U.S.$ DOWN AGAIN

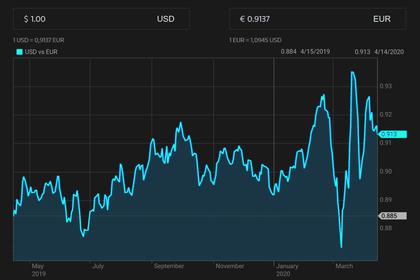

REUTERS - APRIL 27, 2020 - The U.S. dollar fell across the board on Monday as traders turned more positive and less averse to risk amid an easing in coronavirus lockdown restrictions in several countries.

The U.S. dollar was weaker against the Japanese yen and the euro as investors turned slightly more positive on Italy and saw the Bank of Japan continuing to support an economy battered by the virus.

Credit rating agency S&P reaffirmed on Friday Italy’s BBB rating, in spite of what many had expected - a downgrade - supporting the common currency as this limits the escalation of an economic and political crisis on the continent.

The BoJ expanded its stimulus to help companies hit by the coronavirus crisis, pledging to buy unlimited amount of bonds to keep borrowing costs low as the government tries to spend its way out of the deepening economic pain.

The dollar shed 0.3% of its value versus the Japanese yen to trade at 107.23 yen JPY=EBS, having fallen earlier to a two-week low of 106.93.

The euro was up 0.2% at $1.0842 EUR=EBS.

Traders now shift their focus to a U.S. Federal Reserve meeting ending Wednesday and a European Central Bank (ECB) meeting on Thursday as major central banks once again take the stage as the global economy battles against a deep depression.

The Fed has already announced a raft of measures and is expected to stay on hold this week, which is unlikely to trouble the dollar, analysts say.

The stakes are higher for the euro, because the ECB is likely to extend its debt purchases to include junk bonds, and some investors are worried this decision could widen rifts between members of the European Union.

On Sunday, the Australian states of Queensland and Western Australia said they would slightly ease social distancing rules this week as the number of people infected decreased on the continent, pushing the Australian dollar to a seven-week high of 0.6469 against the U.S. dollar AUD=D3.

Encouraged by a fall in infection rates, Germany also has allowed on Sunday small retail stores to reopen, provided they adhere to strict distancing and hygiene rules. Now large corporations are following suit.

Italy will also ease lockdown measures from May 4.

These measures, alongside with more positive COVID-19 data, has turned investors more risky, forcing them to abandon the safety net of greenback, analysts said. A Reuters index which tracks the dollar against other major currencies fell below 100 for the first time since Wednesday.

“The U.S. dollar has started the week on the back foot... It reflects more risk on trading conditions at the start of this week,” said Lee Hardman, currency analyst at MUFG.

“Most notably there was a sharp drop yesterday in the reported number of COVID-19 fatalities in a number of countries including France, Italy, Spain, and the UK which provides further encouragement that lockdown measures are proving effective,” Hardman said.

-----

Earlier: