SHELL LNG NEED CHINA MARKET

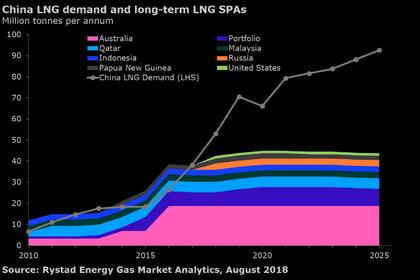

PE- 27 April 2020 - A tentative agreement in April between Chinese conglomerate Golden Concord Holdings Limited (GCL) and Shell to explore LNG marketing and trading in eastern China could give the major a foothold in the Yangtze River Delta gas market—and eventually allow it to access new markets further inland.

The framework agreement between GCL Oil & Natural Gas and Shell includes potentially creating a joint venture, which would buy LNG from Shell and market it to a 2.7mn t/yr receiving terminal planned by GCL in Jiangsu province.

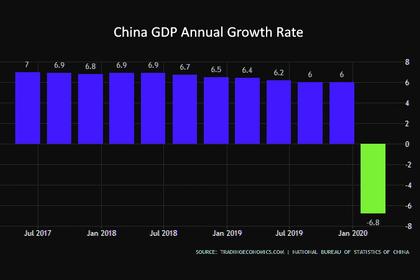

Jiangsu is China's biggest provincial gas market with consumption growing by 6.3pc in 2019 to 28.7bn m³, according to Jiangsu's energy regulatory office. Demand had been targeted to reach 32bn m³ this year, according to a 2018-2020 provincial infrastructure development plan released in March 2019, although this looks ambitious as it would require growth to accelerate to 22pc pa at a time when China's economy is facing major headwinds.

Jiangsu already has two LNG regasification terminals with combined capacity of 7.65mn t/yr, operated by state-owned PetroChina and private player Guanghui Energy. And this is expected to rise to 13mn t/yr once the two companies finish expanding their respective projects by the end of 2021.

While the Shell-GCL venture would initially serve customers in Jiangsu province, there would also be an opportunity for it to access underserved hinterland markets in the future.

Energy islands

Jiangsu is developing a so-called 'energy island' concept at Yangkou Port, where PetroChina's terminal is located. The idea is to develop the port—located near where the Yangtze River meets the Yellow Sea—into a base for unloading, storing, supplying and selling LNG.

A major component of the concept would be breakbulk of large LNG cargoes for transshipment up the Yangtze to inland cities along the waterway.

Jiangsu envisages the Yangkou Port LNG hub would have seven to nine berths capable of serving the largest LNG tankers, along with three midsized and four small-scale berths to reload breakbulk shipments onto river-going LNG carriers.

The energy island would have final receiving capacity of 35-50mn t/yr, which suggests several more regasification terminals will be built at Yangkou to complement PetroChina's existing 6.5mn t/yr facility.

Jiangsu marked the start of development of the energy island when it officially launched an LNG logistics distribution centre at Yangkou at the start of January. The centre will improve the soft infrastructure of the LNG trade at the port, while consolidating oversight of tanker trucks transporting LNG and other hazardous chemicals.

Multiple developments

Besides GCL, Jiangsu Guoxin Investment Group is also planning an LNG peak-shaving terminal with capacity of 3.5mn t/yr.

Yangkou's location near the estuary of the Yangtze River puts it in a good position to be the main channel for shipping LNG upriver to markets along the middle stretches of the waterway.

Two inland LNG terminals, located at Wuhu in Anhui province and Yueyang in Hunan province, have so far won approval from local authorities. Both projects are small-scale and would be used to store and transship deliveries from coastal ports to inland cities as well as supply peak-shaving gas to local and neighbouring markets.

But Jiangsu faces competition in its efforts to establish a foothold in distributing imported LNG upriver. The neighbouring province of Zhejiang issued a plan in September 2019 that identified the Zhoushan archipelago as a prime location for developing a large-scale LNG receiving and distribution hub to serve the Yangtze River Delta and beyond.

Like Jiangsu's plans for Yangkou Port, the Zhejiang government wants to turn Zhoushan into an 'LNG gateway' that would see imports shipped to large-scale terminals and then reloaded onto smaller vessels for distribution upriver.

-----

Earlier: