OIL MARKET MELTDOWN

PLATTS - 21 Apr 2020 - As oil prices continue to wilt before a much-hyped global supply accord takes effect in May, OPEC is keeping an eye on US President Donald Trump, awaiting cues that he may strong-arm the organization into a tougher deal than the one he helped broker nine days ago.

Already, Saudi Arabia and allies the UAE and Kuwait are under pressure from their smaller counterparts in the OPEC+ coalition to do more to right the coronavirus-impaired oil market.

The core Persian Gulf producers are being blamed for exacerbating an already oversupplied market by pushing their crude production to what they readily trumpet as record levels. Some OPEC+ members are calling for deeper production cuts to be implemented immediately instead of waiting until May.

Several ministers held informal discussions via videoconference Tuesday, according to the OPEC secretariat.

"The Saudis must fix this," one delegate said, while another said: "Any more cuts have to come from the big guys. We can't afford to cut any more."

The delegates spoke on the condition of anonymity because multilateral talks are ongoing.

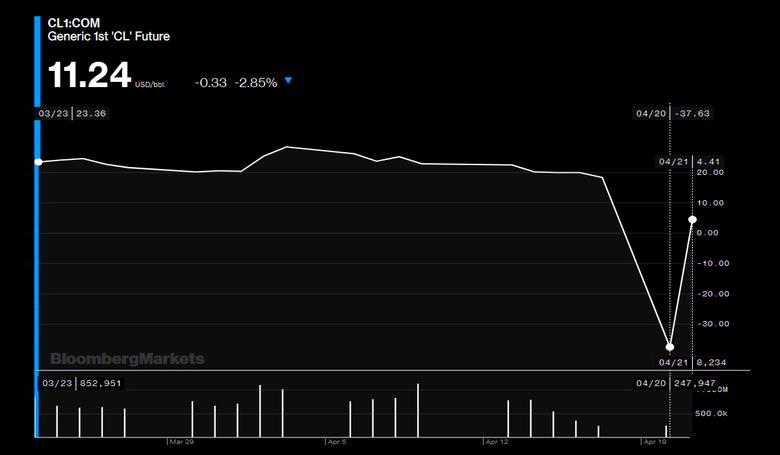

Monday's unprecedented meltdown in oil prices, with front-month NYMEX WTI futures diving deep into negative territory as Tuesday's expiry of the May contract neared, was the exclamation point on what many OPEC+ delegates have described as an alarming and depressing ride.

The deal reached by the 23-country alliance to rein in 9.7 million b/d, or about 10% of global supply, from next month was meant to backstop the market against further coronavirus pain, though many analysts had already panned the pact as insufficient to confront the scale of demand destruction.

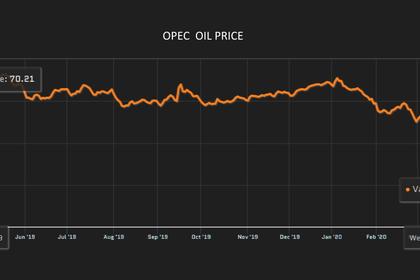

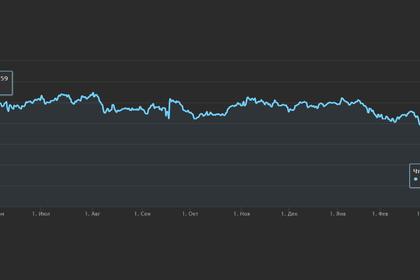

In the physical market, S&P Global Platts' Dated Brent benchmark is down more than 44% since OPEC+ began meeting on April 9 to hammer out that deal.

Some countries are urging an emergency summit or at least a delegate-level technical meeting, with mid-May proposed. The full alliance is next scheduled to meet June 10 via webinar.

"There are tons of people worried about this," another delegate said.

LOOKING TO TRUMP

Those people would seemingly include Trump, who so far has held fire on OPEC but continues to be urged by oil state lawmakers to stave off further bankruptcies and layoffs in the industry.

Trump played a major role in brokering the OPEC+ agreement with diplomatic pressure on key military ally Saudi Arabia and sometime adversary Russia, while declining to force US producers into mandatory output cuts.

One Gulf delegate said OPEC+ was unlikely to act unless "Trump makes another call to push" for a deal.

Trump's first comments about the Monday oil price collapse indicated he was more inclined to let the market sort itself out rather than propose policies to support US drillers.

"It's more of a financial thing than an oil situation," he said during a White House briefing.

In a tweet Tuesday, Trump said he had instructed the US energy and treasury secretaries "to formulate a plan which will make funds available, so that these very important companies and jobs will be secured long into the future."

"We will never let the great US oil and gas industry down," Trump tweeted.

Analysts with RBC Capital said Trump still retains the option of imposing tariffs on US imports of foreign crude – a move that would take direct aim at Saudi Arabia, which owns the largest US refinery, Motiva Enterprises in Texas.

But they said they doubted Trump would risk his strong ties to the kingdom and would likely instead lean on Saudi Arabia to go beyond its commitment in the OPEC+ cut agreement.

State-owned oil giant Saudi Aramco has said it will be pumping 12.3 million b/d in April, an increase of about one-third from levels earlier this year. It will have to pare that back to 8.5 million b/d to comply with its quota under the new deal.

"Given the dramatic price action and the slew of Saudi cargoes headed to the US Gulf Coast, we see President Trump coming under heavy pressure to show that he is doing something further to save domestic producers," the RBC analysts said in a note.

A spokesman for Saudi Arabia's energy ministry did not respond to a request for comment, but energy minister Prince Abdulaziz bin Salman told reporters last week that contractual agreements with customers would make unwinding Aramco's production hike right away extremely difficult.

The official Saudi Press Agency tweeted a statement from the kingdom's cabinet affirming its desire for oil market stability and commitment with key non-OPEC partner Russia to implement the agreed production cuts.

The cabinet expressed "readiness to take any extra measures in cooperation with members of OPEC+ and other producers," the statement said.

CRISIS TALKS IN PROGRESS

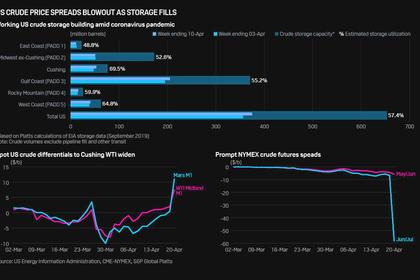

In the absence of more production cuts, market fundamentals figure to get worse before they get better, with global storage capacity already reaching critical levels under the flood of crude supplies.

The coalition's only option may be to ride out the turbulence until the coronavirus pandemic abates and demand rebounds, which some analysts believe could happen later this year.

But for several members, who were already struggling with their finances before the viral outbreak, waiting that long feels like an unpalatable option.

"Supply will need to adjust faster and deeper in order to see prices normalize and stabilize," said Edward Bell, a Dubai-based analyst with Emirates NBD. "OPEC+ production cuts have yet to have a meaningful impact on the market and may need to be deeper for longer."

-----

Earlier: