#OilPriceWar: ARAMCO'S OIL DELIVERIES UP

PLATTS - 01 Apr 2020 - Released from its OPEC obligations to rein in production, Saudi state-run oil giant Aramco said Wednesday it was filling 15 tankers with more than 18.8 million barrels of crude — its most ever in one day as it ratchets up its price war with erstwhile ally Russia.

But plummeting demand, tightening storage availability and shrinking refinery margins with much of the world on coronavirus lockdowns could leave some of those cargoes struggling to find buyers, according to market sources, who say Aramco will have to slash its selling prices further to unload all of its crude.

Many of the tankers that have loaded from Saudi Arabia in recent days have no listed destination or have indicated they are awaiting orders, which could mean their cargoes are unsold, though this information often is not immediately updated on ship tracking services.

"Middle East crude grades are cheap in a sense, but it's pointless when you cannot sell the product," one Singapore-based trader told S&P Global Platts, asking not to be named.

Saudi Arabia is following through on its threat to flood the market, after Russia last month rejected a Saudi-led OPEC proposal for significant production cuts to backstop already sliding oil prices from the coronavirus pandemic's impact on the global economy.

With no deal agreed, the OPEC+ alliance's output quotas expired at the end of March, and Saudi Arabia has said it would export more than 10 million b/d under a plan to supply the market with 12.3 million b/d of crude, including domestic consumption.

Other OPEC members, including the UAE and Iraq, have likewise announced they will boost production and exports, but none has the scale and capacity of Saudi Arabia, already the world's largest crude exporter.

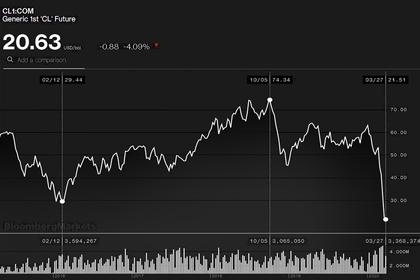

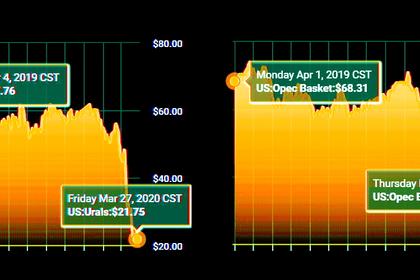

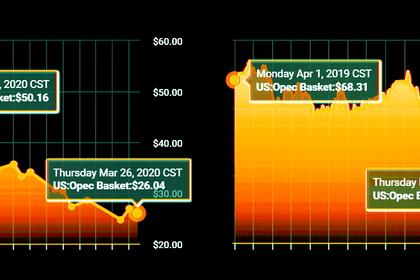

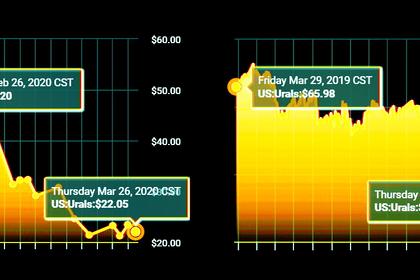

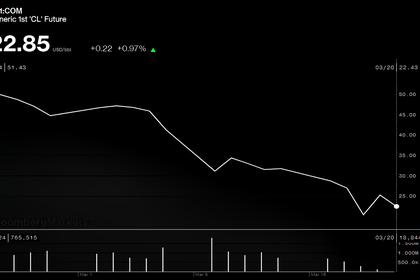

The wave of oil has exacerbated the historic collapse in prices, sparking oil industry panic from Texas to Tehran, many begging the kingdom to back off its crude surge — so far ignored.

"As the world demands economic stability, Aramco remains committed to supplying the world with energy," the company said in a statement.

Aramco already began hiking its crude exports towards the end of March, shipping 8.96 million b/d during the last week, up from 7.50 million b/d in the first week of the month, according to provisional data from Platts shipping tracker cFlow.

For March overall, Saudi crude exports were a 15-month high of 7.60 million b/d, a rise of 400,000 b/d from February, the data showed.

Platts reported last week that Aramco was sending unusually high volumes of crude to its storage caverns in Sidi Kerir, Egypt, and Rotterdam in the Netherlands, as the company seeks to move barrels closer to key European customers.

Energy data firm Kpler also noted a swell in Saudi crude exports in the back half of March, as well as a strong build in the kingdom's domestic onshore inventories to 77.1 million barrels, just below the recent peak and all-time high of 77.4 million barrels.

The export rise and inventory gains are "a strong indicator of increasing production," said Alex Booth, Kpler's head of market analysis.

MORE PRICE CUTS COMING?

Market realities may make it difficult for Aramco to maintain record-busting export levels indefinitely, given the massive contraction in demand. Platts Analytics expects Saudi Arabia may supply as low as 11.5 million b/d to the market, some 800,000 b/d below Aramco's announced pledge.

Sources say many refiners in Asia and the US have turned down offers of crude from Aramco, with several already slashing their runs or even shutting operations in the face of evaporating margins.

"Prices for sour crude grades are quite low, lower than their valuations, but the problem is there is no demand ... yet Saudi keeps increasing production," said one Southeast Asian refinery official on condition of anonymity.

On Wednesday, 29 crude tankers were loading or waiting to be loaded at Saudi Arabia's main export terminal of Ras Tanura in the Persian Gulf, while another five were at Yanbu port on the Red Sea, according to cFlow.

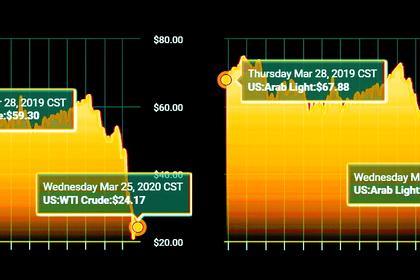

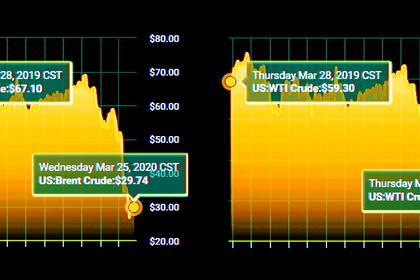

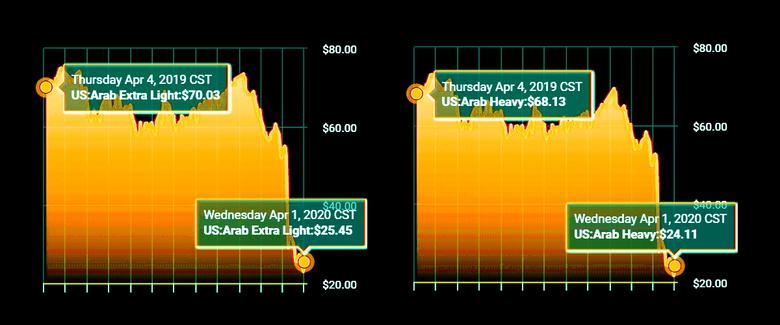

Traders will be watching closely Aramco's official selling prices for May crude cargoes, which are expected to be released next week. Aramco sparked a 30% sell-off in crude prices last month, in announcing its April OSPs with some of its biggest cuts ever.

Even greater discounts may be needed to incentivize buyers to take the flood of Saudi crude, as storage rates rise and tank availability tightens.

"25% of the world on lockdown, and these [OPEC] countries want to produce as much oil as they can," the Singapore-based trader said. "This could become a situation of endless cuts every cycle."

-----

Earlier: