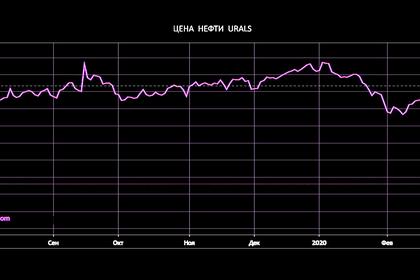

OIL PRICE: NEAR $34

REUTERS - APRIL 9, 2020 - Oil prices rose on Thursday on expectations the world's largest oil producers would agree to cut production at a meeting later in the day as the industry grapples with a coronavirus-driven collapse in global oil demand.

Brent crude LCOc1 futures rose by almost 2.6%, or 87 cents, to $33.71 a barrel as of 0701 GMT. The contract rose to an intra-day high of $33.90, climbing for a second day.

U.S. West Texas Intermediate (WTI) crude CLc1 futures were up 5%, or $1.27 cents, at $26.36 a barrel, after earlier climbing by as much as 6.1%.

The Organization of the Petroleum Exporting Countries (OPEC) and allies including Russia - a group known as OPEC+ - are set to convene a video conference meeting on Thursday.

The meeting is expected to be more successful than their gathering in March, where they failed to agree to extend supply cuts and triggered a price war between Saudi Arabia and Russia.

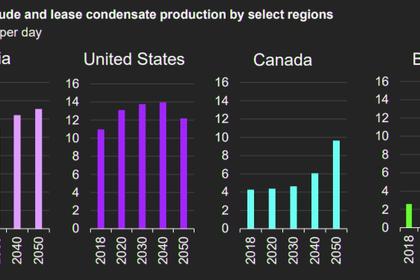

Hopes of an agreement to cut between 10 million and 15 million barrels per day (bpd) rose after media reports suggested Russia was ready to reduce its output by 1.6 million bpd and Algeria's energy minister said he expected a "fruitful" meeting.

Such a sizable reduction would be far bigger than any production cut OPEC has ever agreed on before.

"We're waiting with bated breath," said Lachlan Shaw, head of commodity research at National Australia Bank.

"I think there'll be a deal, which will bring a bit of cheer in the short run. Then everyone's attention will refocus on the fundamentals. The fundamentals are appalling," he said.

Following the OPEC+ meeting, energy ministers from the Group of 20 major economies are set to meet to find ways to help ease the impact of the COVID-19 pandemic on global energy markets.

"If the G20 came out and talked about adding to strategic reserves, that would be taken positively," Shaw said.

However with oil prices having lost half their value since the start of the year and oil demand forecast to slide as much as 30%, analysts are sceptical about how effective an OPEC+ cut would be in shoring up prices.

"Ultimately, the size of the demand shock is simply too large for a coordinated supply cut," Goldman Sachs said in a note.

UBS expects oil demand this quarter to fall by about 20 million bpd, down 20% from a year earlier.

Given the rapidly rising oil inventories, the market is likely to be still awash with cheap oil even when demand recovers.

U.S. Energy Information Administration data on Wednesday showed crude stocks rose by 15.2 million barrels, their biggest ever one-week rise.

-----

Earlier: