LNG PRICES WILL BE WEAK

PLATTS - 27 Apr 2020 - Global LNG prices are not expected to recover significantly before next winter, further pressuring North American project developers that are trying to advance new liquefaction capacity at the same time the coronavirus pandemic is weakening demand, the International Gas Union said in a report Monday.

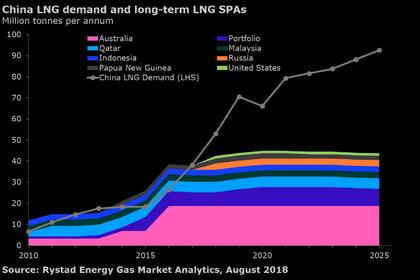

The outlook reflects the depth of the challenge of bringing more terminals online in a market that was already oversupplied before the respiratory illness first observed in China in December 2019 spread across the world. Projects in the US, Canada and Mexico face completion from Russia, Australia and Qatar.

The report highlighted 907 million mt/year of liquefaction capacity that has been proposed and has yet to be sanctioned by a final investment decision. The total market, including existing capacity, will struggle to grow to two thirds that level by 2040, according to S&P Global Platts Analytics.

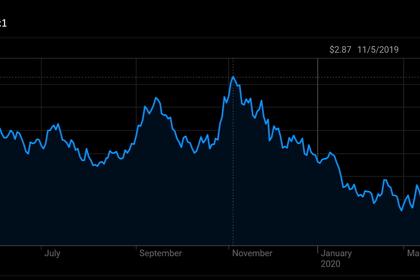

"Due to the low LNG prices in 2019, and into 2020 amid a global LNG supply surplus and uncertainties in the trade environment, some of the proposed projects are seeing slower progress towards FID," the report said. "With the additional effect of COVID-19 on stock markets, many companies, including those in the energy industry, are struggling financially, further delaying progress of projects."

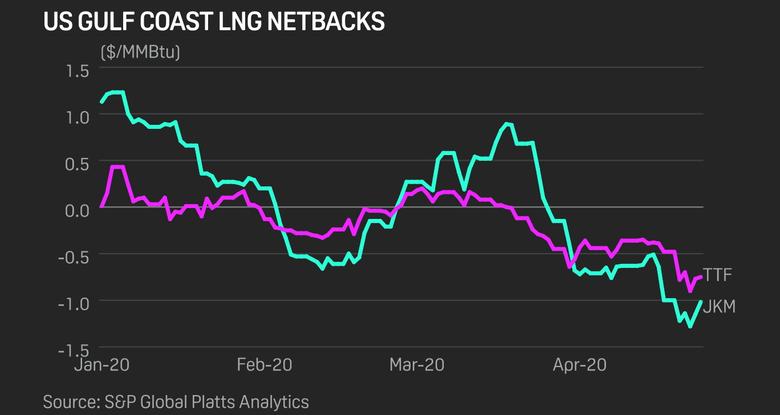

US Gulf Coast LNG netbacks from the Dutch TTF dipped as low as negative $0.90/MMBtu last week, while the netback from the Platts JKM dropped well below negative $1/MMBtu on the back of a wave of Japanese cargo deferrals and cancellations that have sent the Northeast Asian spot markets into a tailspin. The JKM made history last week, with the H2 May assessment falling below the US Henry Hub May contract outright, Platts Analytics data show.

The market will soon get a better idea of the challenges US LNG exporters face -- both for finding homes for current cargoes and in advancing new projects -- when Cheniere Energy releases its latest financial results on Thursday. The biggest US LNG exporter has been pursuing an expansion at the site of its Texas facility that would add midscale liquefaction units. An FID has not yet been announced.

Elsewhere, there are more than a dozen US projects that are being proposed to start up around the middle of the decade that are awaiting FID. Few have secured any long-term offtake agreements with buyers of the capacity they are seeking to build, and the deals announced so far are insufficient to allow the projects to which they are tied to move forward.

An LNG export project in Mexico being proposed by Sempra Energy is seen by some analysts as perhaps the only new North American liquefaction project with a chance to be sanctioned in 2020.

INDUSTRIAL USE

There are some positive signs in the global outlook for gas and LNG, according to the IGU.

Once the threat from the coronavirus eases, natural gas could see a boost as governments look to prioritize cleaner energy, the group said on a webinar to mark the launch of its report.

China is already showing signs of a rebound in industrial gas use, while Italian gas demand in the industrial sector is also starting to recover as Rome eases its lockdown restrictions.

Still, the IGU -- an industry body representing all sectors of the gas value chain --- warned that improved coal-to-gas switching remained a challenge. And, it said that while LNG was becoming more tradable, term supply deals and fixed contract terms for large segments of LNG trade appear to be hampering full commoditization as they are still needed to secure project financing.

-----

Earlier: