OPEC+ U.S.: NO AGREEMENT

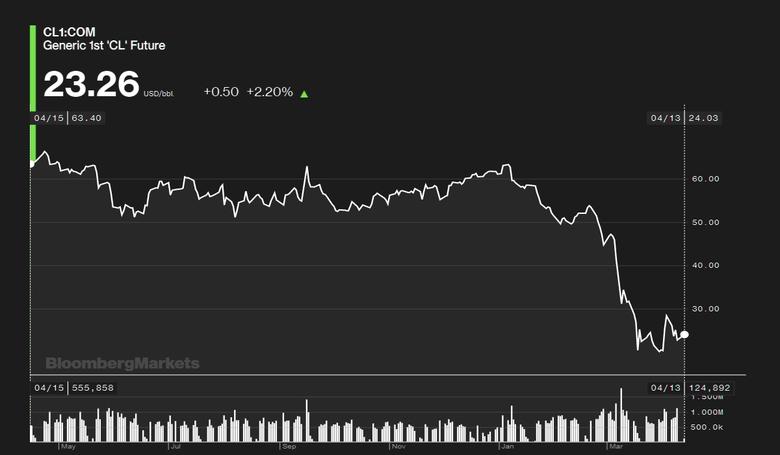

PLATTS - 10 Apr 2020 - The world's biggest economies were poised Friday to endorse the largest coordinated oil production cut in history to combat the coronavirus pandemic's market meltdown.

But calls for the world's largest producer, the US, to contribute its own cuts fizzled, with only a vague commitment to use its Strategic Petroleum Reserve to lock away barrels that would otherwise exacerbate the oil glut.

"We will use the SPR to store as much oil as possible," US Energy Secretary Dan Brouillette said at a G20 energy summit. "This will take surplus oil off the market at a time when commercial storage is filling up and the market is oversupplied."

Saudi Arabia and Russia, the two largest OPEC+ members, were hoping to convince the US, Canada and other oil-producing G20 countries to supplement a deal agreed in principle late Thursday to rein in 10 million b/d with more production cuts.

Brouillette, instead, cited forecasts that US production could fall on its own by as much as 3 million b/d in the next year due to economic forces, obviating the need to impose quotas on US oil companies.

The contributions of other G20 members was still unclear, and the meeting was ongoing late Friday after almost nine hours of discussions.

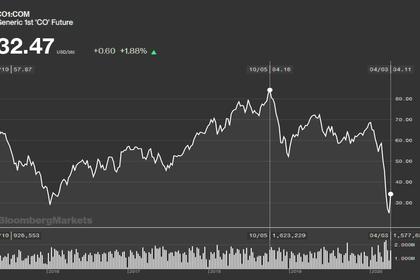

Whatever the final deal is, despite its scale, several analysts say it will fall far short of what is needed to stabilize prices in the short term, as the coronavirus eats away at oil demand.

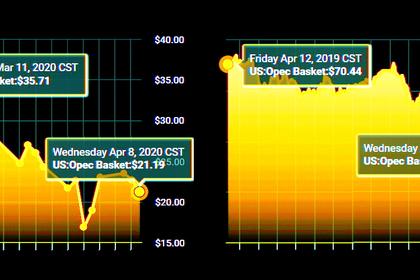

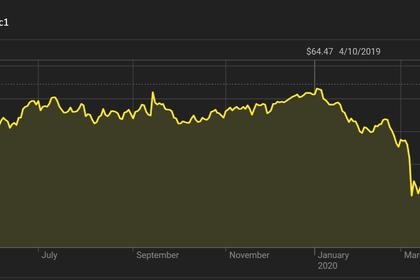

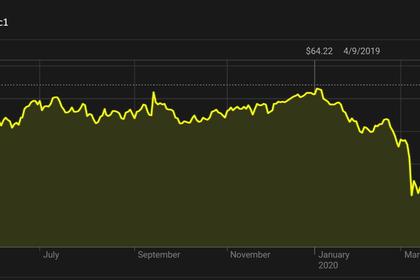

Crude futures fell sharply late Thursday after the provisional OPEC+ deal was announced. Markets were closed Friday for the Good Friday holiday.

"Everything they're doing is still not sufficient to deal with a 20 million-25 million b/d drop in demand," said Jason Bordoff, director of Columbia University's Center on Global Energy Policy, on a Foreign Policy webinar.

Russian energy minister Alexander Novak said OPEC+ ministers would continue to monitor the market and adjust the deal as necessary. The OPEC+ coalition is next scheduled to meet June 10 via webinar.

"The situation on the oil market will undoubtedly change; if necessary OPEC+ will take additional measures or restore production," he said.

TRUMP WORKS THE PHONES

Under the tentative OPEC+ agreement, the 23-country alliance would slash 10 million b/d of output for May and June. The cuts would be rolled back to 8 million b/d for the rest of 2020, and then down to 6 million b/d for all of 2021 through April 2022.

Saudi Arabia and Russia would hold their production down to 8.5 million b/d, representing a decrease of some 3.5 million b/d for Saudi Arabia and 2 million b/d for Russia from current levels.

Details of the deal were still in flux. Mexico had withheld its approval, arguing for a more generous quota. But a phone call between Mexican President Andres Manuel Lopez Obrador and US President Donald Trump apparently brokered a compromise, though not all OPEC+ members appeared to be satisfied.

In a press briefing, Trump said the US would "help" Mexico with its oil cuts and then be reimbursed later, but did not provide details.

Trump also spoke by phone Friday with Russian President Vladimir Putin to discuss the oil deal, after having called both Putin and Saudi Crown Prince Mohammed bin Salman on Thursday.

Trump's active petro-diplomacy highlighted the pressure he was under to rescue the ailing US oil industry -- a key constituency for his electoral prospects -- while also being constrained by US antitrust regulations and his own free market leanings from mandating US output cuts.

IMPLEMENTING THE DEAL

The involvement of the G20 came at the urging of the International Energy Agency, which has warned of the destabilizing impact of freefalling oil prices on the global economy.

Conveniently for OPEC+, the G20 is chaired by Saudi Arabia this year, and Saudi energy minister Prince Abdulaziz bin Salman presided over Friday's meeting.

As difficult as the deal was to hammer out, the hard part now comes in implementing the cuts and ensuring strong compliance.

Since the quotas do not go into force until May and any strategic reserve filling is subject to infrastructure constraints and tenders, the physical market is likely to see a continued glut for the next month. Many key OPEC members, including Saudi Arabia, the UAE and Kuwait, have announced plans to hit record highs in production, which will have to be cranked back down.

The market's skepticism of the deal is warranted, said Helima Croft, global head of commodities research for RBC Capital, on the Foreign Policy webinar. But if implemented properly, the cuts will eventually help relieve the oversupply.

"From our perspective it's really important to keep this oil in the ground," she said. "Now we have to get beyond the COVID-19 crisis, we still have a huge demand issue, but we can potentially be in a better inventory place towards the back end of the year and early 2021. So we think [the deal] is actually meaningful, but not sufficient to boost prices immediately."

------

Earlier: