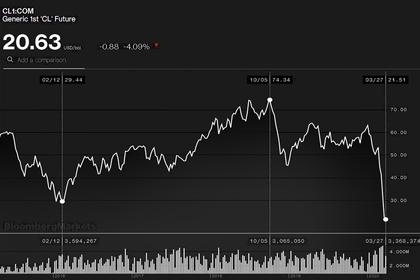

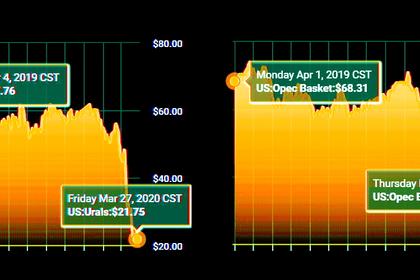

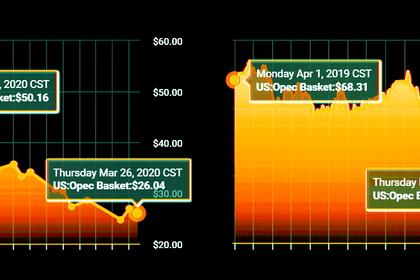

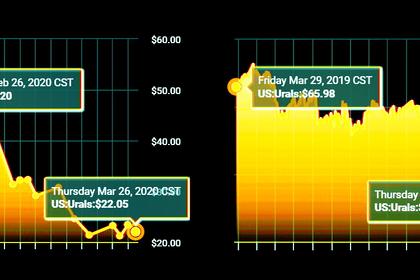

OIL PRICE: NEAR $27

REUTERS - APRIL 2, 2020 - Crude oil futures jumped 10% on Thursday after U.S. President Donald Trump said he expected Saudi Arabia and Russia to reach a deal soon to end their oil price war.

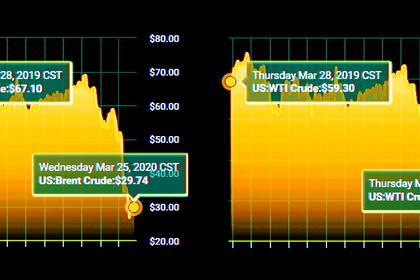

Brent crude futures rose more than 11% in early trade. By 1132 GMT, Brent was up 10.75%, or $2.66, to $27.40, while U.S. West Texas Intermediate (WTI) crude futures rose 10.09% or $2.05, to $22.36.

Trump said he had talked recently with the leaders of both Russia and Saudi Arabia and believed the two countries would make a deal to end their price war within a "few days" - lowering production and bringing prices back up.

Trump also said he had invited U.S. oil executives to the White House to discuss ways to help the industry "ravaged" by slumping energy demand during the coronavirus outbreak and the Saudi Arabia/Russia price war.

"Oil prices are seeing their biggest gains in two weeks this morning...There are two key factors...both of which, however, are not enough to save oil prices from further declines," Rystad's head of oil markets Bjornar Tonhaugen said in a daily note.

"The first, U.S. oil diplomacy efforts towards Saudi Arabia and Russia ... The second big news driving the positive sentiment was rumours that China will speed up its crude purchases for their strategic stockpiles."

Speaking at a government meeting on Wednesday, Putin said that both oil producers and consumers should find a solution that would improve the "challenging" situation of global oil markets.

Saudi Arabia supports co-operation between oil producers to stabilise the market but Russia's opposition to a proposal last month to deepen supply cuts has caused market turmoil, a senior Gulf source familiar with Saudi thinking told Reuters.

Some analysts said there was still a long way to go before any output cut agreement is struck.

With markets facing 15 million barrels per day (bpd) of oversupply in the second quarter and storage maxing out in April, extraordinary curtailments of oil supply will be needed in May and June, said Kang Wu, head of Asia analytics at S&P Global Platts.

He said Brent prices need to drop to low-$10 per barrel to force immediate supply curtailment. He forecast that global oil demand would decline by around 4.5 million bpd this year.

Saudi Arabia's crude supply rose on Wednesday to a record of more than 12 million barrels per day, two industry sources said, despite a plunge in demand and U.S. pressure on the country to stop flooding the market.

"This is a clear sign that the Saudis are not ready to back off in the price war, despite the Russians now saying that they will not increase output given the current oversupply in the market," ING said in a research note on Thursday.

U.S. crude stockpiles rose 13.8 million barrels in their biggest weekly increase since 2016 and analysts expected stocks to keep rising as refineries curb output and gasoline demand falls.

"At the current price, many U.S. oil exploring energy companies won't be able to make a profit and drilling activities might fall in North America," CMC Markets analyst Margaret Yang said.

U.S. shale producer Whiting Petroleum Corp, once the largest oil producer in North Dakota, on Wednesday became the first publicly traded casualty of the oil price collapse as it filed for Chapter 11 bankruptcy.

-----

Earlier: