OPEC+ CONVERSATION

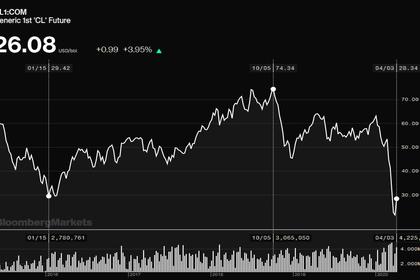

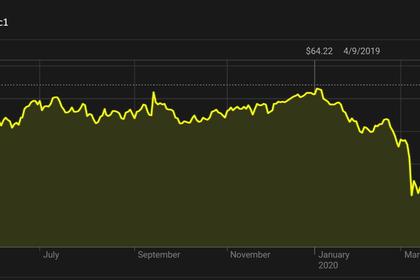

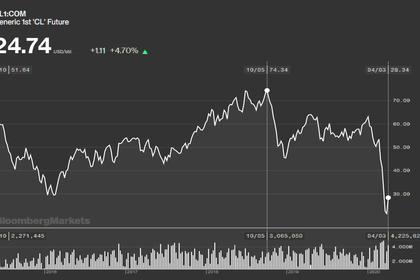

PLATTS - 10 Apr 2020 - Mexico has logged off the OPEC+ alliance's videoconference emergency meeting after nine hours of talks Thursday, without agreeing to the landmark 10 million b/d production cut accord that members were hoping could stem a bruising rout in oil prices caused by the coronavirus pandemic, sources told S&P Global Platts.

The rest of the coalition, led by Saudi Arabia and Russia, were in discussions over how to proceed, with many ministers angry over the potential blow-up of the deal, said the sources, who asked not to be identified because of the sensitivity of the negotiations.

The coalition could try to convince Mexico again Friday at a G20 energy ministerial that was originally scheduled to seek the participation of the US, Canada, Brazil and other key producers outside of OPEC+ to join its efforts.

Under the proposed deal, the 10 million b/d OPEC+ cuts would cover the months of May and June, and then be rolled back to 8 million b/d for the rest of 2020, and then down to 6 million b/d for all of 2021 through April 22, according to a text of the agreement seen by Platts.

Each member would lower its output 23% from its October 2018 levels, except for Saudi Arabia and Russia, who would make their cuts from a baseline of 11 million b/d. That means both countries would limit their production to 8.5 million b/d for the initial two months of the deal.

Saudi Arabia, the world's largest crude exporter, said it had ramped up its crude output to a record 12 million b/d this month. Russia, meanwhile, pumped 10.5 million b/d of crude in March, according to S&P Global Platts Analytics.

But Mexico balked at its new quota of 1.353 million b/d, as the country plans to unveil a $13.5 billion energy investment package to help state oil company Pemex raise its production to 2 million b/d by the end of the year.

Sources in the OPEC+ talks said Mexico initially agreed to the cut and the coalition was on the verge of finalizing the deal, before its delegation asked for time to consult with President Andres Manuel Lopez Obrador. Those consultations and continued haggling over its cut went on for almost four hours, but Mexico stayed firm.

As the impasse lingered, US President Donald Trump, who had convinced Saudi Arabia and Russia to set aside their oil price war and come to the negotiating table, made a phone call with Saudi King Salman and Russian President Vladimir Putin, according to Dan Scavino Jr., a White House aide.

After speaking with the leaders for 90 minutes, he told reporters that he believed the OPEC+ coalition was close to a deal but did not reveal any details.

"We had a really good talk, but we'll see what happens," Trump said. "As you know, OPEC met today and I would say they are getting close to a deal and we will soon find out."

'Horrifying' market outlook

The meeting came after a week of furious petrodiplomacy and back channel pressure by Trump for a deal that could rescue ailing US shale producers.

Trump is reluctant to commit US companies to participating in any OPEC+ pact, despite urging by Saudi Arabia and Russia, and antitrust laws make any collective action legally difficult.

Instead, US Energy Secretary Dan Brouillette is expected to tell the G20 ministerial meeting Friday that some 2 million b/d of US production is forecast to be shut in over the next year, according to a person briefed on his plans.

Mexico's recalcitrance could make it all moot.

But its delegation was made well aware of the stakes, with OPEC Secretary General Mohammed Barkindo telling the group that the market outlook was "horrifying."

The OPEC secretariat has forecast a 6.8 million b/d contraction in global oil demand for the whole of 2020, including close to 12 million b/d "and expanding" for the second quarter, Barkindo told the ministers.

At current rates of supply and demand, global crude oil storage capacity will fill up in the month of May, he said.

"These are staggering numbers," he said, adding that the coronavirus outbreak had "upended market supply and demand fundamentals."

Sources said Saudi Arabia had sought an even bigger OPEC+ cut of 15 million b/d but could not get Russia to agree.

The two countries had feuded at the last OPEC+ meeting on March 6, when the impact of the coronavirus was already forcing analysts to downgrade their demand forecasts, with Russia balking at a Saudi-led proposal for cuts totaling 3.2 million b/d.

Back at the table again this time, they first agreed a deal between themselves, then spent most of Thursday's meeting trying to convince smaller producers and tweaking the numbers.

Mexico was the last holdout, with the deal requiring unanimous agreement.

Friday's G20 meeting will be chaired by Saudi energy minister Prince Abdulaziz bin Salman and is scheduled to begin at 1400 GMT.

With Mexico not the only country needing convincing, the G20 summit promises to be another test of geopolitical wills.

-----

Earlier: