#OilPriceWar: SAUDI ARABIA CALLS OPEC+

PLATTS - 02 Apr 2020 - In a sudden change of heart after intervention by US President Donald Trump, Saudi Arabia on Thursday called for an "urgent meeting" of the OPEC+ alliance and other producers to negotiate a deal on output cuts that could stem the coronavirus-induced freefall in oil prices.

In a statement carried by the official Saudi Press Agency, the kingdom said it was "seeking a fair agreement that will restore the desired balance to the oil markets" and indicated that it wanted other countries outside the OPEC+ alliance to join the talks.

A Saudi energy ministry spokesman did not immediately respond to a request for comment.

Trump had earlier tweeted that he had spoken by phone with Saudi Crown Prince Mohammed bin Salman, who in turn called Russian President Vladimir Putin to heal their oil market rift.

"I expect and hope that they will be cutting back approximately 10 million [b/d], and maybe substantially more, which, if it happens, will be GREAT for the oil and gas industry!" Trump tweeted, later adding that the cuts could even be as high as 15 million b/d.

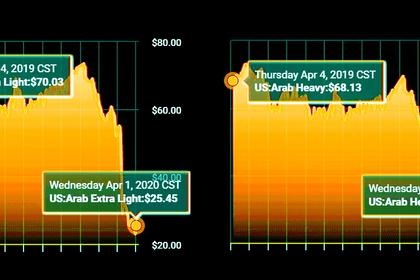

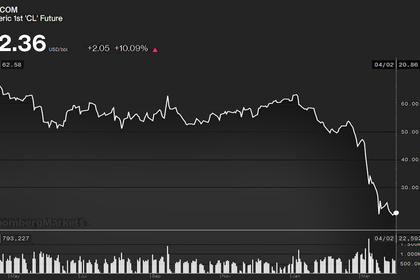

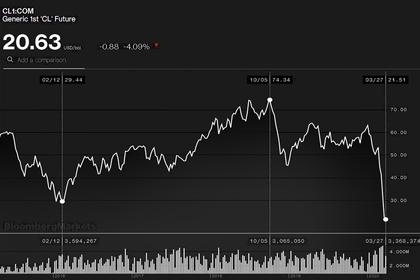

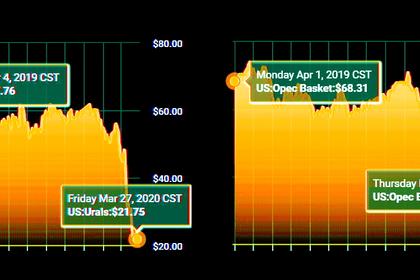

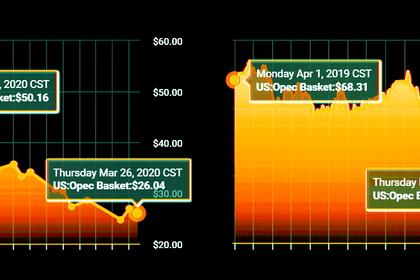

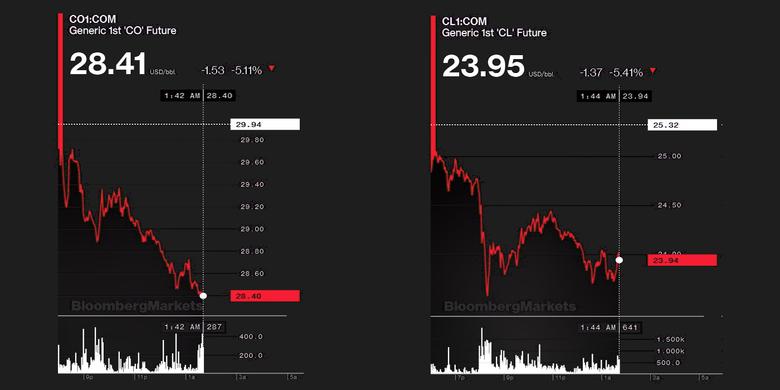

The comments sent crude prices rallying more than 20%, after US benchmark NYMEX WTI had hit an 18-year low earlier this week.

But there clearly is still much talking to be done.

A Kremlin spokesman denied that Putin had spoken with MBS, Russian news agency RIA Novosti reported.

Earlier in the day, Russian energy minister Alexander Novak said a coordinated OPEC+ production cut would not be enough to compensate for the fall in demand caused by the coronavirus pandemic, which he said could reach 20 million b/d.

"It's impossible to take measures to reduce OPEC+ production by 20 million b/d, this is probably half of all countries' total production," Novak said in a radio interview. But perhaps in a concession, he said that Russian producers would not be increasing their output at this time.

Saudi Arabia, as OPEC's largest producer and de facto leader, will also have to smooth over some sore feelings among other members, who have been largely collateral damage in the Saudi-Russia spat.

"It should not be forgotten that the firefighter is also the one who set the oil market on fire," one non-Gulf OPEC delegate said on condition of anonymity.

For weeks, Saudi Arabia has resisted calls to back off its price war with Russia, announcing and then reaffirming almost on a daily basis plans to produce at its maximum capacity of 12 million b/d and export more than 10 million b/d of crude.

The surge of exports along with the coronavirus pandemic's hit to the global economy had caused oil prices to crash.

The price war broke out after Russia rejected a Saudi-led OPEC proposal last month to deepen production cuts in response to the coronavirus pandemic.

Some US producers, their finances hammered by the market collapse, have said they are open to a deal and had urged Trump to intervene on their behalf.

Ryan Sitton, a member of the Texas Railroad Commission, which regulates oil production in the state, has called for cooperation with OPEC, and in a tweet, said he had talked with Novak about a global supply cut pact of 10 million b/d and looked forward to talking with Saudi energy minister Prince Abdulaziz bin Salman soon.

"While we normally compete, we agreed that COVID-19 requires unprecedented level of international cooperation," Sitton said.

Getting on the same page

In his tweets, Trump, who is scheduled to meet with several US oil companies Friday, did not mention the prospects of US participation in a global supply accord, nor did he explain his math of how such a deal could reach 15 million b/d or even 10 million.

For Saudi Arabia, it is unclear whether its cuts would count from its current production of some 12 million b/d or its output level of about 9.8 million b/d in February, before the OPEC+ agreement fell apart.

Russian oil companies, particularly Rosneft, have resisted significant cuts previously, and the compliance of OPEC members Iraq and Nigeria have been extremely spotty.

Coordinating an expanded OPEC+ meeting would presumably be led by the US, Saudi Arabia and Russia, the world's three largest oil producers.

Emergency OPEC meetings are typically organized by whichever country holds the rotating presidency of the organization – Algeria this year – and Secretary General Mohammed Barkindo, whom sources said has been involved in discussions with Saudi Arabia and Russia.

Algeria's energy minister, Mohamad Arkab, has been calling for such a meeting for weeks, ever since the last OPEC+ meeting broke up in acrimony.

Prior to Trump's tweet and the Saudi call for a deal, delegates had said they were hoping for the Russia-Saudi tensions to ease by the next OPEC meeting, scheduled for June 8 in Vienna, when a new agreement could be brokered.

"It is completely unnecessary and counterproductive to wage a price war while the world is fighting against the worst pandemic in a century," a delegate said. "We need cohesion and responsibility between producers, OPEC and non-OPEC, not division."

-----

Earlier: