OPEC+ STABILIZE OIL MARKET

PLATTS - 14 Apr 2020 - Despite a sweeping agreement that calls for record production cuts and massive purchases of crude to fill strategic reserves, OPEC and its allies face a flood of skepticism that they can mop up the oil market's glut in the face of the coronavirus pandemic.

But Saudi energy minister Prince Abdulaziz bin Salman, a central negotiator of the deal, said the collective actions will put a floor under prices and, more importantly, put all producing countries on the same page.

"Whatever will bring stability to the market, in an even-handed approach where everybody is contributing, I think the bigger picture now is this pragmatic approach that has enabled us to see to it where other countries outside of OPEC+ — Supreme OPEC+ — are engaged," the minister said in a briefing with reporters Tuesday. "It's something I never thought I would see in my life."

The deal calls on OPEC, Russia and nine other allies to cut 9.7 million b/d of crude production in May and June, ramping down to 7.7 million b/d for the second half of 2020, and then 5.8 million b/d for all of 2021 through April 2022.

Combined with financially forced shut-ins of wells in the US and Canada, further output restraints by Brazil, Norway and others, and purchases of crude by various countries to fill strategic petroleum reserves, the market could see up to 20 million b/d — one-fifth of world supply — removed over the next two months, the prince said. But he declined to give an exact country-by-country breakdown of the cuts and declines by producers outside of the OPEC+ alliance.

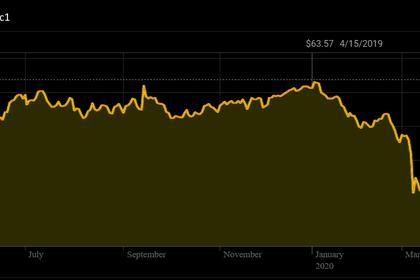

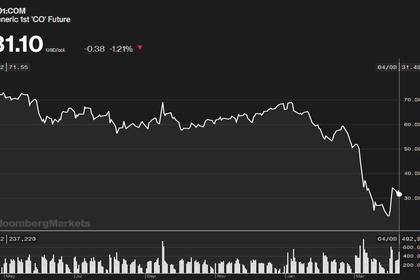

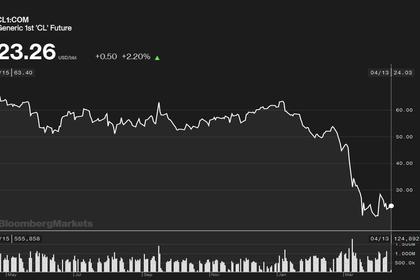

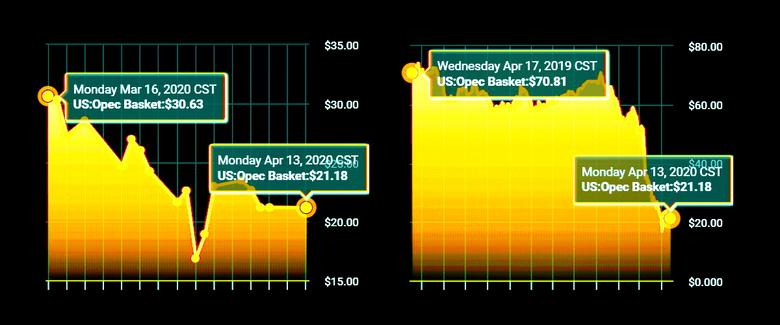

With some analysts projecting an oversupply of more than 20 million b/d this quarter due to coronavirus containment measures and a global economic slowdown, the market appears to doubt whether the cuts are enough. Traders seem especially disappointed by the lack of firm voluntary production restraints by non-OPEC+ members, sending crude prices down about 7% Tuesday.

Prince Abdulaziz, however, noted that prices rose 24% last week in anticipation of a deal, showing how much market sentiment was impacted by news of the negotiations.

"The collective efforts have given a lifeline to many producers," Prince Abdulaziz said.

Compliance with the deal will be key, the prince added. Production cuts on this scale have never been prescribed before, and several OPEC+ members, notably Russia, Iraq and Nigeria, have a spotty history of adhering to their quotas.

With secondary sources, including S&P Global Platts, monitoring production, "by June we will know who performed and who did not perform," said Prince Abdulaziz, who has not been above naming and shaming countries that have flouted their quotas.

PROTECTING MARKET SHARE

As for Saudi Arabia itself, the minister said the kingdom would be producing an average of 12.3 million b/d in April, its highest level, not including output from the Neutral Zone, which is still ramping up after having been offline for about five years.

Even though new quotas have now been negotiated — Saudi Arabia's is 8.5 million b/d — the kingdom is unable to reduce its output immediately due to contractual obligations, the minister said. Saudi refinery runs were down on lower product demand, which will free up more crude for export, he added.

Saudi state oil company Aramco had pledged to max out its production capacity, on orders from the Saudi energy ministry, after March's OPEC+ meeting fell apart with no deal on output restraints.

Saudi Arabia is often accused of launching a price war with that move and a slashing of its April official selling prices for crude exports, with Platts Dated Brent benchmark down some 55% since that meeting. In particular, Putin lobbed the accusation at Saudi Arabia on April 3 just before negotiations started on the new OPEC+ deal, almost poisoning the talks.

But Prince Abdulaziz denied that a price war was at hand.

"A price war is when you are underpricing heavily, with a view to try and restrain other producers to sell in a particular market," he said. "That is not our case. People wait until we do our pricing, and then they assess their pricing according to ours."

Saudi Aramco made big cuts again to its OSPs to Asia, surprising some market watchers. But the prince said the reductions were done to remain competitively priced in a region that makes up 50% of the company's market share and has seen significant refinery run cuts due to the coronavirus.

He also pushed back against accusations by US lawmakers that Saudi Arabia was "dumping" its oil by selling it cheaply to undercut US producers. The prince held an almost two-hour phone call with several oil state US senators on Saturday, who said Saudi Arabia was hurting its close relationship with the US by surging its exports.

Prince Abdulaziz said that Saudi crude exports to the US would be around 620,000 to 630,000 b/d — "not a lot compared to what we've been doing over the last 12 months. I don't know how people would be thinking we are flushing our oil in the US market."

During the previous three-plus years of OPEC+ quotas, Aramco and other Middle Eastern national oil companies focused the bulk of their output cuts on the less valuable heavier crude grades.

Prince Abdulaziz said the new deeper cuts would likely be in the same proportions of light vs. heavy grades, even with lighter barrels seeing lower demand due to the crash in gasoline and jet fuel margins.

But he also said it would depend somewhat on client requests. Nominations for May cargoes are set to be submitted in the next few days.

"We do have clients that take extra light [crude]," he said. "You do your production in accordance to the nominations."

-----

Earlier: