OIL PRICE: NEAR $31 ANEW

REUTERS - APRIL 13, 2020 - Oil prices rose on Monday after major producers finally agreed their biggest-ever output cut, but gains were capped amid concern that it won't be enough to head off oversupply with the coronavirus pandemic hammering demand.

After four days of wrangling, the Organization of the Petroleum Exporting Countries (OPEC), Russia and other producers, a group known as OPEC+, agreed on Sunday to cut output by 9.7 million barrels per day (bpd) in May and June to support oil prices, representing around 10% of global supply.

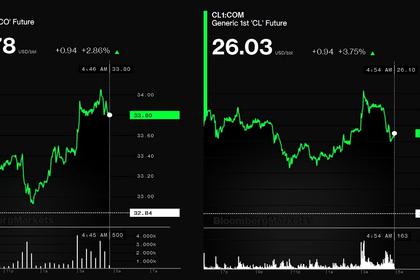

Brent crude LCOc1 futures rose 16 cents, or 0.5%, to $31.64 a barrel by 0709 GMT after opening at a session high of $33.99. U.S. West Texas Intermediate (WTI) crude CLc1 futures were up 37 cents, or 1.6%, to $23.13 a barrel, after hitting a high of $24.74.

"What this deal does is enable the global oil industry and the national economies and other industries that depend upon it to avoid a very deep crisis," said IHS Markit Vice Chairman Daniel Yergin.

"This restrains the build-up of inventories, which will reduce the pressure on prices when normality returns – whenever that is."

Leaders of the world's top three oil producers, Russian President Vladimir Putin, U.S. President Donald Trump and Saudi Arabia's King Salman, all supported the OPEC+ deal to cut global crude output, the Kremlin said on Sunday.

Trump praised the deal, saying it would save jobs in the U.S. energy industry.

Saudi Arabia, Kuwait and the United Arab Emirates volunteered to make cuts even deeper than those agreed, which would effectively bring the OPEC+ supply down by 12.5 million bpd from current supply levels, the Saudi energy minister said.

However, analysts cast doubts on producers' likely compliance with the cuts, adding that the actual reductions may not be as high as the volume pledged by producers.

Furthermore, demand concerns capped oil price gains. Worldwide fuel consumption is down roughly 30%, due to the COVID-19 pandemic caused by the novel coronavirus that has killed more than 100,000 people worldwide and kept businesses and governments on lockdown.

"After an initial positive reaction in oil prices, we expect the OPEC+ decision at best to establish a floor under the market," BNP Paribas' Harry Tchilinguirian said in a note, adding that oil price gains could also be capped by hedges from producers.

"We do not expect a sustained recovery in the oil price until pent-up demand is released in Q3," he said.

The deal had been delayed since Thursday after Mexico balked at the production cuts it was asked to make. The OPEC+ group met on Sunday to hammer out the agreement, resulting in an output cut four times deeper than the previous record reduction in 2008.

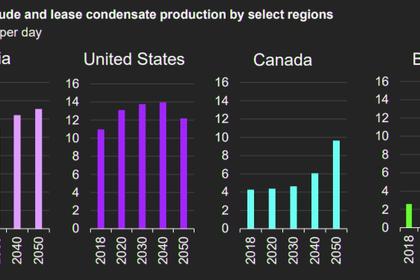

OPEC+ has also said it wanted producers outside the group, such as the United States, Canada, Brazil and Norway, to cut a further 5% or 5 million bpd.

Canada and Norway signalled a willingness to cut. The United States, where antitrust legislation makes it hard to act in tandem with groups such as OPEC, has said its output would already fall by as much as 2 million bpd this year without planned cuts because of low prices.

"We're going to see a significant drop in production anyway from producers who can't make money producing," said Phil Flynn, an analyst at Price Futures group.

However, optimism over the longer term impact of the OPEC+ cuts have lifted prices for future months, widening Brent's contango, the market structure when later dated prices are higher than prompt supplies.

"By (the third quarter), these cuts should make a difference and result in induced inventory draws for most of the rest of 2020," Citi analysts said as the bank raised its Brent price forecasts for third and fourth quarter to $35 and $45 a barrel, respectively.

Morgan Stanley has also raised its forecasts by $5 for the second half of the year to $30 to $35 a barrel.

-----

Earlier: