GLOBAL INDEXES DOWN

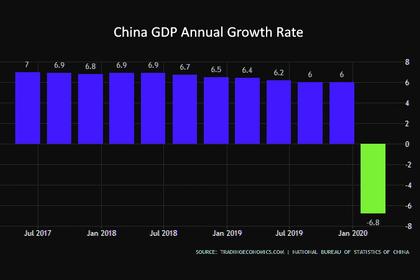

REUTERS - April 21 - Stock markets around the world fell on Tuesday, as a collapse in oil prices brought on by oversupply and a shortage of storage further exposed the depth of economic damage from the coronavirus outbreak and sent investors looking for shelter.

While gold is often seen as a safe-haven bet, even that commodity declined as investors looked to raise cash.

As the difficulties of restarting the U.S. economy sank in, U.S. Treasury yields tumbled, with the five-year note hitting a new record low on rising prices for bonds: one of the safest assets.

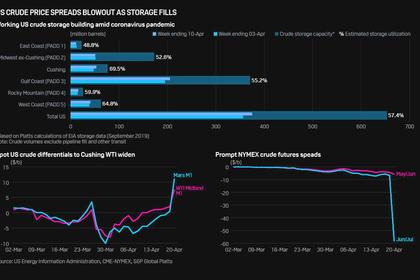

Brent oil futures prices plunged again on Tuesday as panic extended to a second day with no end in sight to a swelling global oversupply as the pandemic has obliterated demand for fuel and led to a dearth of storage space.

Oil demand has shriveled as worldwide lockdowns have kept people at home and businesses shuttered in efforts to contain the spread of the highly contagious virus.

The most actively traded U.S. futures - for oil to be delivered in June - briefly sank into single-digits before settling down 43.4% at $11.57 per barrel. On Monday traders had to pay $37.63 to get rid each barrel of oil under the May contract, which closed at $10.01 per barrel on Tuesday. Brent settled down 24.4% at $19.33 per barrel.

"It's one thing to have to keep lowering prices, but if you have to shut off wells because we're out of storage, that's a huge problem. It's massively expensive to do and undo," said Chris Zaccarelli, chief investment officer at Independent Advisor Alliance, Charlotte, North Carolina, who says many smaller oil companies would go out of business as a result.

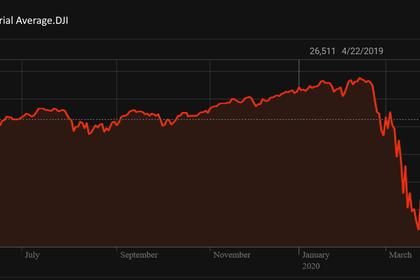

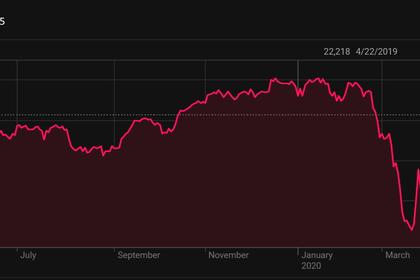

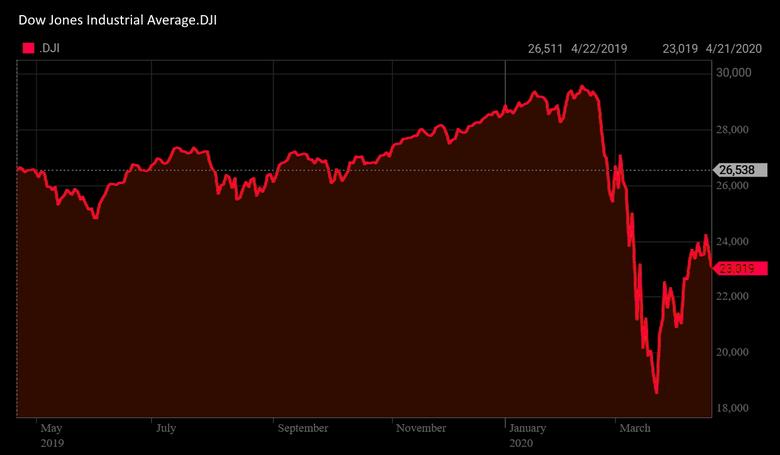

Equities around the world tumbled, with Wall Street's major stock indexes following Europe and Asia lower.

The Dow Jones Industrial Average fell 631.56 points, or 2.67%, to 23,018.88, the S&P 500 lost 86.6 points, or 3.07%, to 2,736.56 and the Nasdaq Composite dropped 297.50 points, or 3.48%, to 8,263.23.

The pan-European STOXX 600 index lost 3.39% and MSCI's gauge of stocks across the globe shed 3.02%. Emerging market stocks lost 2.40%.

Many equity investors saw swooning oil prices as a signal to "go to cash and get out of the market," said Zaccarelli.

"The bright spot is that people are becoming more realistic about what the future holds. The idea we would have a quick V-shaped recovery in the economy was way too optimistic," he said. "It's a wake-up call for companies to be more cautious with their cash flow and make plans for an extended downturn."

DOLLAR RISES

The U.S. dollar rose to a two-week high against a basket of currencies as investors fled riskier assets for the world's most liquid currency while putting pressure on oil-linked currencies such as the Norwegian crown and the Canadian dollar.

The dollar index rose 0.224%, with the euro down 0.04% to $1.0858.

The Mexican peso lost 1.32% versus the U.S. dollar. The Canadian dollar fell 0.25% and the Swedish crown fell 0.60% against the greenback, which was up 1% against Norway's currency.

Latin American currencies also dropped and while lower oil prices would typically benefit crude-importing emerging markets, the plunge in prices saw investors sharply reducing their exposure to risk assets.

Benchmark 10-year notes last rose 20/32 in price to yield 0.5628%, down from 0.626% late on Monday.

The 30-year bond last rose 74/32 in price to yield 1.1521%, down from 1.235%.

Gold prices dropped to their lowest in almost two weeks while palladium slumped 15.5% as investors scrambled for cash to cover losses in other asset classes, mainly driven by the crash in oil prices.

"Oil has really got the entire commodity complex down with it. ... A lot of people are exiting positions that they were very profitable on with a wait-and-see attitude to see whether there's further spillover from the energy into precious metals," said Bob Haberkorn, senior market strategist at RJO Futures.

Spot gold dropped 0.6% to $1,682.05 an ounce. U.S. gold futures fell 1.65% to $1,673.60 an ounce.

-----

Earlier: