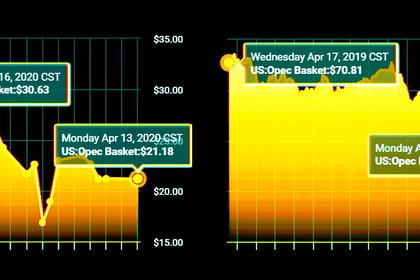

OIL PRICE: ABOVE $28 ANEW

REUTERS - APRIL 16, 2020 - Oil prices ticked up on Thursday after sharp losses in the previous session, with investors hoping that a big build-up in U.S. inventories may mean producers have little option but to deepen output cuts as the coronavirus pandemic ravages demand.

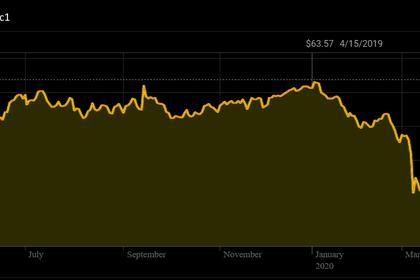

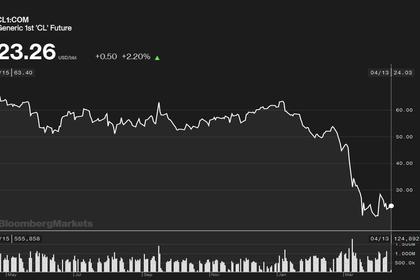

With official data showing U.S. inventories surging the most on record, U.S. West Texas Intermediate (WTI) fell on Wednesday to its lowest since February 2002, with Brent losing more than 6%.

Brent crude LCOc1 was down 19 cents, or 0.7%, at $27.50 a barrel by 0754 GMT. WTI was up 7 cents, or 0.4%, at $19.94.

WTI eked out its first tentative gains after falling for four sessions. Both contracts are poised for weekly losses of around 10%.

Swiss bank Julius Baer's Head of Economics Norbert Ruecker said "oil prices must remain depressed to force shut-ins among non-cartelised producers," such as the United States, where much production is not economic at current prices.

“We stick to our Neutral view and see prices continuing to swing wildly around current levels in the very near term,” he added.

Concerns about crumbling demand kept a lid on gains, with both contracts trading earlier in the session as much as 2.5% higher than on Wednesday.

Energy Information Administration data also showed large U.S. refined fuels stock builds despite refiners operating at 69% of capacity nationwide, the lowest since September 2008.

"The massive storage build, as counterintuitive as it sounds, did provide some price support as the build foreshadows that more wellhead closures are just around the corner, which effectively trims U.S. supply," said Stephen Innes, chief global markets strategist at AxiCorp.

The stockpile figures followed a report from the International Energy Agency (IEA) that forecast oil demand would fall by 29 million barrels per day (bpd) in April to the lowest in 25 years, and to just below 30% of pre-coronavirus global demand levels.

The projected demand loss is far more than the 9.7 million bpd output cuts agreed by Organization of the Petroleum Exporting Countries and allied producers including Russia.

Hoped-for cuts of another 10 million bpd from other countries, including the U.S., could lower production by 20 million bpd, although some analysts have questioned that number.

Some countries have also committed to increasing purchases of oil for their strategic stockpiles, but there are limits to how much oil can be bought and the extent of global coordination.

Speaking of U.S. strategic reserve buying, Commerzbank analysts said that "this would accommodate 23 million barrels, which would normally constitute a massive additional reserve but these days would only just be enough to cope with one weekly increase in stocks."

Highlighting current oversupply concerns, Brent's six-month contango LCOc1-LCOc7, a market structure where prompt prices are lower than those for later dates, kept hovering around $9.4 a barrel, near levels seen before talk of a global output cut.

-----

Earlier: