INDIA'S SHARES DOWN

REUTERS - APRIL 16, 2020 - Indian stocks fell on Thursday as IT shares took a beating after Wipro Ltd flagged a hit from the coronavirus pandemic, with worrying data from the United States and grim economic outlook for Asia further weighing on investor sentiment.

The NSE Nifty 50 index was down 0.3% at 8,898.25 by 0507 GMT, while the benchmark S&P BSE Sensex slipped 0.36% to 30,271.27. Both indexes fell as much as 1.2% in early trade.

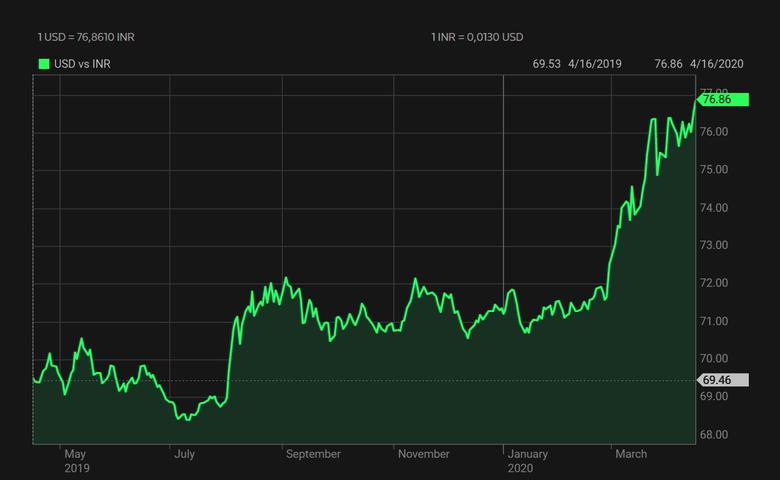

The rupee declined in line with emerging market peers amid worries of a steep global recession due to the pandemic and hit a record low of 76.82 against the dollar.

Software services company Wipro on Wednesday said it would not forecast revenue for the next quarter because of the uncertain market conditions caused by the pandemic, and warned of “huge pressure” on margins in the fiscal first quarter to end-June.

Wipro shares fell as much as 3.5% on Thursday and rival Infosys Ltd slid 5.6%, while Tata Consultancy Services Ltd dropped 3.5% ahead of its earnings due later in the day, dragging the Nifty IT index 3.9% lower.

“There is some contemplation that the entire pack of IT firms will be posting a weak set of numbers this quarter,” said Siddharth Sedani, head of equity advisory at Anand Rathi Financial Services Ltd in Mumbai.

“Markets are already expecting that guidance from Indian corporates will be very weak this quarter, but the Nifty has shot up to 9,200 levels, and we may be seeing some profit-booking.”

Asian stock markets were also under pressure after data showed U.S. retail sales fell the most on record last month and manufacturing output fell by the most in 74 years, raising fears of a deep recession.

The International Monetary Fund said growth in Asia would grind to zero for the first time in 60 years in 2020.

Gains in energy and construction majors limited the losses in Mumbai trading, with Reliance Industries Ltd climbing as much as 3% and Larsen & Toubro Ltd up 4.1%.

Miner Vedanta Ltd jumped 7.3% to a near five-week top and was the top percentage gainer on the Nifty 50.

-----

Earlier: