OPEC+ U.S.: NO INDICATIONS

PLATTS - 07 Apr 2020 - OPEC's ambitions for expanded global production cuts to level out the oil market's coronavirus nosedive remain in the balance, with countries still far apart on many details — not least of all who's in and who's out.

OPEC, Russia and nine other allies plan to hold a virtual summit Thursday to finalize a deal, and additional invitations have been sent to the US, Canada, Brazil, Colombia, Ecuador, Argentina, Trinidad & Tobago, Egypt, Chad, Indonesia, Norway and the UK, according to OPEC sources.

How much crude supply can be clawed back in a negotiated pact will depend on how many nations join in, but hopes that the world's largest producer, the US, will participate grow fainter by the day.

US officials declined to comment Tuesday, but a White House source said no one from the Trump administration was expected to attend the OPEC+ video conference.

The US has also been invited to participate in Friday's emergency G20 energy ministers' summit, which has been scheduled to discuss oil cuts and other measures to shore up the slumping global economy.

Saudi Arabia, OPEC's largest producer and de facto leader, holds the G20's rotating presidency for this year.

The meeting, to be held via webinar, will "foster global dialog and cooperation to ensure stable energy markets and enable a stronger global economy," the G20 said in a statement Tuesday.

But with a majority of the G20 comprising oil and gas net importers, including key demand growth economies China and India, an endorsement of OPEC-led production cuts is far from certain.

"A negotiated settlement of the ongoing oil war could require unprecedented multilateral cooperation at unprecedented scale," analysts with ClearView Energy Partners said in a note Tuesday.

Still, the International Energy Agency, which largely represents oil consuming nations, has been pushing for the G20 to be a venue for expanded oil talks. IEA Executive Director Fatih Birol has said the continued crash in oil prices could spark a global recession and also set back energy transition efforts if unchecked.

"We need solidarity at this time to urgently bring stability to the world economy and to support millions of jobs," he said in a tweet Tuesday.

Voluntary versus involuntary

The oil industry has perked up ever since US President Donald Trump tweeted last Thursday that he had convinced Saudi Arabia and Russia to end their bruising price war and work out a deal that could take 10 million-15 million b/d of crude production off the market.

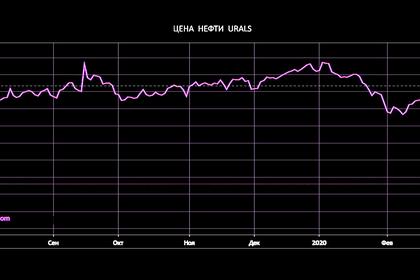

With demand contracting severely due to the coronavirus and core OPEC Gulf nations planning to flood the market, crude prices have plummeted, stressing the budgets of producing countries and oil companies.

Despite pressure from some US producers to broker a deal with OPEC to support oil prices or, alternatively, impose tariffs on crude imports into the US, Trump appears content to let market forces play out in a wave of involuntary shut-ins across the shale patch.

"I think the cuts are automatic, if you're a believer in markets," Trump said at a press conference Monday.

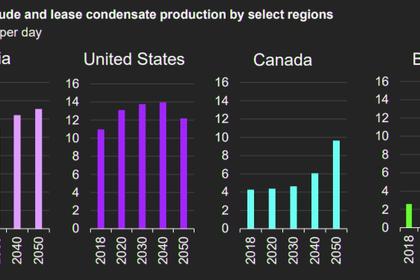

S&P Global Platts Analytics projects that up to 5 million b/d of US production could be at risk from current conditions, as oil storage tanks hit maximum capacity by May.

The US Energy Information Administration on Tuesday forecast that US crude oil production would contract 470,000 b/d in 2020 and another 730,000 b/d in 2021, the first falls since 2016.

Baseline for cuts

OPEC has been open to counting natural production declines in its output cut agreements, but there is no indication the US would be willing to sign up to that, and some delegates say Russia might not agree such a dressed-up US cut anyway.

"I don't know if Russia will accept that the US part is involuntary shut-ins," an OPEC delegate said.

Russia and Saudi Arabia also appear at loggerheads over the baseline from which any new cuts would be determined, given that the Saudis and their Gulf allies appear to have ratcheted up their production in the last few weeks and have plans to hit record highs in April.

S&P Global Platts' latest OPEC survey released Tuesday found that Saudi Arabia raised its production by 460,000 b/d month on month to 10.15 million b/d in March, while the UAE boosted its output by 440,000 b/d to 3.45 million b/d and Kuwait pumped an additional 230,000 b/d at 2.90 million b/d.

Russia, meanwhile, reported relatively flat output in March, and President Vladimir Putin has said any new cuts should be determined from first-quarter production.

However, delegates said Russia also faces skepticism from its counterparts, given its spotty compliance with its output quotas over the past three-plus years of its alliance with OPEC, not to mention its strong resistance to additional cuts the last time it met with OPEC on March 6, which led to the price war and everybody's current predicament.

Russian officials have not commented since the head of the country's sovereign wealth fund, Kirill Dmitriev, said in an interview Monday with CNBC that Russia and Saudi Arabia were "very, very close to a deal."

The OPEC+ webinar summit is scheduled to start at 1400 GMT Thursday, though much of the logistics, including media access, have yet to be ironed out.

-----

Earlier: