EUROPE'S SHARES UP

REUTERS - APRIL 27, 2020 - European shares rose on Monday as airline stocks soared on hopes of state support, while upbeat earnings from Deutsche Bank and others added to optimism from signs many countries will soon ease coronavirus-driven lockdown measures.

Shares of Lufthansa (LHAG.DE) jumped 6.8% after Germany’s transport minister said he was in favour of protecting the airline company, with Air France KLM (AIRF.PA) advancing 4.3% following a 7-billion-euros ($7.6 billion) government aid package.

Euro zone banks .SX7E surged 4.1% as Deutsche Bank (DBKGn.DE) beat first-quarter earnings expectations but warned it might miss its capital requirement target this year as it prepares for a spike in defaults and extends more credit in response to the COVID-19 pandemic.

The German lender’s shares jumped 10.8%, on course for their biggest percentage gain in a month, while peer Commerzbank (CBKG.DE) rose about 7%.

“One important point is that earnings have actually been coming better than expected,” Sebastien Galy, macro strategist at Nordea Asset Management, wrote in a client note.

“What matters is the pace with which the global economy reopens. Europe is on the path of re-opening and companies are sending out plans to restart onsite activity.”

Italy, among the worst-hit countries by the virus, is set to allow factories and building sites to reopen from May 4 and permit limited family visits.

Milan-listed shares .FTMIB rose 2.2% after ratings agency S&P Global on Friday affirmed its credit rating on Italy, saying the country's diversified and wealthy economy and net external creditor position offset a drag from high public leverage.

Volkswagen (VOWG_p.DE), the world’s largest carmaker by sales, said it had resumed work at its biggest factory in Wolfsburg, Germany.

Germany's DAX .GDAXI also got a boost from drugs and pesticides company Bayer (BAYGn.DE), which gained 3.1% after its first-quarter adjusted core earnings beat market estimates.

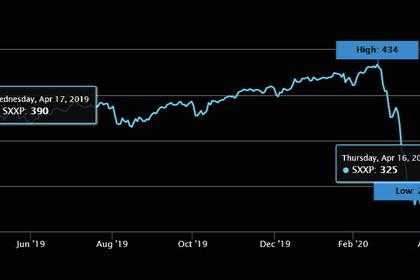

The pan-European STOXX 600 rose 1.5%, following gains in Asian markets after the Bank of Japan pledged to buy unlimited amount of bonds to keep borrowing costs low.

The benchmark index has recovered about 25% from mid-March lows as policymakers inject trillions of dollars into the global economy that has ground to a halt due to the health crisis. Investors are pinning hopes on further stimulus actions from the European Central Bank after its Thursday meet.

Shares in Adidas (ADSGn.DE) gave up early losses to trade 2.5% higher after its upbeat views on e-commerce sales and China markets. The company reported a 93% plunge in first-quarter profit and warned of a deeper hit to second-quarter revenue.

Companies listed on the pan-European STOXX 600 index are expected to record a 24.6% drop in first-quarter earnings, with consumer cyclical companies expected to take the biggest hit, according to Refinitiv data.

-----

Earlier: