U.S. GAS FUTURES UP

REUTERS - APRIL 6, 2020 - U.S. natural gas futures rose almost 7% on Monday on forecasts for cooler weather and higher heating demand next week than previously expected.

"Today's gains are led by a shift to stronger demand brought by cooler weather forecasts," said Daniel Myers, market analyst at Gelber & Associates in Houston. "If it materializes, the spell of April chill will still have enough bite to significantly restrain the first month of storage injections."

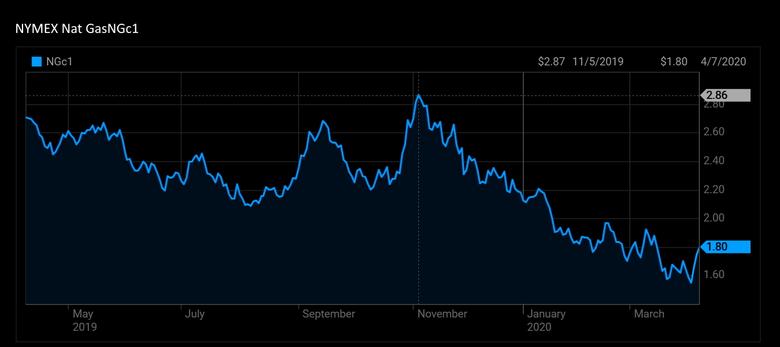

Front-month gas futures for May delivery on the New York Mercantile Exchange rose 11.0 cents, or 6.8%, to settle at $1.731 per million British thermal units. Despite the increase, gas was still less than 20 cents over the $1.552 settle on April 2, its lowest close since August 1995.

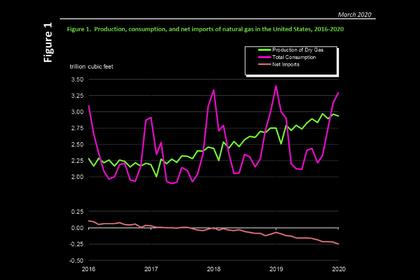

Even before the coronavirus started to cut global economic growth and energy demand, gas was already trading near its lowest in years as record production and months of mild winter weather enabled utilities to leave more fuel in storage, making shortages and price spikes unlikely.

Gas futures, however, are trading much higher for the balance of 2020 and calendar 2021 on expectations demand will rise in coming months after governments loosen travel and work restrictions once the spread of coronavirus slows. Calendar 2021 has traded at a premium over 2022

for 20 days and over 2025 for 10 days.

Prices are also trading much higher in the forward spot market. At the Waha NG-WAH-WTX-SNL hub in the Permian basin in West Texas, where next-day prices were negative at the start of March, forwards were averaging $1.17 per mmBtu for the balance of the year and $1.90 for calendar 2021.

That compares with an average of 52 cents so far this year, 91 cents in 2019 and a five-year (2014-2018) average of $2.80.

As forward prices rise, speculators have been cutting their short positions on the NYMEX and Intercontinental Exchange. Last week, their net shorts fell for a fifth week in a row to their lowest since May 2019, according to data from the Commodity Futures Trading Commission.

With cooler weather coming, data provider Refinitiv projected gas demand in the U.S. Lower 48 states, including exports, will rise from an average of 94.0 billion cubic feet per day (bcfd) this week to 100.3 bcfd next week. That compares with Refinitiv's forecasts on Friday of 94.6 bcfd this week and 97.9 bcfd next week.

The amount of gas flowing to U.S. LNG export plants edged up to 8.2 bcfd on Sunday from a two-week low of 8.0 bcfd on Saturday, according to Refinitiv. That compares with an average of 8.9 bcfd last week due to a reduction at Cheniere Energy Inc's Sabine Pass export plant in Louisiana for pipeline work.

-----

Earlier: