OIL PRICE: NEAR $31

REUTERS - APRIL 3, 2020 - European stock markets sank on Friday, erasing meagre gains for the week, as more companies flagged a hit to business from the coronavirus pandemic while oil prices extended their previous day's gains on hopes of a global supply cut.

With virus-fighting lockdowns raising the risk of a prolonged global downturn, investors continued to seek the safety of the U.S. dollar and government bonds, pushing U.S. Treasury yields near their lowest in three weeks.

With over a million people infected worldwide, there were more signs the pandemic would take a massive toll on economic growth. Morgan Stanley said the U.S. economy will shrink 5.5% in 2020, the steepest drop since 1946, with a huge 38% contraction predicted for the second quarter.

The pan-European STOXX 600 index was down 0.4% by 0749 GMT, taking MSCI'S All Country World Index down 0.3%.

A number of firms flagged a hit to business from the pandemic, foreshadowing a deeper earnings recession ahead of the reporting season.

MSCI's Asia-Pacific index outside Japan dipped 0.6% while Japan's Nikkei erased earlier gains to end flat.

U.S. stock futures sank nearly 1 percent.

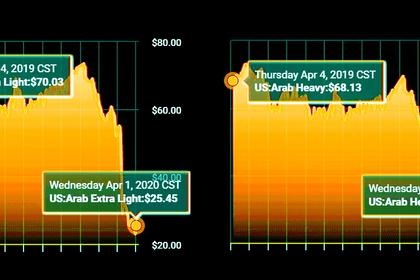

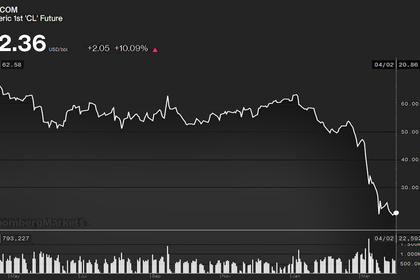

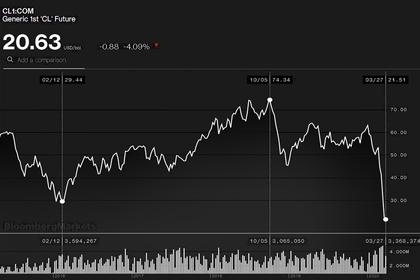

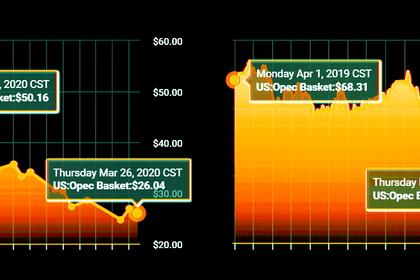

Brent crude futures gained 3.64% to $31.03, extending Thursday's record 24.7% surge , while U.S. West Texas Intermediate (WTI) crude fell 0.83% to $25.11.

Trump said on Thursday he had spoken to Saudi Crown Prince Mohammed bin Salman, and expects Riyadh and Moscow to cut oil output by as much as 10 million to 15 million barrels, as the two countries signalled willingness to make a deal.

Saudi Arabia said it would call an emergency meeting of the Organization of the Petroleum Exporting Countries, state media reported.

The amount cited by Trump would represent an unprecedented cut equal to 10% to 15% of global supply, in output per day terms, a common unit of measurement.

However, Trump provided few details, an omission some analysts said was likely intentional, and which they said explained a pullback in prices in the Asian session.

"The reason the price came back down is that these figures are so unbelievable as to make one wonder whether the person saying them understood what he was talking about," said Marshall Gittler, head of investment research at BDSwiss Group.

In early March, talks over production cuts between the two countries collapsed, leading them to start a price war that pushed oil prices to the lowest levels in nearly two decades.

SAFE ASSETS IN DEMAND

Investors sought the safety of government bonds. Benchmark U.S. 10-year notes last yielded 0.597%, near a three-week low of 0.563% touched on Thursday.

More evidence of the damage from widespread stay-at-home orders to contain the spread of coronavirus emerged in the United States, with an unprecedented number of workers - 6.6 million - filing jobless claims.

Projections released by the U.S. Congressional Budget Office showed gross domestic product would decline by more than 7% in the second quarter as the health crisis takes hold.

The pandemic has claimed more than 52,000 deaths as it further exploded in the United States and the death toll climbed in Spain and Italy, according to a Reuters tally.

Highly rated U.S. corporate bond issuers raised a record $110.502 billion this week, according to Refinitiv IFR data, as firms borrowed cash in fear the coronavirus crisis may soon limit their access to capital markets.

In the currency market, the dollar maintained its firmness against a basket of currencies as investors and companies continued to hoard the world's most liquid currency.

The dollar index has risen 1.97% so far this week, even as extreme tightness for greenback since last month eased.

The euro dipped 0.5% to $1.0798 set for five straight days of losses, and at its lowest level since March 25. The yen also stepped back to 108.11 per dollar from Wednesday's two-week high of 106.925.

Gold prices extended the previous day's gains on the dire U.S. jobless claims figures, intensifying fears of the coming economic slowdown and driving investors toward the safe-haven metal.

Spot gold rose 0.1% to $1,613.78 per ounce after a 1.28% rise on Thursday.

-----

Earlier: