consensus to mutualize this debt."

The euro fell 0.6% against the pound EURGBP=D3 to 87.7240 pence, with sterling gaining even after UK preliminary PMI readings for April fell far below even the most pessimistic forecasts.

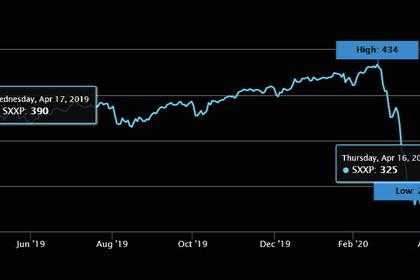

European stocks rose 0.2%, erasing earlier losses as energy shares jumped.

DOLLAR SLIPS AS OIL RISES

Elsewhere, the dollar slipped against the currencies of oil-producing states as a bounce in crude prices gave succour to markets shaken by the massive coronavirus-induced drop in demand.

The Norwegian crown, Russian rouble and Mexican peso all gained as Brent crude LCOc1 rallied on tensions in the Middle East and signs that producers were cutting production to address collapsing demand for fuel.

In volatile trading, Brent crude LCOc1 soared as much as 15%, bouncing back from its lowest level since June 1999. It was last up 9.1% at $22.23 a barrel.

The greenback fell 1% against the rouble to 75.1017 RUB=, and by 0.8% against the crown NOK= to 10.7061, pulling back from a one-month high reached a day earlier.

Against the peso MXN=D3 it fell 0.8% to 24.4640, retreating from a two-week high hit earlier.

The gains for oil came as major economies have been brought to a virtual standstill, with severe restrictions on businesses and travel aimed at limiting the spread of the novel coronavirus hitting commodity currencies.

As a result, analysts said, the boost for commodity currencies was not likely to last.

“The demand contraction is a far more compelling story than the production cuts, and that will remain the dominant influence,” said Derek Halpenny, EMEA head of research for MUFG.

The dollar was up 0.1% against a basket of currencies =USD, lasting trading at 100.620.

-----

Earlier: