U.S.$ DOWN ANEW

REUTERS- APRIL 14, 2020 - The dollar slipped on Tuesday and the Australian dollar led a rally in riskier currencies as China's trade data painted a less gloomy picture of the coronavirus' economic fallout than markets had feared.

China's March exports fell 6.6% from a year earlier, compared with a forecast for a 14% drop and imports fell by less than 1%, compared with a 9.5% drop anticipated by economists.

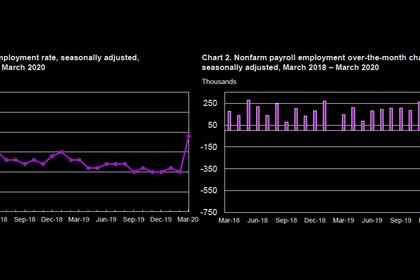

Daily fatalities in the United States also fell sharply and states began plans to re-open their economies.

The Australian dollar rose 0.7% to $0.6432, the New Zealand dollar firmed 0.6% to $0.6131 and the pound added 0.4% to $1.2562 - their strongest since mid-March.

"The market is front-running the idea that we're going to see the case count dissipate," said Chris Weston, head of research at Melbourne brokerage Pepperstone.

"The baton is now being firmly handed over to the reality of the situation in economic data," he said, calling the Chinese figures "way better" than expected.

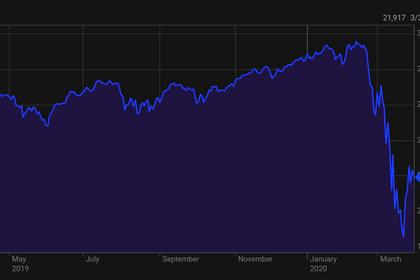

The positive mood was reflected in equity market gains in Asia, yet trepidation kept a cap on further rises in currencies.

Gold and the safe-havens of the Japanese yen and Swiss franc also rose, in a nod to the underlying caution.

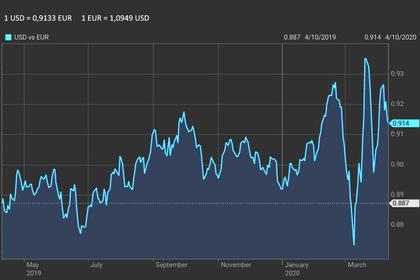

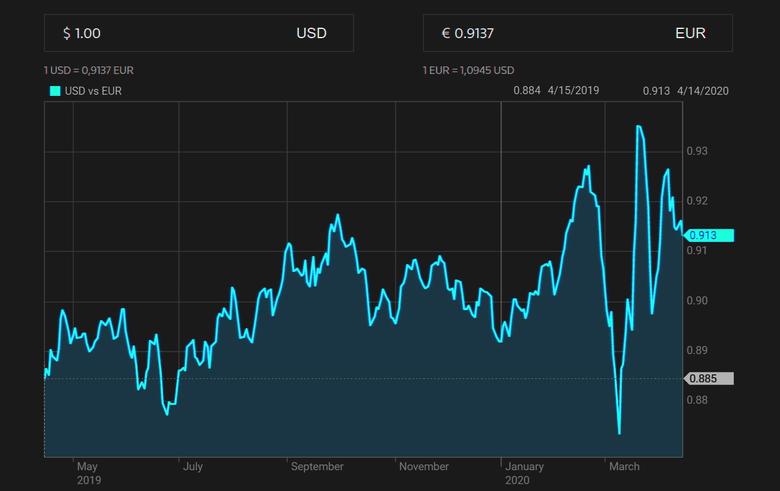

The yen held at 107.70 per dollar, a fraction softer than a two-week peak hit on Monday. The euro recouped overnight losses to $1.0939. The Chinese yuan firmed 0.1% to 7.0428 per dollar.

Against a basket of currencies, the dollar was 0.2% weaker at 99.195.

CAN IT LAST?

The Australian dollar has gained nearly 17% from a 17-year low hit last month, and analysts are beginning to wonder if it has run out of puff as a global recession looms.

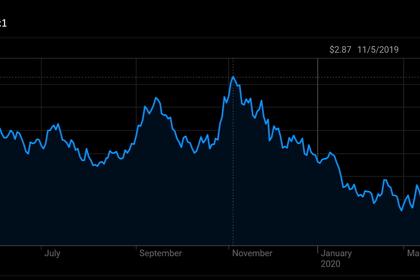

"The traditional drivers, like commodity prices and the world economy are going to put downward pressure back on the Aussie," said Joe Capurso, FX analyst at the Commonwealth Bank of Australia in Sydney.

"So it's prepped for a fall," he said. "We think it'll oscillate around 60 cents for the next couple of months."

The kiwi has also climbed 12% from a decade low in March and faces a dour outlook.

New Zealand's Treasury Department released a suite of five possible scenarios for the future of the national economy on Tuesday - all of them forecast a deep contraction in the June quarter.

"What is clear is that whatever path the global and domestic economies follow, the effects of this recession will be severe and long lasting," the department's report said.

That is only likely to heighten investors' nerves ahead of the start, later on Tuesday, of a dour U.S. earnings season, beginning with J.P. Morgan and Wells Fargo.

Though volatility-boosted trading earnings may deliver a silver lining for the banks, earnings for S&P 500 firms are expected to tumble 10.2% in the first quarter, compared with a Jan. 1 forecast of a 6.3% rise.

-----

Earlier: