OPEC+ SEEKS CUTS TO 15 MBD

PLATTS - 08 Apr 2020 - The 23-country OPEC+ alliance is aiming for a global output cut pact totalling 10 million to 15 million b/d, including producers outside the group, when ministers meet Thursday for a critical summit to shore up the coronavirus-stricken market, Kuwaiti oil minister Khaled al-Fadhel told S&P Global Platts.

Many details still remain in flux, but all OPEC+ members are committed to clinching a deal, Fadhel said in an interview Wednesday.

"How much, when, what share -- these remain topics of discussion for the meeting," the minister said. "According to the discussions and phone calls and optimistic comments I hear from my colleagues, it seems that the platform is ready to take decisions that are beneficial to both producers and consumers."

The emergency meeting, to be held via webinar, is scheduled to start at 1400 GMT. It had originally been scheduled for Monday but was pushed back to give countries more time to hammer out an agreement.

US President Donald Trump last week indicated a deal was near between Saudi Arabia and Russia, the top producers of the OPEC+ alliance, but then declared that US oil companies would not be participating in any output cut, complicating the negotiations.

Trump administration officials have suggested that involuntary shut-ins due to market forces could be counted as the US "contribution" to a deal, but Russia has rejected that idea and called on the US to supply meaningful cuts.

Comments by Russian President Vladimir Putin blaming Saudi Arabia for flooding the market at the expense of US shale producers also raised tensions, with Saudi energy minister Prince Abdulaziz bin Salman and other senior officials condemning the statements as false.

Fadhel, however, said the rhetoric is just part of the negotiating process.

"Comments come and go, and even though we hear some negative comments or comments that we consider not positive, there are still positive comments being said," Fadhel said. "If there is no willingness to have an agreement, countries would not have accepted to come to the meeting and discuss issues related to the oil market. The comments raised by Russia are just concerns, and they will be discussed to reach an agreement."

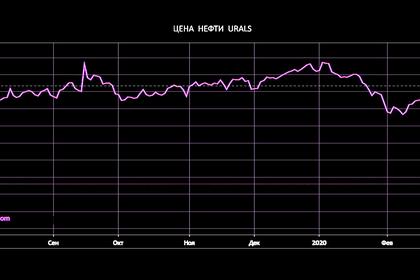

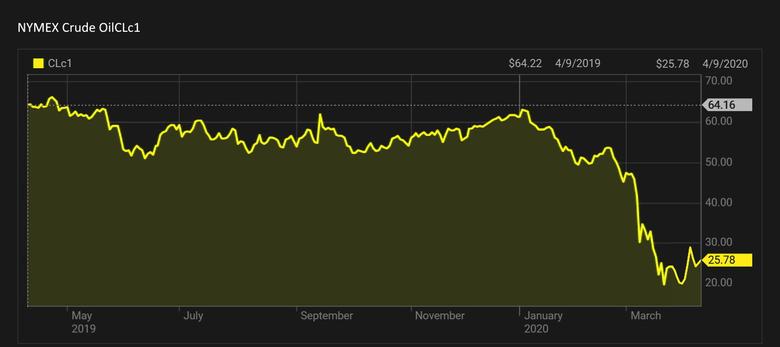

The oil market has collapsed due to the coronavirus pandemic, as well as the inability of the OPEC+ alliance to agree on a production cut strategy at its last meeting March 5-6, when Russia rejected a Saudi-led proposal for deeper cuts.

Members have been free to pump at will since April 1, when quotas expired.

Carrying the burden

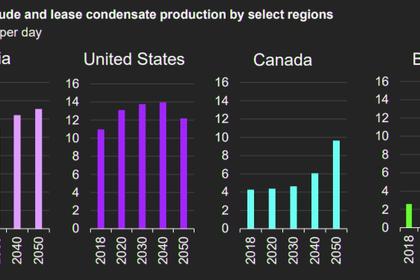

Analysts have said global oil demand could contract by more than 20 million b/d in the second quarter as coronavirus containment measures continue to eat away at the world economy, leaving doubts about whether an OPEC+ production cut would be sufficient to balance the market, even with the inclusion of other countries, such as the US, Canada, Brazil and Norway, whom have all been invited to the meeting.

Fadhel said the OPEC+ efforts are just a start, and that its 23 members can not take on the burden of reducing the market overhang on their own.

"Having a cut is better than no cut," he said. "What we are looking for is more participation from other countries, not only OPEC+ but outside, including the US, Norway and some other influential countries. With that, we can say we are talking about almost 70% of production of the world. When you talk about 10 or 15 million b/d or whatever we decide on, that can be accommodated by that collection of countries."

Kuwait pumped 2.90 million b/d in March, according to the latest S&P Global Platts OPEC production survey.

The minister said production in April could reach between 3.25 million and 3.30 million b/d, but noted that once a deal is agreed on production cuts, Kuwait would fully comply with its obligations as it has always done.

Kuwait's compliance with its cuts averaged 145% in 2019, according to Platts calculations, and it was in full compliance with its 2020 quota of 2.67 million b/d before surging its production in March after the last OPEC+ meeting broke up with no deal.

-----

Earlier: