EUROPE'S COVID-19 INVESTMENT €21 BLN

EBRD - 23 Apr 2020 - The EBRD is rapidly stepping up support for its regions in the face of the coronavirus pandemic and now expects to dedicate the entirety of its activities to helping the 38 emerging economies where it invests to combat the economic impact of the crisis.

EBRD shareholders agreed today to a comprehensive series of response and recovery measures that strengthen the Bank’s Solidarity Package , which was first unveiled on 13 March. The Bank now stands ready to provide support worth €21 billion over the 2020-21 period.

EBRD President Suma Chakrabarti described Covid-19 as an unprecedented challenge to the world and to the EBRD regions. Announcing the new measures, he said, “The crisis is now so all‐encompassing that, in practice, it is expected that all of the Bank’s business over the next one to two years will contribute to the EBRD’s crisis response.”

The EBRD is adapting and scaling up existing instruments and developing new initiatives to provide finance and policy support to help stave off the immediate threat of the virus.

It is also working to prepare its countries for the post-virus era and to safeguard their hard-won progress towards sustainable, fair and open market economies.

A key pillar of the EBRD’s Solidarity Package is a Resilience Framework providing finance to meet the short-term liquidity and working capital needs of existing clients.

Demand has been strong and, as part of the scaled up response, financing available under the Framework will rise to €4 billion from €1 billion until a further assessment of needs before the end of this year. The EBRD has widened its scope to include the affiliates of existing clients.

The EBRD will increase financing under its Trade Facilitation Programme , responding to fast-rising demand for trade finance to keep open the channels of commerce under challenging circumstances. It will also offer fast-track restructuring for distressed clients.

The Bank will strengthen established frameworks that can reach out especially to small and medium-sized enterprises (SMEs) and corporations that are not yet clients of the EBRD, making the real economy more resilient with financing delivered directly and indirectly via the banking system. Another element in the Solidarity Package is a new emergency facility to meet essential infrastructure requirements.

The focus with all these instruments is on the speed of the EBRD’s response through effective streamlined procedures.

The emergency channels will target all sectors of the economy, but especially those badly hit by the crisis, including among others, financial institutions, SMEs, and corporate sectors such as tourism and hospitality, automotive and transport providers, agribusiness, and medical supplies.

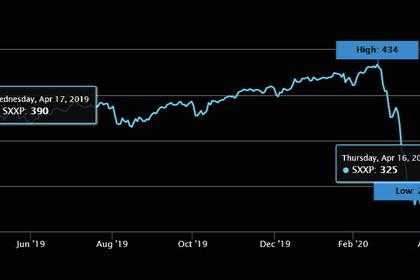

The economies in the EBRD regions, which stretch from central and eastern Europe through to Central Asia and North Africa, are suffering from the effects of measures to contain the virus, but also from external shocks including sharp drops in commodity prices, disruption to global value chains, a collapse in tourism and a fall in remittances.

The EBRD will focus primarily on the rapid provision of debt needed to respond to these challenges in this phase of the crisis. As the situation evolves, the Bank will also ramp up its local currency, capital markets and equity offers.

The economic resilience package offered by the EBRD complements the significant health and budgetary support measures delivered by other international financial institutions (IFIs) in these regions.

In delivering its support, the EBRD will work closely with other IFIs, including at the country level, to ensure efficient and coordinated responses for economies and clients in their time of need.

The EBRD acknowledges that in this period of threat there can be no business as usual. However, even as credit conditions worsen, the Bank will continue to subject its projects to the normal standards and requirements. The EBRD will not compromise the standards on which its impact and reputation rest. Transition impact, sound banking and additionality remain the EBRD’s key operating principles.

In parallel with its increased financial support, the EBRD will put an even greater focus than usual on policy support in order to respond to the short- and longer-term consequences of Covid‐19.

In the short term, the EBRD will provide “bridge support” to help clients develop effective responses to the pandemic in order to preserve value and survive. Virtual advice and training is already being offered to help governments identify innovative policy solutions and to clients to assist with workforce planning and crisis management.

At the same time, the EBRD will need to play a systemic role in supporting the broader private sector and well-functioning markets.

This pandemic has the potential to entrench and exacerbate inequalities in society and to jeopardise hard‐fought commitments in the battle against climate change.

As the EBRD acts to protect the economies of its regions, it will also seek to safeguard transition, working to ensure an inclusive and gender-sensitive response to the crisis and to preserve commitments on transition to the green economy.

In response to an inevitable increase in the footprint of the state in economies, the EBRD will work with governments to shape their interventions, to minimise distortions and unfair competition and to protect the effectiveness of open markets.

-----

Earlier: