SAUDI ARABIA, RUSSIA, U.S. REDUCTION

PLATTS - 08 Apr 2020 - Saudi Arabia's attempt to negotiate a global pact with Russia to rescue oil prices from the coronavirus crisis will come to a head Thursday, when ministers from OPEC and other key countries log on to a high stakes online summit to settle geopolitical scores and parcel out production cuts.

The meeting will not include the world's largest oil producer, the US, though Energy Secretary Dan Brioullete is expected to take part in an emergency Saudi-chaired G20 ministerial webinar Friday that could endorse and widen any OPEC+ accord to narrow the widening gap between surplus oil supply and sickly demand.

With Trump administration officials exerting strong back-channel pressure on the countries to close a deal to stave off further industry bleeding, Saudi Arabia and Russia will likely be motivated to avoid a repeat of their last meeting a month ago, which ended in recriminations and launched a bitter price war.

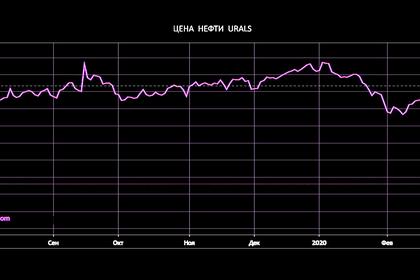

Dated Brent prices have fallen some 70% since that meeting, and the market is waiting to see if the so-called OPEC+ alliance can craft a deal that claws back 10 million-15 million b/d of global supply, as US President Donald Trump claimed last week was in the works.

Russia would be willing to cut 1.6 million b/d from its Q1 production level, Tass news service reported Wednesday, while Saudi Arabia has not disclosed how much output it would be willing to rein in, as the two countries remain split over the baseline production figures from which to determine new quotas.

"The dilemma for Saudi and Russia is whether they will benefit from throwing the high cost producers a lifeline," said Chris Midgley, global head of S&P Global Platts Analytics.

Saudi Arabia and Russia, the two OPEC+ leaders, have insisted that they will only participate if the US also agrees to production cuts.

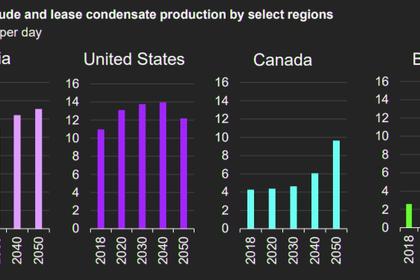

US President Donald Trump, however, is hostile to the idea, and US officials instead have offered up as their contribution to a deal projections from the Energy Information Administration showing that American oil output will fall on its own by 1.81 million b/d in a year due to market forces.

Russia, however, has rejected that line of reasoning, with Kremlin spokesman Dmitry Peskov telling reporters in Moscow that conflating involuntary declines with actual production cuts "is like comparing length and width."

Analysts say that could be a negotiating ploy, as Russia is likely seeking sanctions relief from the US.

But Russia also has a bone to pick with Saudi Arabia and its Gulf allies, who have ramped up their production to record levels since the last OPEC+ meeting and are insisting that any cuts be set from those higher volumes, according to people involved in the talks.

Russia, which says it has not correspondingly raised its oil output, has maintained that quotas be set according to Q1 levels, which in the case of Saudi Arabia would be more than 2 million b/d lower than its current production of some 12 million b/d.

TANGLED GEOPOLITICAL WEB

Delegates say they are expecting talks to go down to the wire.

Thursday's OPEC+ webinar is scheduled to start at 1400 GMT, but officials have not said whether there will be a post-meeting press briefing or any other media availability with ministers.

Friday's G20 energy ministerial is set for 1400 GMT.

"I think a deal will be done, but now the question will be if it will be 10 million b/d," one delegate told S&P Global Platts.

Beyond the core Saudi-Russian disagreements, OPEC+ may also have to resolve a host of other geopolitical issues.

Some analysts suggest the fate of Venezuela's leadership could be part of the talks, with the Trump administration pressing Russia, a key ally of President Nicolas Maduro, to accept a transition plan that would see Maduro ousted.

Iran, which like Venezuela has been heavily sanctioned by the US, may also make sanctions relief a condition of its participation in a deal, as it seeks an emergency International Monetary Fund loan to combat the impacts of the coronavirus pandemic on its economy.

The more moving parts to the negotiations, the more complicated the talks will likely become, straining the OPEC+ coalition's bandwidth for a deal on production cuts.

-----

Earlier: