OPEC+ RUSSIA CHANGES

РЕЙТЕР -

-----

Раньше:

2018, March, 14, 11:45:00

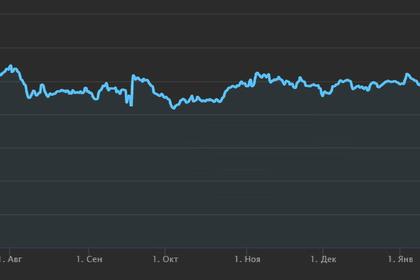

REUTERS - U.S. West Texas Intermediate (WTI) crude futures CLc1 were at $60.77 a barrel at 0753 GMT, up 6 cents, or 0.1 percent, from their previous settlement. Brent crude futures LCOc1 were at $64.62 per barrel, down just 2 cents from their last close.

|

2018, March, 7, 15:00:00

РЕЙТЕР - К 9.17 МСК фьючерсы на североморскую смесь Brent опустились на 0,85 процента до $65,23 за баррель. Фьючерсные контракты на американскую лёгкую нефть WTI к этому времени торговались у отметки $62,07 за баррель, что на 0,85 процента ниже предыдущего закрытия.

|

2018, March, 7, 14:00:00

EIA - North Sea Brent crude oil spot prices averaged $65 per barrel (b) in February, a decrease of $4/b from the January level and the first month-over-month average decrease since June 2017. EIA forecasts Brent spot prices will average about $62/b in both 2018 and 2019 compared with an average of $54/b in 2017.

|

2018, March, 5, 11:35:00

РЕЙТЕР - К 9.28 МСК фьючерсы на североморскую смесь Brent поднялись на 0,33 процента до $64,58 за баррель. Фьючерсные контракты на американскую лёгкую нефть WTI к этому времени торговались у отметки $61,44 за баррель, что на 0,31 процента выше предыдущего закрытия.

|

2018, March, 4, 11:30:00

МИНФИН РОССИИ - Средняя цена нефти марки Urals по итогам января – февраля 2018 года составила $ 65,99 за баррель.

|

2018, February, 27, 14:15:00

РЕЙТЕР - К 9.18 МСК фьючерсы на североморскую смесь Brent опустились на 0,15 процента до $67,40 за баррель. Фьючерсные контракты на американскую лёгкую нефть WTI к этому времени торговались у отметки $63,80 за баррель, что на 0,17 процента ниже предыдущего закрытия.

|

2018, February, 27, 14:05:00

МИНФИН РОССИИ - Средняя цена на нефть Urals за период мониторинга с 15 января по 14 февраля 2018 года составила $66,26457 за баррель, или $483,7 за тонну.

|

OPEC+ RUSSIA CHANGES

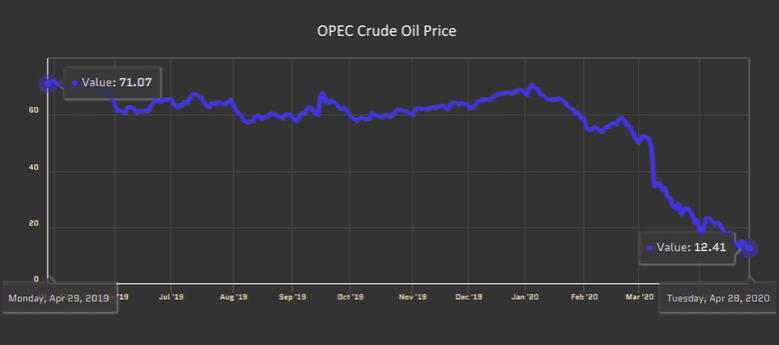

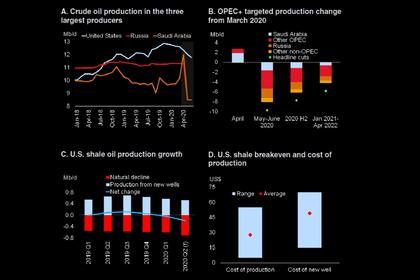

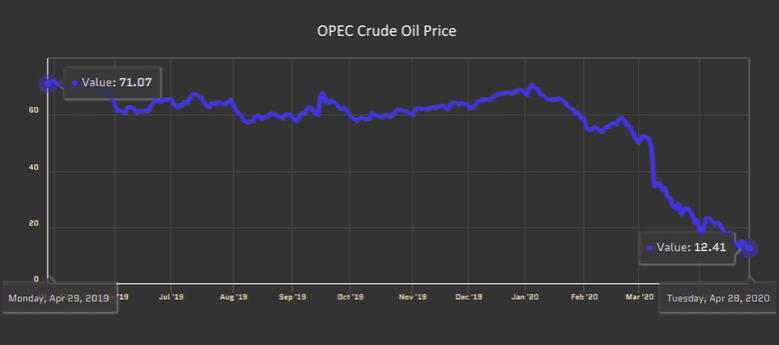

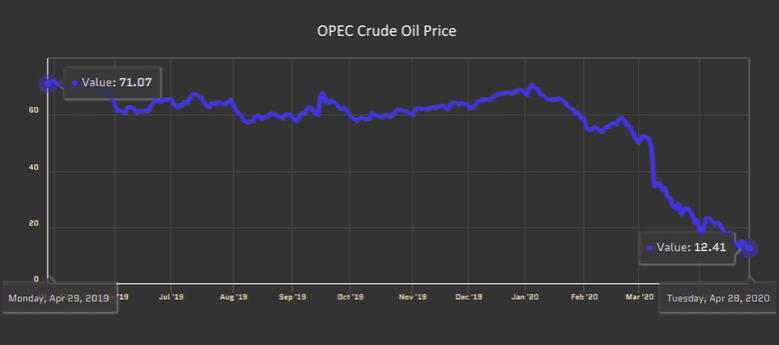

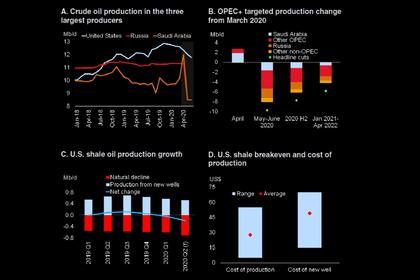

ENERDATA - 30 Apr 2020 - Russia is advocating a shift in the OPEC+ strategy once global crude oil recovers, calling for a focus on the OPEC+ market shares rather than on commercial oil inventories. The country expects relaxing lockdown measures in the United States, China and Europe to revive oil demand later in 2020 and wants to avoid the recovery to benefit to the United States, which are not part to the OPEC+ agreement.

In March 2020, Russia had rejected an OPEC+ proposal to cut global crude oil production by 1.5 mb/d, considering that it would benefit to large producers not subject to such agreements, such as the United States. The lack of agreement contributed to a collapse in crude oil prices, which were already falling due to the coronavirus outbreak that slashed global oil demand. Despite the OPEC+ decision in April 2020 to cut oil production by 9.7 mb/d in May-June 2020 and to continue production restrictions until April 2022, prices remained very low, well below the breakeven for many US shale oil producers that had to reduce production.

Russia, which agreed in April 2020 to cut its crude oil production from a baseline level of 11 mb/d to 8.5 mb/d in May-June 2020, expects its crude oil production to fall by around 15% in 2020, to 480-500 Mt, its first annual decline since 2008.

-----

Earlier:

2020, April, 29, 12:45:00

OIL PRICE: NEAR $21 AGAIN

Brent were up 2.30%, or 47 cents, to $20.93 a barrel, WTI jumped 12.56% or $1.55 to $13.89

2020, April, 28, 14:30:00

OIL PRICE: NEAR $20

Brent rose 41 cents, or 2%, to $20.40 a barrel, WTI was down 78 cents, or 6%, at $12.00 a barrel.

2020, April, 27, 12:55:00

OIL PRICE: NEAR $21 ANEW

Brent was down 90 cents, or 4.2%, at $20.54 a barrel, WTI fell $2.42, or 14.3%, to $14.52 a barrel

2020, April, 24, 13:35:00

OIL PRICE: NEAR $21

Brent was down 73 cents, or 3.42%, at $20.60 per barrel, WTI fell by 84 cents, or 5.09%, to $15.66 a barrel

2020, April, 24, 13:30:00

ENERGY PRICES WILL DOWN BY 40%

Energy prices overall (which also include natural gas and coal) are expected to average 40 percent lower in 2020 but see a sizeable rebound in 2021.

2020, April, 23, 15:10:00

U.S. OIL BANKRUPTCY

The U.S. oil industry was already struggling to satisfy investors unhappy with weak returns, even as the United States surged to become the world’s largest oil producer in the last few years.

2020, April, 22, 11:55:00

ОПЕК+ РОССИЯ: ВСЕ ВОЗМОЖНОСТИ

ОПЕК+ Россия внимательно следят за ситуацией и имеют, в случае необходимости, все возможности для реагирования.

All Publications »

Tags:

OPEC,

RUSSIA,

OIL,

PRICE,

PRODUCTION