GLOBAL SHARES DOWN

REUTERS - APRIL 15, 2020 - Global share markets dipped into the red on Wednesday as warnings of the worst global recession since the 1930s underlined the economic damage done during the coronavirus panemdic even as some countries try to re-open for business.

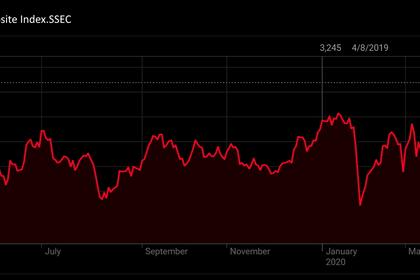

China moved again to cushion its economy, cutting a key medium-term interest rate to record lows, paving the way for a similar reduction in benchmark loan rates, while reducing the amount banks must hold as reserves.

But despite those moves combined injecting a total of $43 billion into the financial system of the world's second largest economy, they failed to provide a sustained boost for world shares. MSCI's All-Country World Index, which tracks shares across 49 countries, was 0.37% down.

European stock markets opened lower, with the pan-European STOXX 600 index opening 0.8% lower after five previous days of gains, fuelled by early signs the health crisis was ebbing and on hopes that sweeping lockdown measures would soon be lifted.

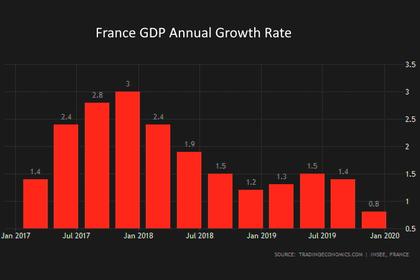

French shares fell 0.9% as France became the fourth country to report more than 15,000 deaths due to the coronavirus after Italy, Spain and the United States.

Much economic damage has also already been done, with the International Monetary Fund predicting the world this year would suffer its steepest downturn since the Great Depression of the 1930s.

Ahead of a steady stream of results due in the coming weeks, signs of corporate stress caused by the pandemic are widespread.

“A lot of good news has been priced in and we’re due for some consolidation, particularly as we head into earnings season as we all know the numbers will not be good,” Francois Savary, chief investment officer at Swiss wealth manager Prime Partners.

PERSISTENT WORRIES

Dutch navigation and digital mapping company TomTom shed 2.7% after saying it expected negative free cash flow this year and lower revenue from its automotive and consumer businesses due to the pandemic.

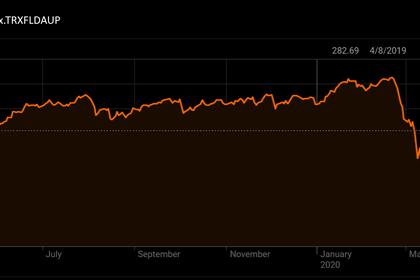

London-based asset manager Jupiter Fund Management dropped 5.6% after reporting an 18.3% drop in assets under management in the first quarter as fears over the pandemic rattled financial markets.

In the United States, E-Mini futures for the S&P 500 fell 0.5%, following a 3% rise in New York.

Even as some U.S. states considered relaxing restrictions, the country’s death toll rose by at least 2,228, a single-day record, according to a Reuters tally.

President Donald Trump responded by saying some states could still open shortly or even immediately. He also temporarily halted funding to the World Health Organization, saying it should have done more to head off the pandemic.

Italian bonds remained under pressure amid lingering disappointment with the half-a-trillion euro plan to support coronavirus-hit economies agreed by euro zone finance ministers last week.

Italy’s 2-year bond yield was last up 5 basis points to 0.89% after rising nearly 20 bps on Tuesday Ten-year yields were flat at 1.79%.

The closely watched gap with Germany’s 10-year bond yield, effectively the risk premium Italy pays investors, continued to rise, last at nearly 220 bps, the highest since mid-March.

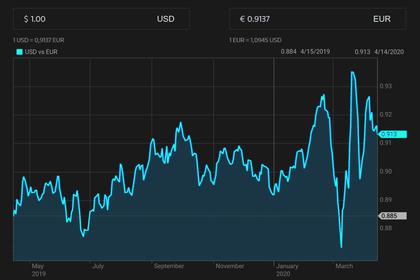

In currencies, the dollar index extended gains, rising 0.57% to 99.400.

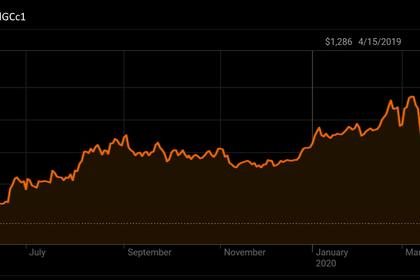

Gold prices fell on Wednesday as investors locked in profits after strong recent gains. It was last at $1,711 an ounce.

In energy markets, oil prices fell amid persistent worries about oversupply.

Brent futures were down 51 cents, or 1.7%, giving up earlier gains. U.S. West Texas Intermediate crude slid 4 cents, or 0.2%, to $20.07.

-----

Earlier: